My Swing Trading Strategy Three of my four positions increased in value yesterday, the other was stopped out by the volatility created by the FOMC Statement. I’ll be looking to add one new position to the portfolio today, possibly two. Indicators Volatility Index (VIX) – a 3.4% decline yesterday pushed the VIX just below the 14

Information received since the Federal Open Market Committee met in July indicates that the labor market remains strong and that economic activity has been rising at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Although household spending has been rising at a strong

My Swing Trading Strategy I was stopped out of my trade in Macy’s (M) for a loss yesterday, right at the open. I replaced the stock with a healthcare stock, and will hold off on making any additional trading decisions until after the FOMC Statement today. Indicators Volatility Index (VIX) – A 1.5% decline, wiped out much

The Fed is the next likely headline risk for the market. No one knows which way the market wants to go after the Fed announces its statement, and it is probably for that very reason that the market has stalled out over the past three trading session, and the ever so hot small caps are

My Swing Trading Strategy I added one new trade to the portfolio yesterday, but in terms of adding more long exposure at this point, I may hold off, until I can see with a bit more certainty as to whether this market wants to challenge new all-time highs or not. For sure, I’ll be increasing

My Swing Trading Strategy I booked profits in SPXU yesterday for a 2.4% gain, and SQ for a 0.6% profit. I’ll look to add one or two new trades to the portfolio today. Indicators Volatility Index (VIX) – A very mellow 3.6% rise in the index on a day where the market was trying to

My Swing Trading Strategy I’m under the threat of a hurricane today, so that makes trading a little dicey for me today. Power could go out, internet/cell coverage could go down. As a result, my focus today will likely be to manage the existing positions and nothing else. Indicators Volatility Index (VIX) – A 6.2% pop

My Swing Trading Strategy Closed out my two short positions early yesterday, and flipped the script and added two long positions to my already existing long position. I may add one additional long position today, depending on how the market performs. Indicators Volatility Index (VIX) – It surprises me that the VIX isn’t dropping more than

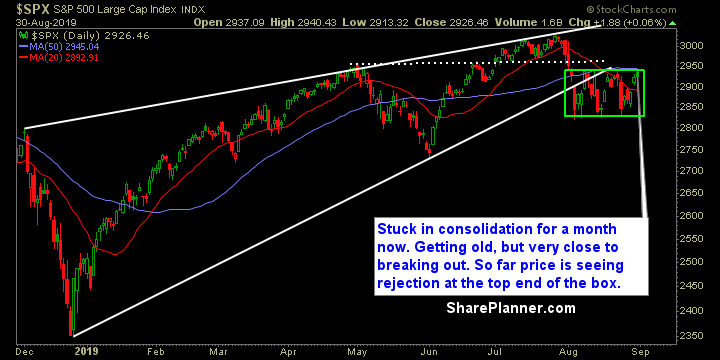

My Swing Trading Strategy I’m likely to be forced out of my two short positions, while riding my one long position higher. I am open to add one to two new long positions, but until we break out of this four week consolidation pattern, I am not going to put a lot of confidence in