Bears are showing signs of life today, namely due to the heavy weakness in the Dow dragging everything else down today. If IBM and United Technologies (UTX) report better earnings the market might be making a run towards all-time highs today. But because the Dow is price weighted and not based on the market cap

June has been a great month in the SharePlanner Splash Zone and I plan to take that success into July. You can experience the same kind of profitable trading by trying out the Splash Zone out with a with a Free 7-Day Trial. With your membership, you will get each and every trade that I make with real-time

Learn to take low-risk swing-trading setups by joining me in the SharePlanner Splash Zone. You can try try it out today with a with a Free 7-Day Trial. With your membership, you will receive all of my swing-trade alerts via email and text (international too) as well as access to my world-class chat-room that I trade in

Learn to take low-risk swing-trading setups by joining me in the SharePlanner Splash Zone. You can try try it out today with a with a Free 7-Day Trial. With your membership, you will receive all of my swing-trade alerts via email and text (international too) as well as access to my world-class chat-room that I trade in

Learn to take low-risk swing-trading setups by joining me in the SharePlanner Splash Zone. You can try try it out today with a with a Free 7-Day Trial. With your membership, you will receive all of my swing-trade alerts via email and text (international too) as well as access to my world-class chat-room that I trade in

Learn to take low-risk swing-trading setups by joining me in the SharePlanner Splash Zone. You can try try it out today with a with a Free 7-Day Trial. With your membership, you will receive all of my swing-trade alerts via email and text (international too) as well as access to my world-class chat-room that I trade in

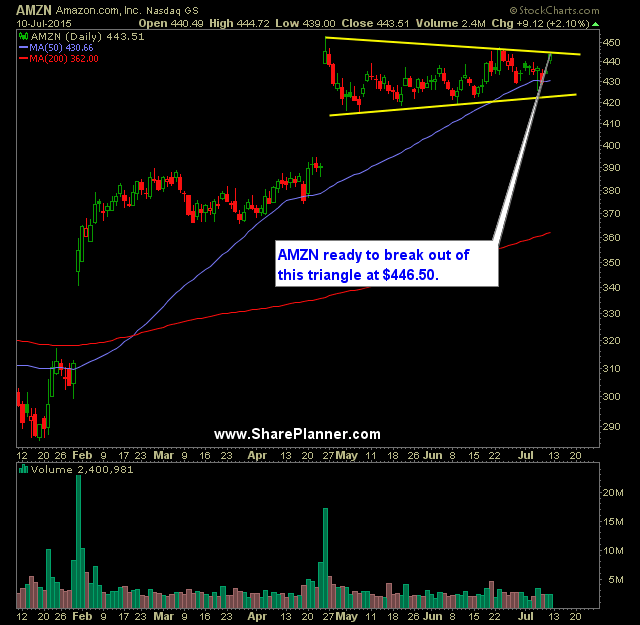

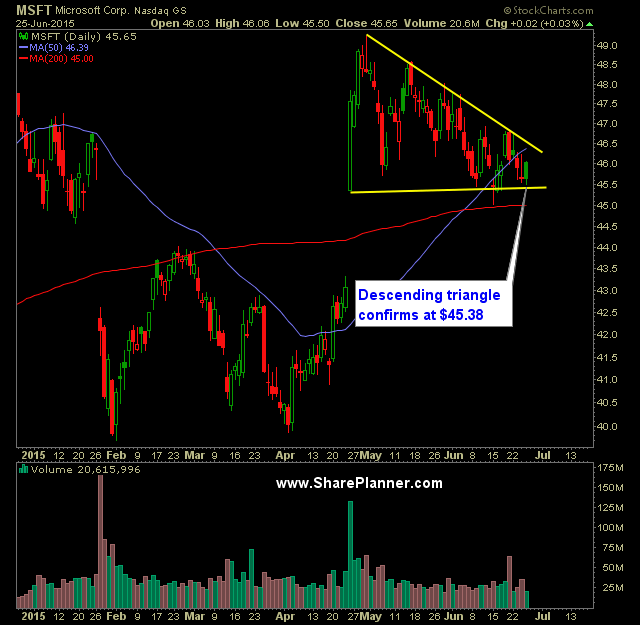

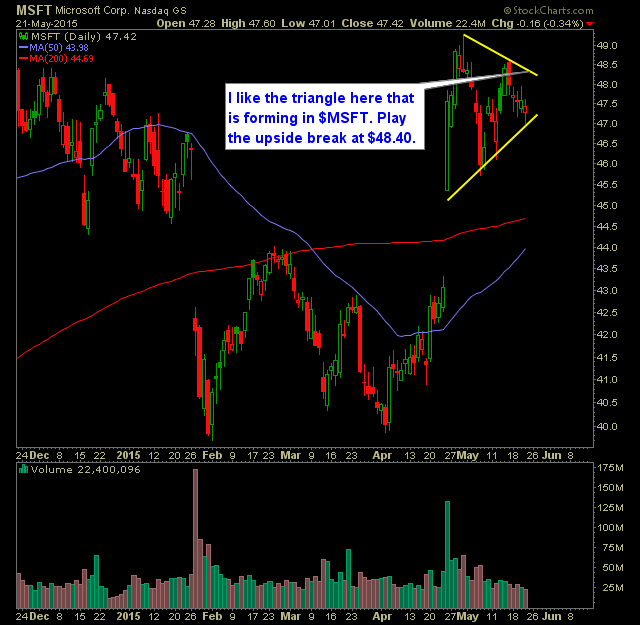

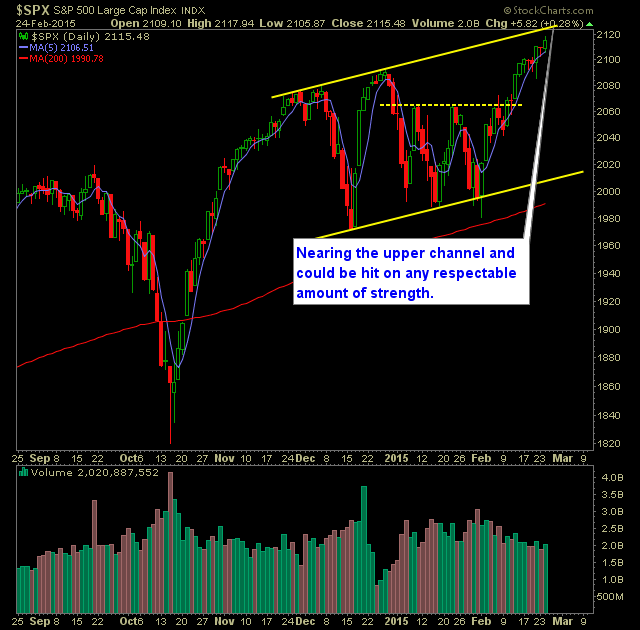

Technical Outlook: SPX broke out to new closing highs on Friday. However the move wasn’t strong among individual equities, as the market was pulled higher mainly by MSFT, GOOG and AMZN earnings reports. Nonetheless, there is very little in the way of resistance for the market heading forward until it reaches the

Technical Outlook (SPX): SPX drifted higher yesterday, and saw early morning weakness get quickly bought up. Following Friday’s breakout, we have a nice series of higher highs and higher lows on the 30 minute chart of SPX. Nasdaq has pushed higher for 10 straight days – a rarity by any measure, with the negative

Technical Outlook (SPX): Sixth straight day where SPX spent the majority of the day digging itself out of the hole, yet managing to finish near break even or higher. Futures are pointing slightly higher for /ES which is a rarity these days. Volume was off yesterday and well off of the previous day’s volume