Quite the descriptive title, I know, but the market is rallying hard right now, and is doing so on very strong and above average volume. No doubt there is some end of year chasing going on coupled with FOMO, and a dash YOLO, I suppose too. There are gaps all over the charts popping up,

Information received since the Federal Open Market Committee met in October indicates that the labor market remains strong and that economic activity has been rising at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Although household spending has been rising at a strong

Some serious long-term resistance overhead for this market, and that is probably going to stunt growth going forward in this market. That’s not me calling for a major sell-off, because I’m not. In fact as long as the Fed keeps QE4 going, this market will keep going up right along with it. However, the gains

My Swing Trading Strategy I added one short position to the portfolio, not sure if that will be instant regret today or not, with the futures spiking, but it is the only short position in the portfolio, so it isn’t too bad. I’ll look to add possibly one additional long position today considering how the

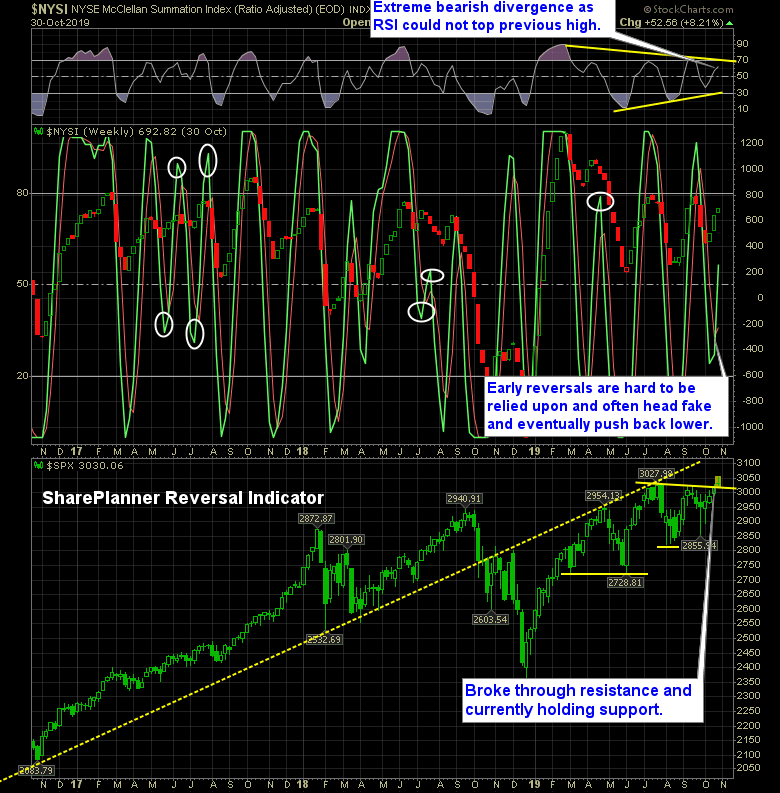

Bullish reversal in place on my market indicator, but can it be trusted? The reversals on the SharePlanner Reversal Indicator are always best served when they happen at extreme levels, because there is enough reflex bounce to get price moving in a substantial way. But this confirmation comes at almost all-time highs, weak volume

My Swing Trading Strategy With FOMC yesterday, I didn’t add any new swing-trades to the portfolio yesterday. I instead sat on my hands and let my current positions increase in profits. There are a few particular stocks that I have my eye on today for possible entries. Indicators Volatility Index (VIX) – The sell-off in

Information received since the Federal Open Market Committee met in September indicates that the labor market remains strong and that economic activity has been rising at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Although household spending has been rising at a strong

My Swing Trading Strategy One oversold bounce play added to the portfolio. My portfolio is quite conservative considering how much this market is run, and don’t want to be adding a significant amount of new positions at all-time highs here. Indicators Volatility Index (VIX) – Bounced two days in a row, but far from anything special.

The bears have lost themselves and their chance to drive this market lower yet again. The market has been on a three week rally and when it couldn’t find enough momentum to push SPX to new all-time highs, it gapped above them instead on a Sunday night. Now, the market is officially back in uncharted

My Swing Trading Strategy No new positions yesterday as I sat on the sidelines. Market breadth looked questionable, and not real panic moment for the market that would lead me to believe a bottom had been put in place. Indicators Volatility Index (VIX) – A 7% drop yesterday took the indicator back down to 19.12. Not