Technical Outlook: After a strong sell-off initially, the dip buyers came back strong and rallied the market back into positive territory. Volume was actually surprisingly stronger than I would have expected yesterday for a Thanksgiving holiday trading. It was higher than Monday and just a shade below average readings. SPX is at a

Technical Outlook: SPX failed to add to its gains yesterday, and now a retraction is possible today, with futures plunging over news of Turkey shooting down a Russian warplane for crossing over into Turkish airspace. The year of the headline strikes again – random global events triggering fear in the stock market. More times

Technical Outlook: Sloppy day for stocks on Friday as it was options expiration and following the initial burst higher at the market’s open, the market remained in a slow sell-off the rest of the day. Breaking the declining resistance off of the May highs of this year, is of high importance here to the sustainability

Technical Outlook: Very low volume day yesterday on the SPY and SPX traded within an eight point range. All key support levels were held up yesterday, and the 20-day moving average was tested and held as well. The key for the bulls moving forward is to push through the declining resistance off of the

Technical Outlook: Another major rally yesterday following the eight day pullback, gives SPX 64 points in gains in the last three days. SPX has managed to reclaim the 200-day moving average that posed as resistance on Tuesday. Also, it reclaimed the 10 and 20-day moving averages, the latter of which puts SPX in the upper

Technical Outlook: SPX was off to a good start yesterday, and looked like it may string two consecutive days of gains together until a bomb scare at a stadium in Germany resulted in the market selling off all the day’s gains and then some. The sell-off happened at the 200-day moving average, and that now

Technical Outlook: Yesterday’s bounce was significant in many ways. First, it came off of the price level where the market broke out of the double bottom base it had been in. That base breakout level held perfectly. Secondly, the bounce coincided with the 38.2% Fibonacci retracement level. Now, today, the market must follow through to the

Not your typical way of posting charts these days, but with technology and to use these digital pens, it makes it far more easier to point out more of the nuances of a chart than ever before... so here you go.... Apple $AAPL: Microsoft $MSFT: Alphabet (Google) $GOOGL: Netflix $NFLX: Walt Disney Company $DIS:

I’m in the home stretch of October and it has been a dandy of a month so far. Try out my service by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone and with your membership, you will get each and every trade that I make with real-time text and email alerts (international

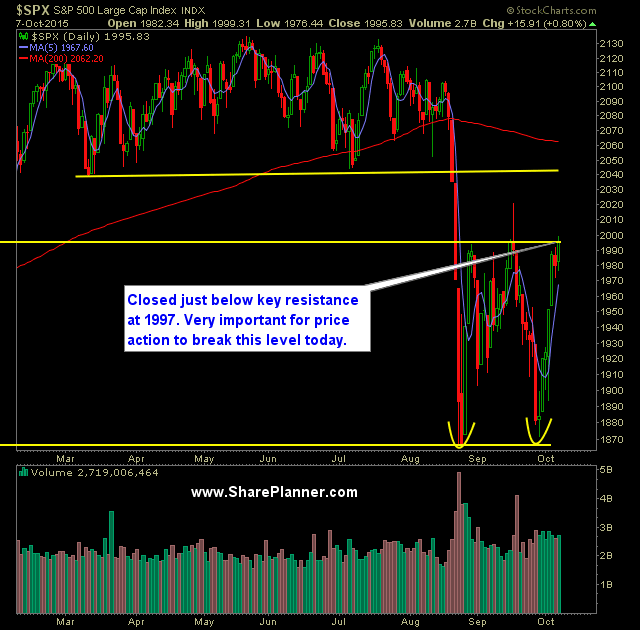

Technical Outlook: Choppy trading session yesterday that saw price give up all of its gains early on before finally rallying in the afternoon. SPY and SPX were unable to break and close above the 50-day moving averages. This resistance level is in conjunction with price level resistance that confirms the double bottom at 1997.