Information received since the Federal Open Market Committee met in December indicates that the labor market has continued to strengthen and that economic activity has been rising at a solid rate. Gains in employment, household spending, and business fixed investment have been solid, and the unemployment rate has stayed low. On a 12-month basis, both

Information received since the Federal Open Market Committee met in November indicates that the labor market has continued to strengthen and that economic activity has been rising at a solid rate. Averaging through hurricane-related fluctuations, job gains have been solid, and the unemployment rate declined further. Household spending has been expanding at a moderate rate,

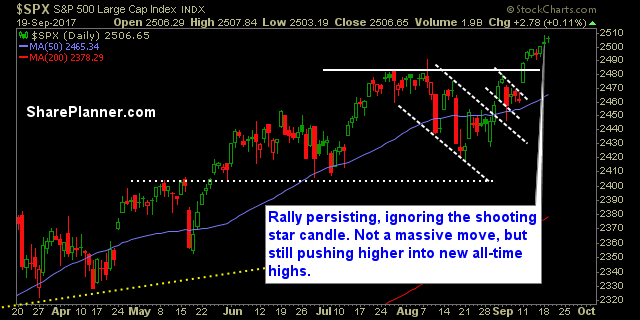

My Swing Trading Approach FOMC at 2:30pm eastern today, I am not likely to be overly active ahead of the announcement. Indicators

Information received since the Federal Open Market Committee met in September indicates that the labor market has continued to strengthen and that economic activity has been rising at a solid rate despite hurricane-related disruptions. Although the hurricanes caused a drop in payroll employment in September, the unemployment rate declined further. Household spending has been expanding

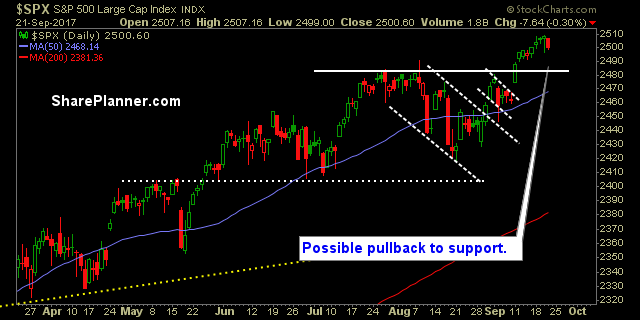

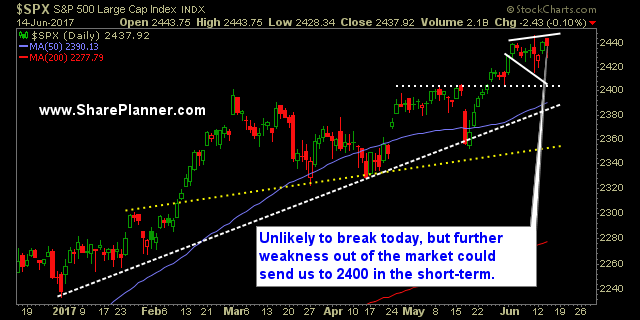

My Swing Trading Approach I’m concerned with the selling yesterday, and whether that could usher in more weakness today and the week ahead. I will be very careful about adding additional long exposure at this point, until I get some clarification from the market. Indicators

My Swing Trading Approach I’m not opposed to adding new long positions at this point in the rally, but I am cautious about overloading the portfolio with too many long positions at this point, as we are more likely than not to see a 1-2% pullback in the near term (in the coming weeks).

Information received since the Federal Open Market Committee met in July indicates that the labor market has continued to strengthen and that economic activity has been rising moderately so far this year. Job gains have remained solid in recent months, and the unemployment rate has stayed low. Household spending has been expanding at a moderate

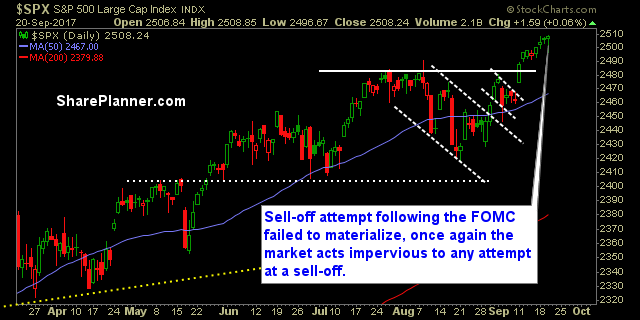

My Swing Trading Approach I don’t expect to make any trades during the morning. I will hold off until after the FOMC meeting to make any new trades to the portfolio. Continue to increase my stop-losses on existing positions. Indicators

Information received since the Federal Open Market Committee met in June indicates that the labor market has continued to strengthen and that economic activity has been rising moderately so far this year. Job gains have been solid, on average, since the beginning of the year, and the unemployment rate has declined. Household spending and business

‘Hawkish Rate-Hike’ Gets the market in a tizzy But lets not kid ourselves, all this talk about a ‘hawkish rate hike’, whatever that means, probably gives the bulls another opportunity to by the dip. If the bears can pull it together today, it could be a very nice for their short positions. But it is