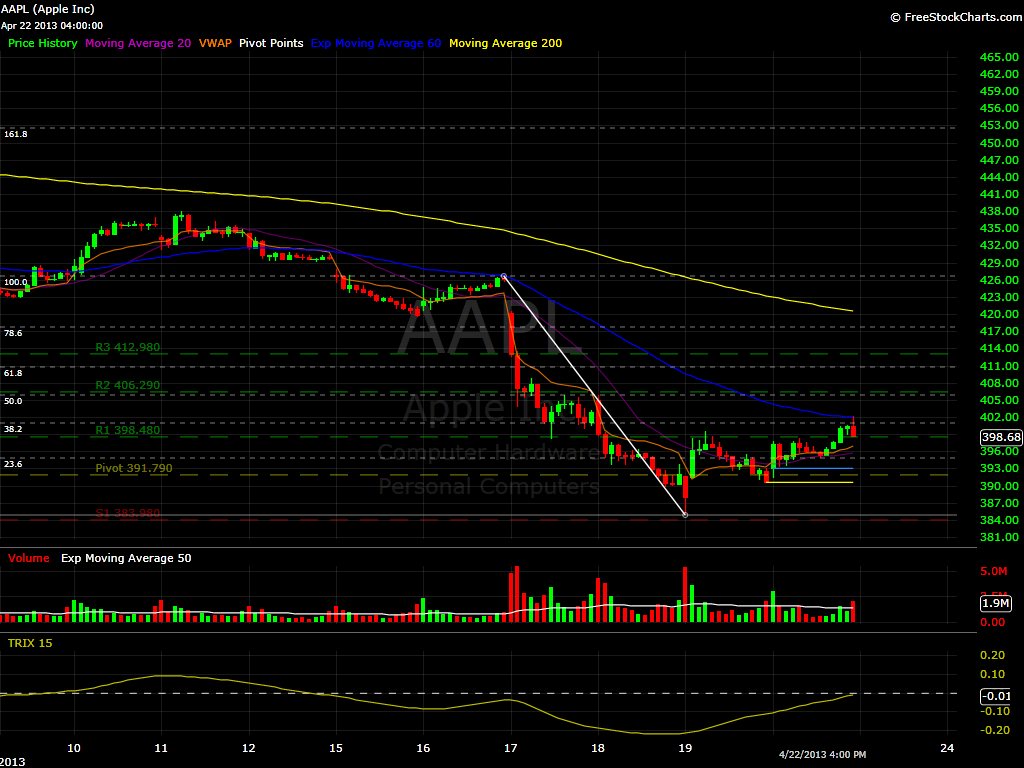

Apple (AAPL) 3 Day Chart - Nice move from the 385 level, that I tweeted about last week. It is currently above 400 which on a short term basis, correspond to the 38.2% Fibonacci Level. So as long as it stays above 400.90, it is a good long. Amarin (AMRN) 4 Hour - I want

Netflix (NFLX) finally redeems itself. The best that NFLX has looked in years. Kudos to them. Now get some content that I can’t get elsewhere for free. Quick Glance at the Market Heat Map and Industries Notables: Another mixed bag of goods in technology. Services showed a nice rebound today. Outside of Steel, Copper,

NFLX sets up nicely as a swing-trade short setup. Stock: Netflix (NFLX) Long or Short: Long Entry Range: $91.00 – $90.50 Stop-Loss: $95.55

Pre-market update (updated 8:00am eastern): European markets are trading -0.2% lower. Asian markets traded -0.5% lower. US futures are trading slightly lower ahead of the open. Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45am), Bernanke Speaks (8:45am), Redbook (8:55am), PMI Manufacturing Index Flash (8:58am), FHFA House Price Index (10am), Richmond Fed

Rough day for the bulls (understatement) and so far it has managed to bounce off of those early morning lows and forming sort of a cup and handle pattern on the 5min SPX chart. So, let’s tally it up for me on the day: I was knocked out of Agrium (AGU) at $93.7 for

