It’s still never too late to finish the year off right – and you can do so by signing up for the SharePlanner Splash Zone and with your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my chat-room that I trade

Technical Outlook: With options expiration on Friday, SPX concluded a 71 point sell-off over the last two trading days, wiping out the market bounce from earlier in the week. Divergence (bullish) over the past two days with the selling that was seen, as the VIX did not make new closing highs for December, despite

Technical Outlook: Yesterday’s sell-off raised eye brows, because even with the selling early on, it appeared as if SPX would rally out of the base it was forming at the lows of the day, but the last hour of trading in particular completely derailed those plans and completely changed the look and feel of this

Technical Outlook: The Fed yesterday came through on what was widely expected and that was a 1/4 point rate increase. The market subsequently rallied hard thereafter. With yesterday’s monster rally, SPX managed to reclaim every major moving average including the 10, 20, 50 and 200-day moving average. A lot of talk about the “Golden Cross”

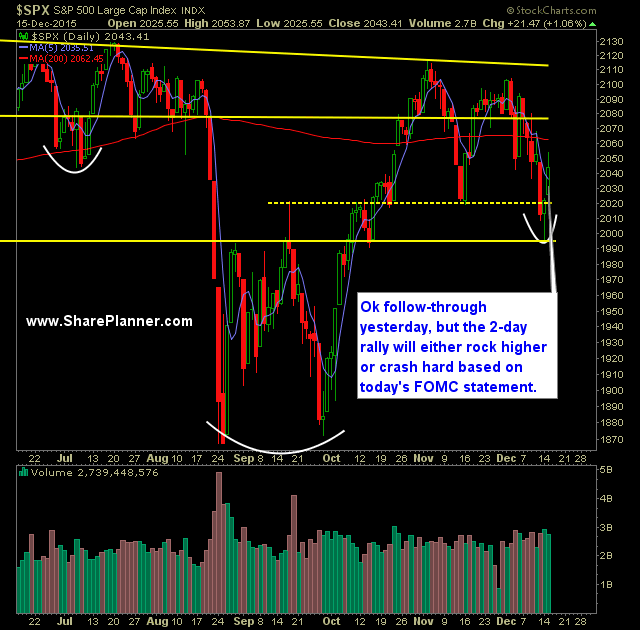

Technical Outlook: Respectable follow through yesterday, though SPY failed to do much of anything after the first 30 minutes of trading, finishing just barely higher than where it started the day at. Today is the day where the FOMC is expected to begin increasing interest rates – with today starting at a quarter point

Technical Outlook: A wild morning in trading that saw the market seesawing 20 points within minutes in both directions, ultimately led to a quick sell-off and then even bigger bounce. As a result, SPY has formed the ideal bottom candle that is in the shape of a hammer. If you look back at many

It’s still never too late to finish the year off right – and you can do so by signing up for the SharePlanner Splash Zone and with your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my chat-room that I trade

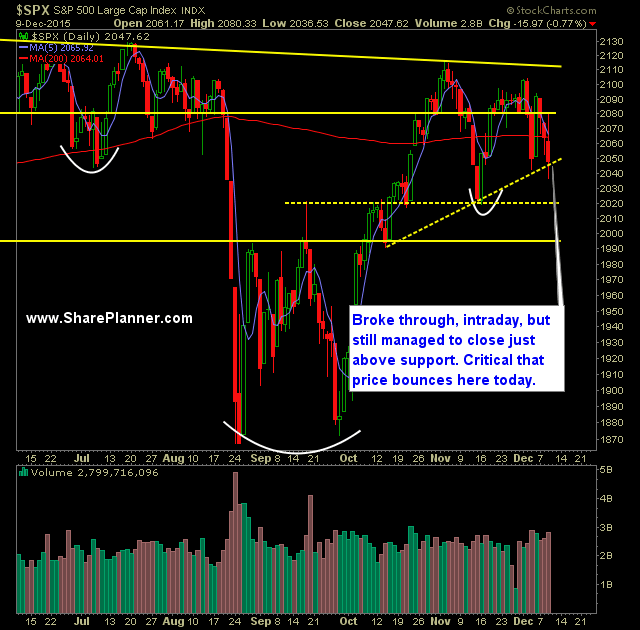

Technical Outlook: After being up more than 17 points on the day, SPX dropped, within a two hour period, 44 points to the downside. That marks one of the most significant intraday reversals we have seen this year. SPX managed to close, as noted in the chart below, just above the rising support level off

I just finished up another profitable month in November! It’s still never too late to finish the year off right – and you can do so by signing up for the SharePlanner Splash Zone and with your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as

Technical Outlook: SPX returns to normal trading after a low volume week. Over the last six trading sessions, SPX has coiled nicely. I expect at some point for there to be a break to the upside to challenge the rally highs and ultimately SPX’s all-time highs. On SPY, of the past six trading sessions,