Pre-market update: Asian markets traded 0.1% higher. European markets are trading 0.1% higher. US futures are trading 0.1% lower ahead of the market open. Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45), Consumer Price Index (8:30), Housing Starts (8:30), Redbook (8:55) Technical Outlook (SPX): Another mild bounce out of the

Netflix proves there is always something left in the gas tank… SharePlanner Market Compass: Too much for this rally to handle… I suspect we need at least a 10 point pullback. Quick Glance at the Market Heat Map and Industries Notables: A lot more weakness than the market led us to believe today. Lots of

One helluva bounce today… Source: StockingNFLX.com SharePlanner Market Compass: You can trash that pullback – SPX just got clear skies from the twits in DC for the time being. Quick Glance at the Market Heat Map and Industries Notables: You did not want to be short any bank today. Oil got a long sought after

Even Netflix is starting to feel the effects of this market… Source: StockingNFLX.com SharePlanner Market Compass: Market in the last month hasn’t strung together two consecutive positive days – good chance we don’t see that tomorrow either. Quick Glance at the Market Heat Map and Industries Notables: Big tech, particularly HPQ carried the day for that

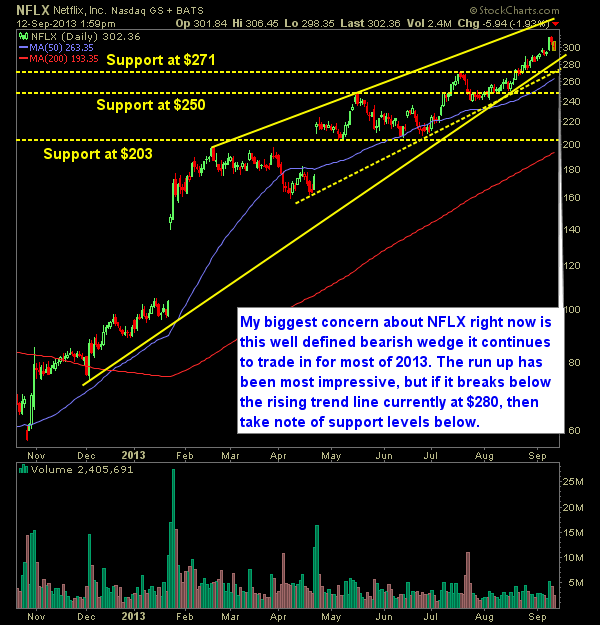

Netflix (NFLX) is by far one of the best stories of 2013. They are the dominant online streaming companies despite the fact their fundamentals are pretty wretched. Their climb back to $300 was fast but if you look at the chart you’ll notice that during that same time it has been forming for most

Today's breakout leads to tomorrow's wedge Quick Glance at the Market Heat Map and Industries Notables: Utilities and banks weighed heavy on the market. Tech had relative strength in its favor. Utilities was today's market dog. Be sure to check out my latest swing trades and overall past performance

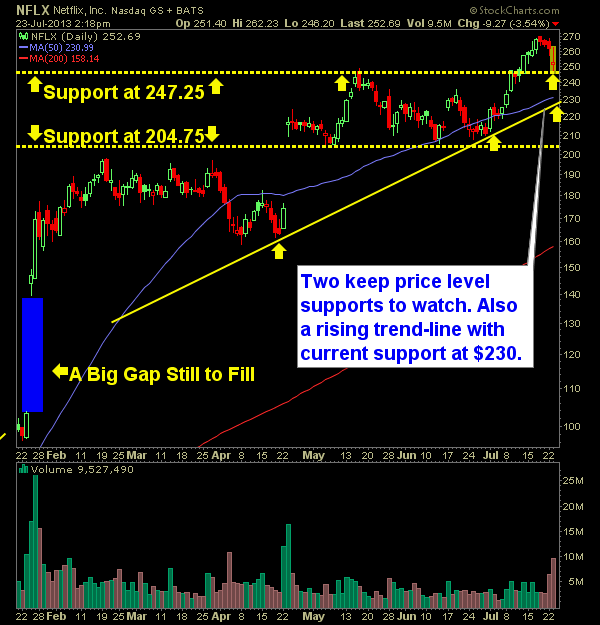

I’m not one to believe that the comeback is done and over with in Netflix (NFLX). They’ve done an excellent job of creating original content and building new subscriber loyalty with their exclusive shows that finally allows consumers to justify their $7.99/month purchase. With Netflix earnings from yesterday missing, it appears to me to