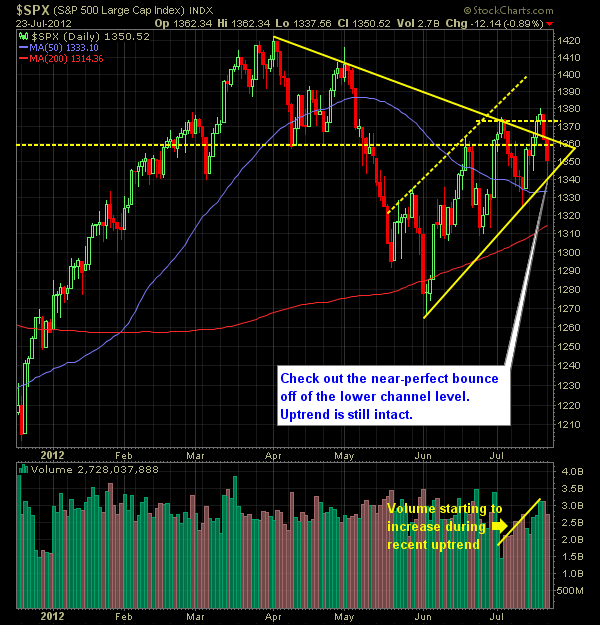

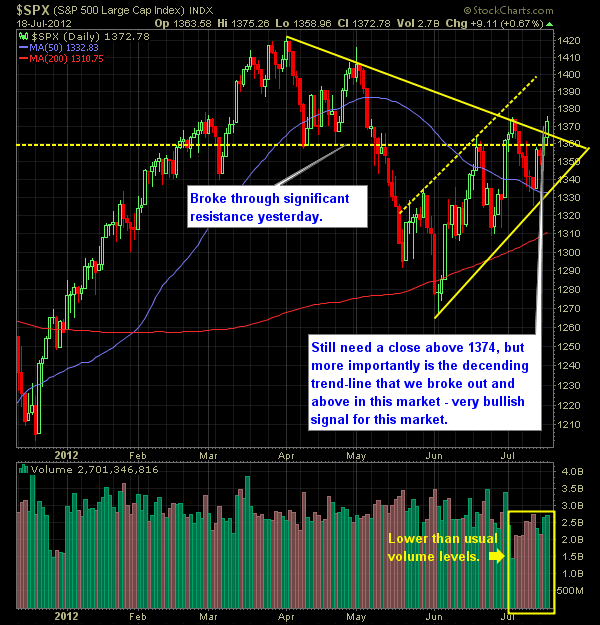

Pre-market update (updated 8:30am eastern): European markets are trading -1.4% lower.. Asian markets traded in excess of -1.0% lower. US futures are moderately lower ahead of the open. Economic reports due out (all times are eastern): None Technical Outlook (SPX): SPX finally manged to break and close above 1374, thereby putting in a

Pre-market update (updated 8:30am eastern): European markets are trading 0.7% higher. Asian markets traded 1.2% higher. US futures are moderately higher ahead of the open. Economic reports due out (all times are eastern): Jobless Claims (8:30am), Existing Home Sales (10am), Philadelphia Fed Survey (10am), Leading Indicators (10am), EIA Natural Gas Report (10:30am) Technical Outlook

Pre-market update (updated 8:30am eastern): European markets are trading 0.2% higher. Asian markets traded -0.6% lower. US futures are slightly lower ahead of the open. Economic reports due out (all times are eastern): MBA Purchase Applications (7am), Housing Starts (8:30am), Ben Bernanke Speaks (10am), EIA Petroleum Status Reports (10:30am), Beige Book (2pm) Technical Outlook (

Thanks to the discovery by @thetradingwife, I ended up taking a long position in Priceline (PCLN) and now I’m forever cursed the rest of the day with the “Price.Line.Neg-o-ti-a-tor!” theme song. The two things about this trade that interests me most is the breakout of the 3-day consolidation pattern of late, and the solid amount

Pre-market update (updated 8:30am eastern): European markets are trading in a wide range from -0.3% up to +0.7%. Asian markets traded in a wide range from -0.4% up to 1.8%. US Markets are moderately higher ahead of the open. Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45am), Consumer Price Index