Technical Outlook: Another day where the bulls might not be ambitious for higher prices, but still willing to buy any dip that comes the market way. Despite the early selling, SPX managed to finish the day in the green yesterday. At some point this month, the brexit vote will become a concern for the market.

Technical Outlook: A rare down day for the market – in the case of SPY, only its second in the past seven trading sessions. And as we have seen of late, the sell-offs are quite often mitigated by a huge swell of buying into the close that wipes out all of the day’s losses

Technical Outlook: Quiet move in the market on Friday that led to another nice gain for the bulls. Slight uptick in volume on Friday but well below recent volume averages. This market has all the makings of a market the wants to continue to move higher, however, there are numerous resistance levels overhead between the

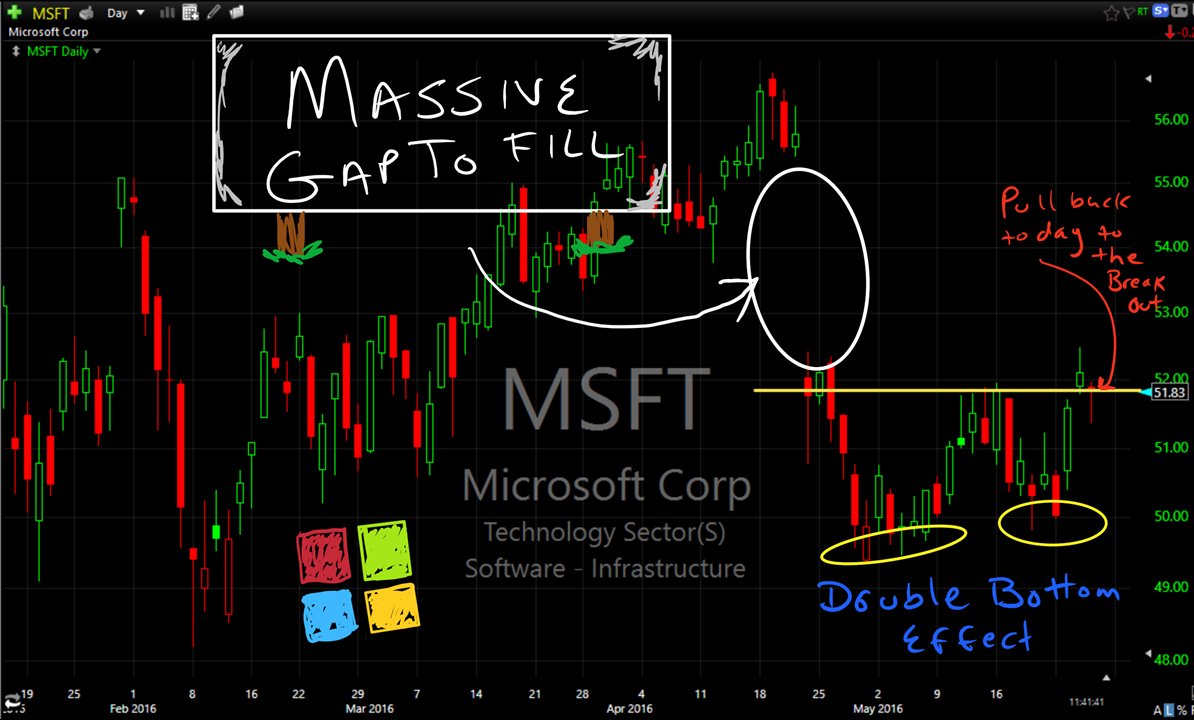

5/26: Double bottom price action that was confirmed at its neckline yesterday. Using today's weakness to buy the dip and see whether we can ride this trade into the massive gap for a fill.

Microsoft (MSFT) has one of the more intriguing charts that you will find out there today. In fact it may be one that I end up buying before day’s end. You have a nice double bottom play, over the course of the past month, and followed by a breakout of the double bottom base

Technical Outlook: First legitimate sell-off on SPX yesterday since April 7th. SPX finished the day trading below the 5-day moving average. Watch the rising trend-line off of the February 11th lows. Currently the trend-line sits at 2087. A slew of earnings came out last night and this morning resulting in hard sell-offs in

Futures are looking ‘okay’ right now, but there is some fair value cooked into them. For instance, the Nasdaq isn’t down only a few points, instead, it is down about 1% from where it closed the day at 4pm eastern. From the looks of things with Google (GOOGL) and Microsoft (MSFT) putting

Technical Outlook: SPX continued yesterday in its current 5-day trading range. The market is not providing clear direction here and being light until it shows otherwise is absolutely key here. I still think that there is a retest of the month’s lows in the near futures, at which point I think that is where you

Technical Outlook: SPX bounced back from Monday’s decline creating a 3-day period of choppiness for the market as it is trying to digest recent gains. With futures pointing downward, there is the possibility of continued choppiness today. FOMC Statement comes out today and will spur on additional volatility. I expect that FOMC will play this

2016 couldn't be any more crazier than it is right now and you are probably searching for a way to conquer these senseless market. So do yourself a favor, stay in the game and sign up to the SharePlanner Splash Zone! With your membership, you will get each and every trade that I make with