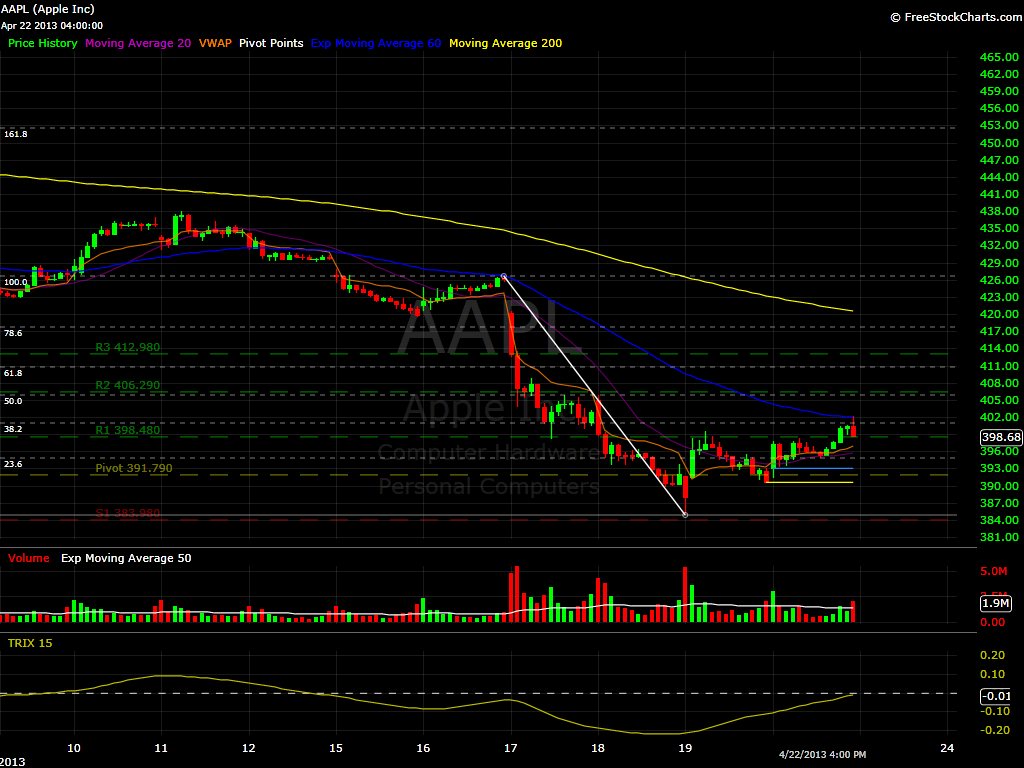

Apple (AAPL) 3 Day Chart - Nice move from the 385 level, that I tweeted about last week. It is currently above 400 which on a short term basis, correspond to the 38.2% Fibonacci Level. So as long as it stays above 400.90, it is a good long. Amarin (AMRN) 4 Hour - I want

Netflix (NFLX) finally redeems itself. The best that NFLX has looked in years. Kudos to them. Now get some content that I can’t get elsewhere for free. Quick Glance at the Market Heat Map and Industries Notables: Another mixed bag of goods in technology. Services showed a nice rebound today. Outside of Steel, Copper,

NFLX sets up nicely as a swing-trade short setup. Stock: Netflix (NFLX) Long or Short: Long Entry Range: $91.00 – $90.50 Stop-Loss: $95.55