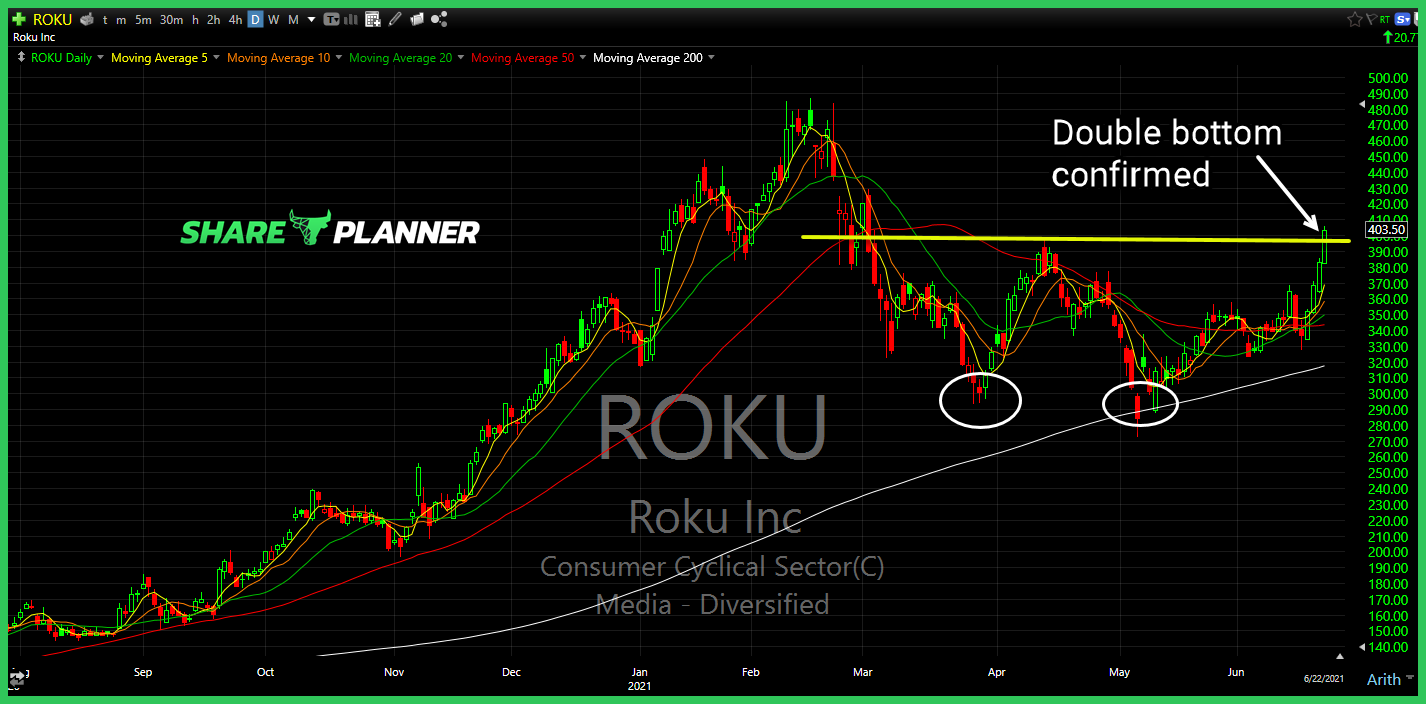

Intel (INTC) making a run towards its upper channel band. Amazon (AMZN) clawing its way back to hold a critical level of support today. Not every day you see McDonalds (MCD) go parabolic like this... Home Depot (HD) breaking out and confirming the double bottom.

Good bounce so far for Schlumberger (SLB), getting closer to testing resistance, but not quite there yet. Two significant levels of resistance overhead on Home Depot (HD) heading into earnings on the 17th. Twitter (TWTR) price below pre-Musk buyout offer. Spirit Airlines (SAVE) rallying hard today, but not dealing with some heavy short-term

For the better part of a month, I've been saying that Digital World Acquisition (DWAC) is a problem chart as long as it stays below major resistance. Crude Oil Futures (CL) pulling back to its long-term support level at $109-110 Home Depot (HD) declining trend-line weighing on price. Can't get bullish on the

Macy's (M) testing key support levels right now. Nvidia (NVDA) once again trying to hold its 200-day moving average. Home Depot (HD) major support broken following its earnings. Digital World Acquisition (DWAC) pulling back to the breakout level - a key moment for the stock.

As a new feature to SharePlanner, I’m going to roll out, the SharePlanner Notebook, where I essentially “clear out my notebook” of the charts I went through today, and provide you with some or all of the ones that I found interesting. Some of them, may have been requests from members of the SharePlanner Trading

Swing Trading Strategy: Holy cow what a crazy, freakin’ day! Granted, a 100 point sell-off on SPX is nothing like a 100 point sell-off back in January of 2018 when it was trading 500 points lower. However the impact that it has on the portfolio is still incredible. Most of my long positions over the

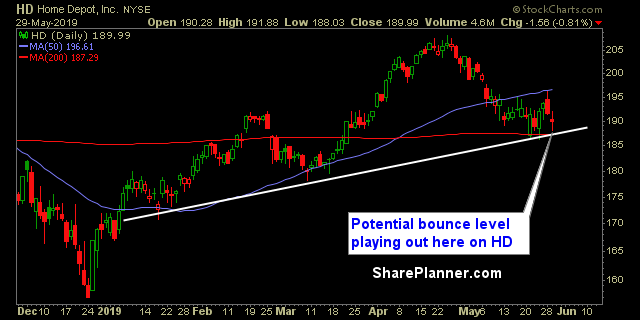

Swing Trade Approach: I took some partial positions off the table yesterday which included +6% in ETSY (ETSY), +5% in Splunk (SPLK), +3% in Home Depot (HD), while also cutting a couple of other positions to minimize losses following Friday’s sell-off. Also added some more short exposure to the portfolio as well. I’m open

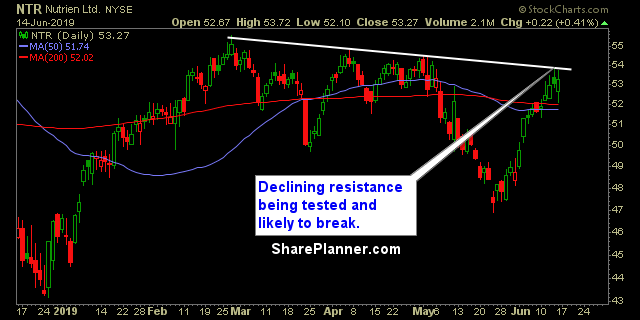

Monday’s Swing-Trades: $HD $NTR $CFX Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Home Depot (HD)

Thursday’s Swing-Trades: $HD $LMT $CWK Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Home Depot (HD)