Manchester terrorist attack adds additional volatility to the market The horror that terrorist groups keep bringing to the lives of people simply trying to live at peace and keep to themselves is startling. I'll never understand what could possess a person to bring such havoc to the lives of others - random people that have

Political headline risk holding the market hostage Friday looked and felt great, until there was about 45 minutes left in the trading session, then when wheels were up on Air Force One, WaPo and the New York Times dropped simultaneous, rumored based articles that no one can verify independently.

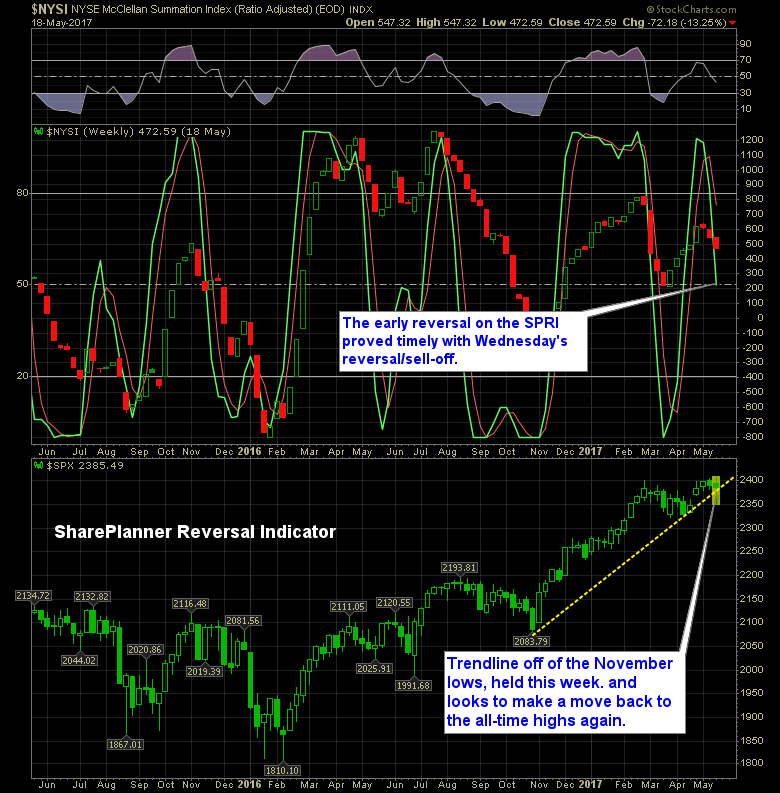

The Sell-Off That Almost Was….Here’s some of my market musings I guess Wednesday will simply go down as a “scare” for the market and nothing more because right now the market is acting like nothing ever happened. Instead it is desperate to get back to the consolidation area just below all-time highs so it can

The market that doesn’t hold a grudge With every crisis or potential crisis that occurs, the market has one of the shortest memories of all time. In some ways the market would make an excellent spouse, because when something doesn’t go right, it only holds it against your for a day, maybe a couple of

Fear grips traders and the VIX pops 46% I like buying the dip as much as anybody, and it has proven to be a really good strategy over the last eight years. But yesterday was not a day to buy the dip. The internals did not show an anemic sell-off that was going to quickly

The bears are gaining a foothold on the Trump Controversies My objective here isn’t to defend Donald Trump or prosecute him. I leave my personal opinions out of my trading simply because the market doesn’t care what I think when it comes to politics. So I have to look at price action for what it

