Pre-market upadate (updated 9:00am eastern):

- European markets are -0.8% lower.

- Asian markets traded -0.4% lower.

- US Markets are nearly 1% lower ahead of the opening bell.

Economic reports due out (all times are eastern): Employment Situation (8:30am), EIA Natural Gas Report (10:30am)

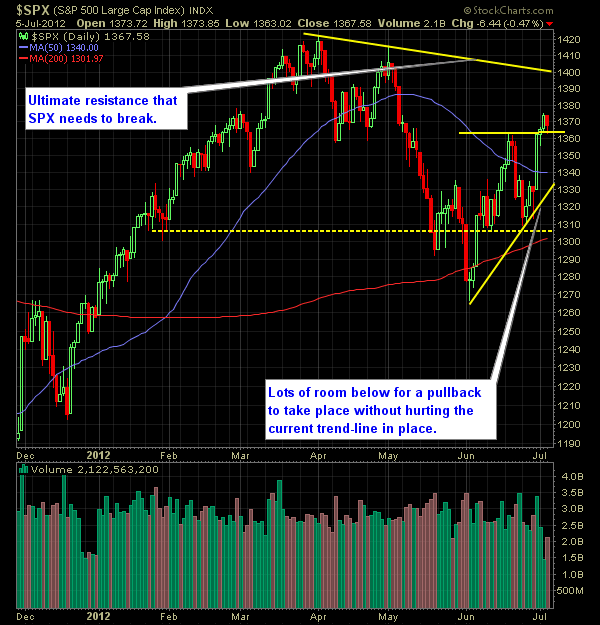

Technical Outlook (SPX):

- Yesterday’s pullback was light, and without any sense of panic to it.

- Today’s market is trading lower off of a disappointing payroll number.

- There is plenty of ‘wiggle-room’ without causing much damage on the charts

- As long as 1327 is held the existing upward trend-line remains in-tact.

- Some weakness here is not surprising, considering the extent of which the market has moved over the past six trading days (on average more than 10 points per day).

- If today’s weakness holds, the SPX should come off of the overbought levels that it has been experiencing.

- Gap downs in the market, like we are seeing today, are often hard to maintain, and usually attracts dip-buyers. Be very cautious and don’t get overly excited about the early morning action in the markets.

- This isn’t the time to add new short positions – you do that on bounces.

- Breaking through the 1390’s will be difficult as there are plenty of separate resistance levels in that area.

- Safe to assume that volume will be light this week as it was on Monday and Tuesday, as many traders/investors will take the remainder of the week off.

- Volume in general continues to be relatively light during the past month of trading.

- SPX has now made new highs on the uptrend that began on 6/4.

- 30-minute chart continues to highlight the need for a pullback in the short-term.

- Below 1306-1308 price level, will nullify the current rally off of the 6/4 lows.

- Would represent a ‘lower-low’ in the market.

- VIX dropping hard and is now below 18.

My Opinions & Trades:

- Good chance that today’s weakness may take me out of 1-2 long positions.

- Will look to add new long positions on the early morning weakness.

- Closed out NFLX yesterday at 77.68 from $70.00 for a 11% gain.

- Covered WLT at $47.05 from $45.81 for a -2.7% loss.

- Bought WBC at $53.98 yesterday.

- Bought on Tuesday .

- May add an additional 1-2 positions, as well as close out any non-performers.

- If UA continues to struggle, it will be a prime candidate for me to scrap.

- I don’t see really any strong evidence to be short “right-now”. Don’t short the market right now expecting the market to come to its senses. It could be a long painful wait.

- Speaking from experience.

- Still long WNR at $20.51, CMG at 378.44, UA at $93.09, HD at $51.50 .

- Increasing my stop-loss in WNR to $22.70 locking in 10.7% in gains and providing plenty of wiggle-room for the stock.

Charts:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.