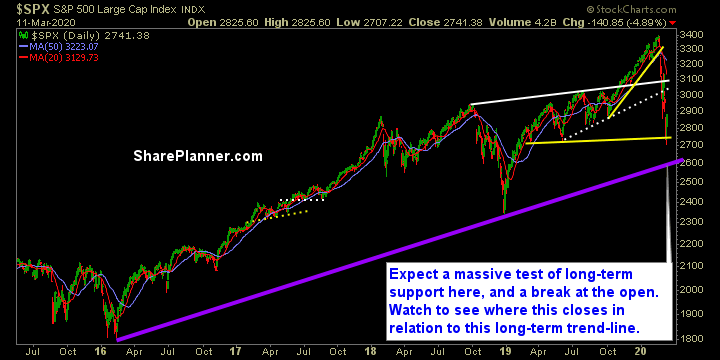

Swing Trading Strategy: Where Panic sets in… Hitting levels all throughout this week that seemed like a bounce was near, and the following a Presidential prime time address that the market puked all over, the futs are limiting down in pre-market action and stocks look to bathe in the blood of investors. Today has the

Swing Trading Strategy: Another one-day rally? Shaken out early on with my positions I carried over from yesterday, but managed to quickly jump back in like a chicken with his head cut off and capture the profits in those positions – so I am happy about that. What tipped me off was the shakeout early

Swing Trading Strategy: Tell me more about these ‘limit downs’? So President Trump has a press conference, says some good feeling things, the market rallies, now, what if, and bear with me a second, what if we limit up tomorrow? The market is 20% off of its all-time highs, and you’re telling me you’ll

Swing Trading Strategy: A scary market indeed! These are by far uncertain times for the stock market, bond market, currency markets, let me think, what else? Oh yes, commodities too. Have you seen oil prices crashing tonight? Down -32%! DOWN 32%, I say!!! While Coronavirus has had an impact on oil, this has more to

Swing Trading Strategy: Oh the places the stock market will take you. For those who are just starting out in the stock market for the first time, you are witnessing some of the most volatile trading days that you’ll ever experience. You certainly can learn a lot from market turbulence like this. I’ve done it

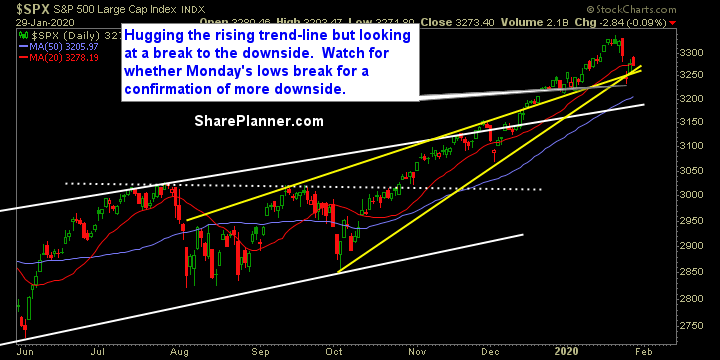

Swing Trade Approach: Another busy day as I closed Vertex (VRTX) at 232.69 for a +6% profit, Virgin Galactic (SPCE) for a +6% profit, I took some profits in my Square (SQ) trade for a +8% profit, and reduced my exposure in my Spotify (SPOT) trade by taking a portion of that trade

Information received since the Federal Open Market Committee met in December indicates that the labor market remains strong and that economic activity has been rising at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Although household spending has been rising at a moderate

Swing Trade Approach: I closed out the second half of my short position in Walt Disney (DIS) today for a +3% profit. I also added two new long positions while closing out one other long position in Levi Strauss (LEVI) which was one of more bizarre acting stocks that I have traded in some time, taking a

Quite the descriptive title, I know, but the market is rallying hard right now, and is doing so on very strong and above average volume. No doubt there is some end of year chasing going on coupled with FOMO, and a dash YOLO, I suppose too. There are gaps all over the charts popping up,