My Swing Trading Strategy

One new trade was added on Friday, but I stayed put the rest of the day. I sold my position in Netflix (NFLX) for a +1.1% profit. Today the market is opening lower, so it will be important that any weakness can be contained and kept from seeping lower.

Indicators

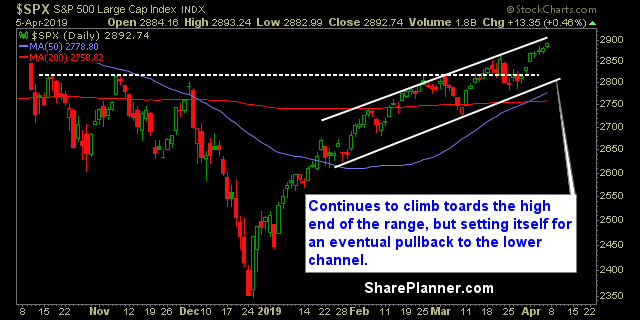

- Volatility Index (VIX) – Dropped for the 8th time in the last 10 sessions and now below 13. March’s lows held, but could see further tests in the days ahead.

- T2108 (% of stocks trading above their 40-day moving average): Another solid increase of 7% taking the indicator up to 68%. Bearish divergence is close to being wiped out on this indicator.

- Moving averages (SPX): Trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy is starting to take off, and will have a chance today to break its 200-day moving average. Healthcare consolidating at the high end of its consolidation and seeing strength in biotech of late. Utilities appears ready for a bounce after a light volume pullback.

My Market Sentiment

Likely to see the market held back some today by weakness from Boeing’s (BA) production cut. The market is up seven straight days and due for a pullback of some kind. However, with the low volume activity seen in the market of late, I don’t expect it to be much.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 30% Long.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, Ryan answers the questions of one listener ranging from his transition from paper trading to live trading, and swing trading to day trading. Also addressed is his approach to trading, specifically Fibonacci retracement levels and why Ryan prefers Pivot Points instead.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

X: https://x.com/shareplanner

INSTAGRAM: https://instagram.com/shareplanner

FACEBOOK: https://facebook.com/shareplanner

STOCKTWITS: https://stocktwits.com/shareplanner

TikTok: https://tiktok.com/@shareplanner

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.