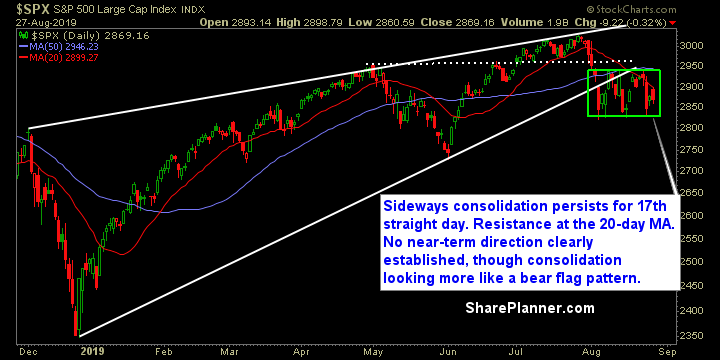

My Swing Trading Strategy I added one additional short position yesterday to the portfolio, while keeping the existing portfolio and balance the same. I won’t look to add any additional short exposure here, until we get confirmation that the market wants to break down and out of the current trading range that price finds itself

My Swing Trading Strategy I closed out my position in QID for a +2% profit. Not thrilled about the ultimate outcome of that trade, especially considering how well the futs were performing Sunday night, but that is the stock market for you, what the current situation happens to be doesn’t denote its ultimate outcome. I

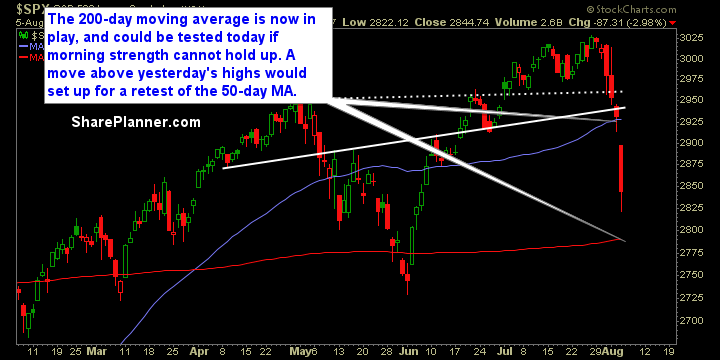

My Swing Trading Strategy I added QID on Friday one the initial dump following Trump’s tweets. I held over the weekend, as well as my one long position too. Obviously futures are all over the place, and the only thing I can do here is tighten up my stops and see where price action wants

My Swing Trading Strategy I sold Twitter (TWTR) yesterday for a +2.4% profit. I still have one long position, but am looking to add a short position depending on the outcome of the Jackson Hole speech today. Staying light is the best approach to this market. Indicators Volatility Index (VIX) – A 5.6% spike yesterday off of the 50-day

My Swing Trading Strategy I didn’t touch the market yesterday. I wasn’t overly crazy about shorting a market that gapping down over 40 handles on SPX. Though it would have been a profitable trade, the risk/reward wasn’t there. Today sets up for a potential gap and crap, so it is very much worth

My Swing Trading Strategy I sold my inverse ETF position in SDS on Friday for a +3.2% profit. While I’d like to still be in that position today, considering how weak the market was, selling it on Friday did make sense as the price action was well below the lower bollinger band and the S&P

My Swing Trading Strategy Yesterday was a real clown act by the market. I originally closed out my position in SDS for a 0.6% profit, only to have jump right back in the trade later in the day following the Trump Tweet. Right now, I have one staple play and one short position. Indicators Volatility

My Swing Trading Strategy My Long position SDS which provides a 2:1 inverse return of SPY did marvelously yesterday, and helped deflect some of the losses in the two positions I was stopped out of, due to Jerome Powell’s unbelievably and disastrous presser. Seriously, can we end these senseless press conferences already? It’s a dumpster fire every time.

Information received since the Federal Open Market Committee met in June indicates that the labor market remains strong and that economic activity has been rising at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Although growth of household spending has picked up from

My Swing Trading Strategy I have been playing more conservative ahead of the FOMC Statement Today, I have long and short positions to give my portfolio a more “neutral” balance to it. Depending on how the market reacts to the Fed and its interest rate cut, will determine how I trade going forward. For now,