Indicators of economic activity and employment have continued to strengthen. The sectors most adversely affected by the pandemic have improved in recent months but are being affected by the recent sharp rise in COVID-19 cases. Job gains have been solid in recent months, and the unemployment rate has declined substantially. Supply and demand imbalances related

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals. The COVID-19 pandemic is causing tremendous human and economic hardship across the United States and around the world. Economic activity and employment have continued to

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals. The COVID-19 pandemic is causing tremendous human and economic hardship across the United States and around the world. Economic activity and employment have picked up

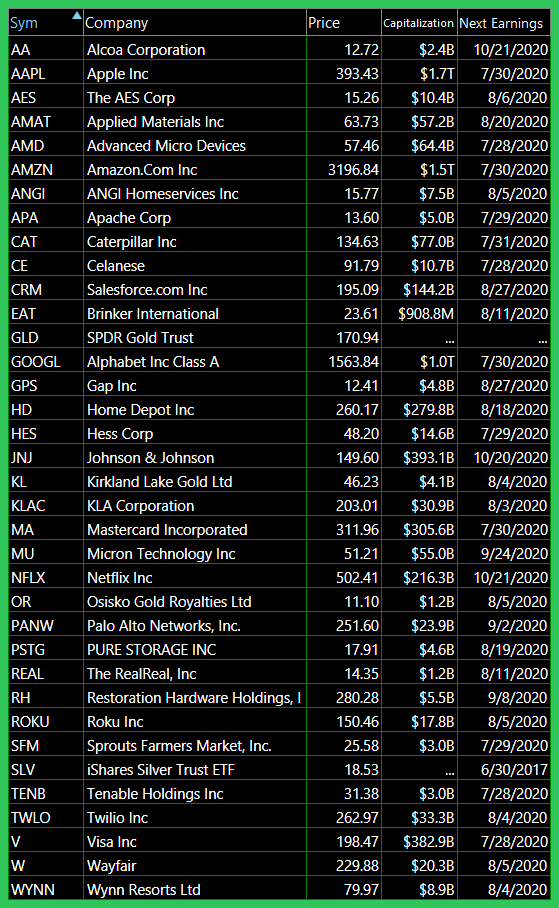

Another Monday, another rally, albeit a small one this time. The inverse correlation between the Nasdaq and Russell 2000 persists, with the latter only rallying hard when it needs to cover for the former and vice versa.

Rally Stocks Now and Forever More Honestly, I hate this market, as I am sure plenty of of others do too. It isn’t that I have something against bullish markets, but I do have something against markets that have been completely taken over by a federal government trying to win re-election and re-appointment, and investors

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals. The coronavirus outbreak is causing tremendous human and economic hardship across the United States and around the world. Following sharp declines, economic activity and employment

The Stock Market Crash 2020 might seem long forgotten, as Tesla stock is now all the rage, but with a major earnings week coming up, and the FOMC Statement as well, there is the potential for a resumption of the stock market crash if all does not go well. You already see a lot of

We got the ceremonial Monday rally. Now it is just a matter of whether the stock market craps all over itself the rest of the week. I took Silver (SLV) off the watch-list and I'll probably get a bunch of "you're an idiot" emails because some of you out there don't realize what risk and

Oh what a mess this Federal Reserve has put the stock market in! Oh I know, S&P 500 and the Nasdaq are both positive on the year, and the latter is raging at new all-time highs, day after day practically. But what happens when the Fed balance sheet goes back to “normal”?

We lived a life time in the first half of 2020, what does the second half have in store? I hate to say that there's no way that the second half of this year could be crazier than what we have experienced so far in 2020, but the mere statement will likely doom us all