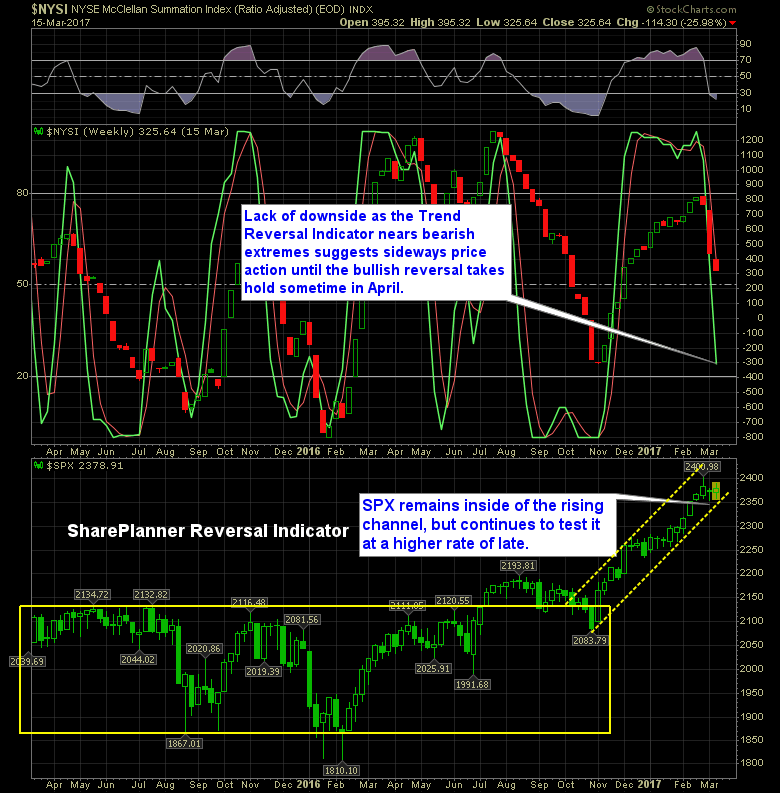

Risk On Attitude has Created a No-Fear Market Trading Atmosphere Intraday sell-offs aren’t even being taken serious by traders any more. Before the market can drop five points on SPX, mentions of BTFD and “Buy the ‘you-know-what’ dip” begins to permeate throughout financial social media. You want to know why the VIX is

Looking For a Selloff That’ll Never Come About Bearish reversal was triggered on the SharePlanner Trend Reversal indicator a few weeks ago, but instead of a selloff, which most of us would come to expect, we are instead seeing nothing more than sideways to slightly downward price action.

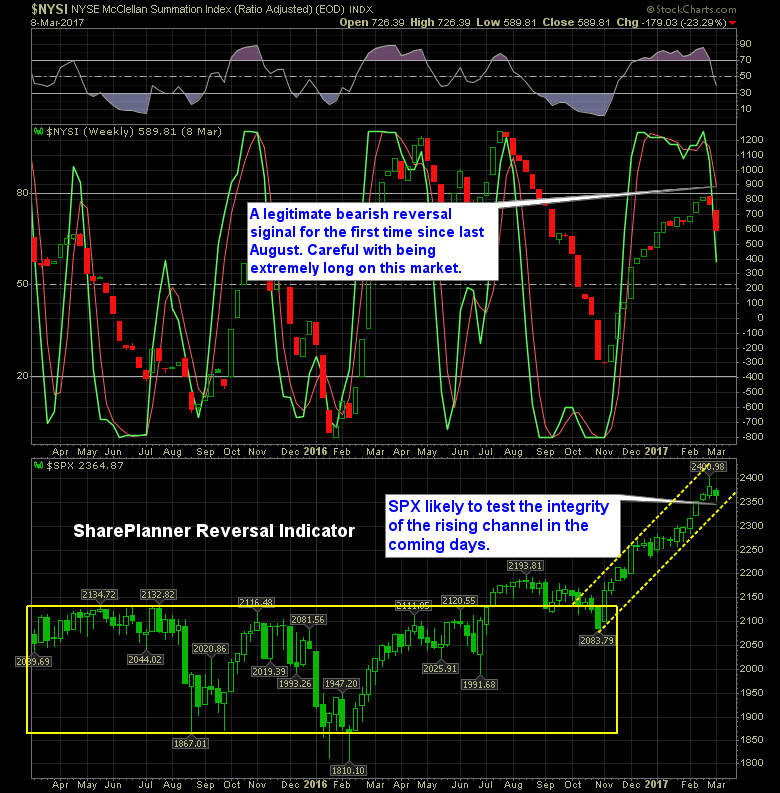

The SharePlanner Trend Reversal Indicator is flashing all sorts of bearishess And it is worth noting that there hasn't been a bearish reversal signal on the indicator since August of last year, which led to a 100-point reversal in the markets over the course a three month period. Obviously that came to an end when

That was one nasty market sell-off at the close today (comparatively speaking). Plenty of people were selling stocks, myself included. The biggest concern for me right now is that only 49% of stocks are trading above their 40-day moving average. That is with us only being about a week removed from having established all-time highs.