Pre-market upadate (9:00am eastern):

- European markets are trading flat.

- Asian markets traded mixed/flat.

- US Markets are looking at a slightly negative open.

Economic reports due out (all times are eastern): MBA Purchase Applications (7am), Challenger Job-Cut Report (7:30am), ADP Employment Report (8:15am), Jobless Claims (8:30am), ISM Non-Manufacturing Index (10am), EIA Natural Gas Report (10:30am),

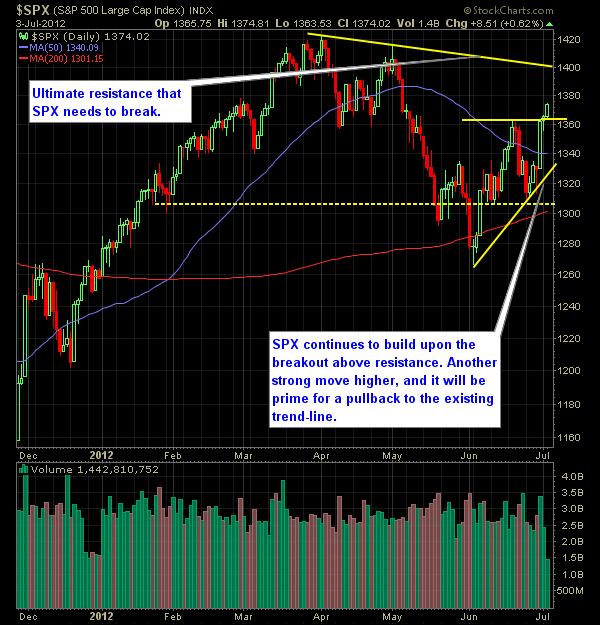

Technical Outlook (SPX):

- SPX continued to march higher for a third straight day, and five out of the last six.

- Beginning to look a bit parabolic, if you ask me.

- Breaking through the 1390’s will be difficult as there are plenty of separate resistance levels in that area.

- Safe to assume that volume will be light this week as it was on Monday and Tuesday, as many traders/investors will take the remainder of the week of.

- Volume in general continues to be relatively light during the past month of trading.

- SPX is hitting short-term extremes of being overbought.

- SPX has now made new highs on the uptrend that began on 6/4.

- 30-minute chart continues to highlight the need for a pullback in the short-term.

- Below 1306-1308 price level, will nullify the current rally off of the 6/4 lows.

- Would represent a ‘lower-low’ in the market.

- VIX dropping hard and is now below 17.

My Opinions & Trades:

- Bought NFLX at $70 on Tuesday.

- Bought HD at $51.50 on Tuesday .

- May add an additional 1-2 positions, as well as close out any non-performers.

- If UA continues to struggle, it will be a prime candidate for me to scrap.

- I don’t see really any strong evidence to be short “right-now”. Don’t short the market right now expecting the market to come to its senses. It could be a long painful wait.

- Speaking from experience.

- Still long WNR at $20.51, CMG (bought on Friday) at 378.44, UA (bought Friday) at $93.09 .

- Increasing my stop-loss in WNR to $22.70 locking in 10.7% in gains and providing plenty of wiggle-room for the stock.

Charts:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.