Information received since the Federal Open Market Committee met in May indicates that the labor market has continued to strengthen and that economic activity has been rising moderately so far this year. Job gains have moderated but have been solid, on average, since the beginning of the year, and the unemployment rate has declined. Household

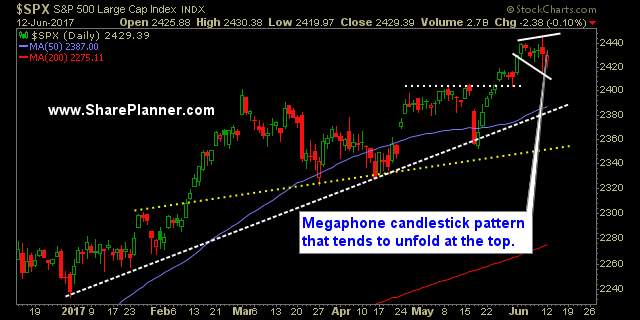

Short-term bearish megaphone pattern showing itself. Much of it comes from the fact that Friday’s crazy doji pattern has created this megaphone pattern, but nothing happened today to change the look of it either.

Information received since the Federal Open Market Committee met in March indicates that the labor market has continued to strengthen even as growth in economic activity slowed. Job gains were solid, on average, in recent months, and the unemployment rate declined. Household spending rose only modestly, but the fundamentals underpinning the continued growth of consumption

The Fed Up Rally Takes Price Back to Almost All-Time Highs Of couse I am using a play on words as this Fed Up Trump Rally is hated and despised by most and defies the logic of investing in general. I mean, c'mon it has been since last October - almost a half of a

Fed Announcement by Janet Yellen Hikes Interest Rates Again Below is the Fed announcement and the FOMC Statement regarding the 0.25% interest rate hike: Information received since the Federal Open Market Committee met in February indicates that the labor market has continued to strengthen and that economic activity has continued to expand at a moderate

My List of bearish stocks to watch this week Yesterday it was 77 bullish stocks, and this time around it is 77 bearish stocks to watch. Coincidence? Yup. Wasn't trying for that though it is kind of cool for reasons unknown to me. We've got a market that is gradually weakening right now, and has

Still the market that can’t slow down. My stocks watchlist has another two long setups and one short setup today. Let price confirm moves, don’t rush trades, and definitely don’t chase price. Also, check out the SharePlanner Splash Zone which is absolutley on fire. You can try it out with a Free 7-Day Trial. Here’s

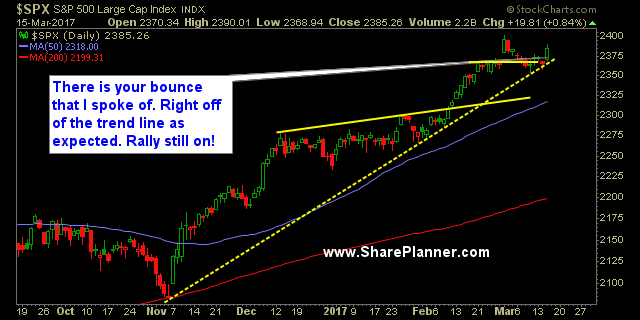

Technical Analysis: A much cleaner trading session for the bulls, as the market opened and rallied higher on the day, leaving little doubt as to who was in control during the session. Biotechs saw a solid push higher yesterday which provided the market with a solid floor to work from. Nasdaq (COMPQX) looked re-energized

Technical Analysis: Another “sell-off” that was hardly a sell-off on Friday, where price basically stood still. Right now, it is more likely that the bulls are alleviating overbought conditions through “time” rather than “price”. The steep rising uptrend on S&P 500 (SPX) could possibly be tested today at 2252. The only rising uptrend that has been broken

Technical Analysis: The Federal Reserve raised interest rates yesterday by a quarter point. Initially the S&P 500 (SPX) tried to rally on the news but quickly gave up its gains on the day to finish 0.8% down on the day. SPX also managed to close below its 5-day moving average for the first time since 12/2