My Swing Trading Strategy

No new positions yesterday as I sat on the sidelines. Market breadth looked questionable, and not real panic moment for the market that would lead me to believe a bottom had been put in place.

Indicators

- Volatility Index (VIX) – A 7% drop yesterday took the indicator back down to 19.12. Not a huge move considering how much it has risen since mid-September.

- T2108 (% of stocks trading above their 40-day moving average): This 6% pop yesterday concerned me, because if the bottom was in, the indicator should have moved a lot more to the upside. Currently sitting at 41%.

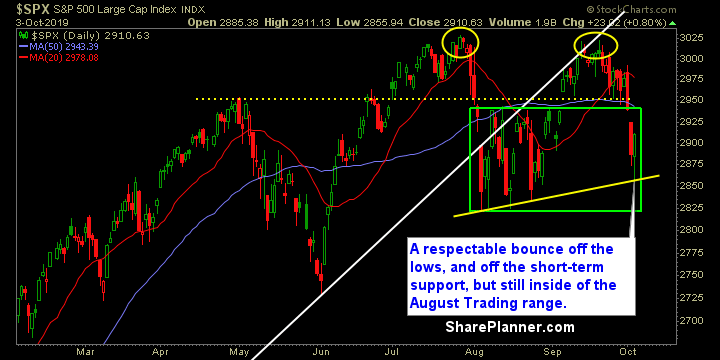

- Moving averages (SPX) No major changes here. Still trading below all of its major moving averages except for the the 200-day MA.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology led the way yesterday, which is what you’d expect on a dead-cat bounce or any bounce for that matter. Healthcare rallied well beyond the indices and did so off of key support going back to the April lows. Energy showed a really nice move yesterday, should be considered suspect still as it refuses to sustain a move above the 200-day moving average and still has a series of lower-lows and lower-highs in place. Discretionary struggled to keep up with the rally yesterday and is of some concern for this rally going forward, though it did bounce off of the rising trend-line from the June lows.

My Market Sentiment

Bounce off of short-term support, but inside the August trading range. This creates a messy market still for traders, and one that should be approached with extreme caution. Double top still in play, and the market is rallying and selling off for the same reasons of late. Plenty of headlines that can affect the market today, including Jerome Powell (Fed Chairman) at 2pm eastern.

Current Stock Trading Portfolio Balance

- 100% Cash.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I continue the two-part series on the rise of the retail trader and the growing impact they have in today's stock market. I also talk about how this impacts your trading and the stock market going forward.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

X: https://x.com/shareplanner

INSTAGRAM: https://instagram.com/shareplanner

FACEBOOK: https://facebook.com/shareplanner

STOCKTWITS: https://stocktwits.com/shareplanner

TikTok: https://tiktok.com/@shareplanner

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.