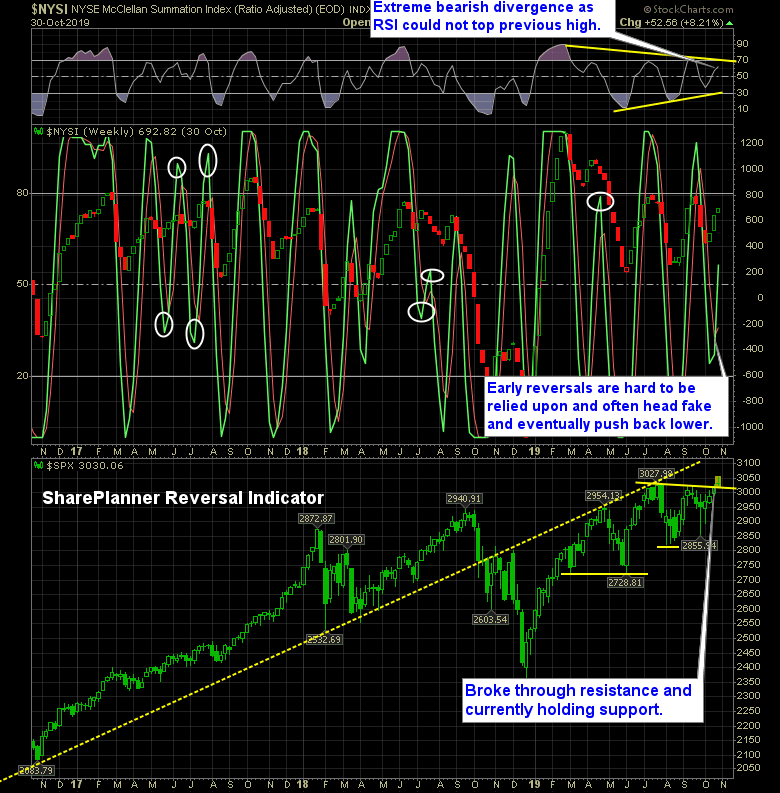

Bullish reversal in place on my market indicator, but can it be trusted?

The reversals on the SharePlanner Reversal Indicator are always best served when they happen at extreme levels, because there is enough reflex bounce to get price moving in a substantial way. But this confirmation comes at almost all-time highs, weak volume and a history of false signals when it happens earlier than typical in the process.

What I am talking about here is shown in the chart below, because when the bullish reversals happen early, they often lead to a quick head fake, and so, I am skeptical that this market, with all the bearish divergences seen on so many indicators, will be able to sustain this current market rally for the foreseeable future without some profit-taking first.

Remember, last year everyone was feeling quite positive about this market at the end of September of last year, and then the entire bottom fell out of it seeing a sell-off of over 20%. So, I’m not smoking anything here to believe that we should show some caution at these levels, especially with most of the companies out there having already reported earnings, the Fed having already cut rates for a third time, and without guarantees of a fourth, followed by the market being priced for perfection when it comes to the US and China relations.

Meaning, there’s not a lot of new “good news” out there that can continue pulling this market higher, and this market is feeding 100% off of the headlines right now.

So be careful, and be hesitant to get too aggressive when it comes to this market here. Also, for more information on the strategy that I am taking with my stock trading right now, listen to my latest podcast by clicking here.

Here’s the SharePlanner Reversal Indicator:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I cover the expectations that we should be setting for ourselves as swing traders, from the number of trades we should be expecting to take, how long and how short we should be in our trading portfolio, as well as what the expectations for a win-rate should be.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.