April Stock Market If you believe in old stock market cliches, then you’ll know that April represents, in theory, the last good month of trading for the bulls before they “Sell in May and Go Away!”. But lets face, it, yes, the volume in the summer is lower, and sell-offs tend to happen more often

Trading Calendar Quarter End in Sight Slight open lower yesterday quickly evaporated as the market engaged in its normal morning routine – rally higher and into the green before the market closes, and usually much sooner. The biggest risk these days tends to be a gap higher which has the highest chance of being faded

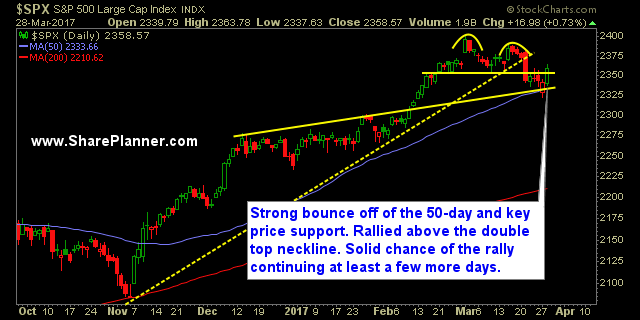

Dead cat bounce until proven otherwise. It’ll probably take the market establishing new all-time highs in order for me to not view this market rally the last two days from a dead cat bounce perspective. There has been some technical improvements, but even still, the downtrend off of the March highs are still in

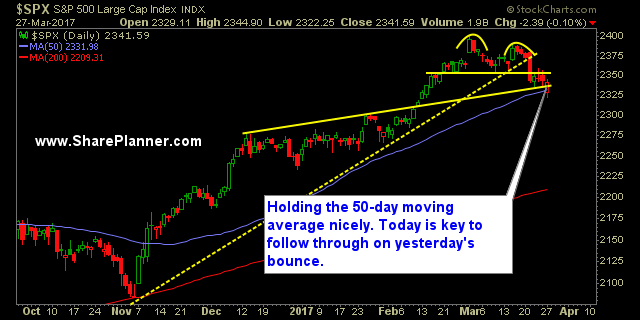

Solid bounce yesterday, but can the markets today follow through? For many years now, when we see the dead cat bounce come about, stocks overall will look to continue the bounce for several days going forward. For the markets today, will that ring true yet again? The futures are slightly down, but that has

Dow Jones Chart has not been down 9 straight days since 1978 That is quite a run, to not have a sell-off of nine straight days since Jimmy Carter was president. But the Dow Jones chart is finding some support at the 50-day moving average as is the S&P 500 chart. I suspect that we’ll

Not a stock market crash based on historical sell offs Obviously! But the sell-off that we are seeing this morning before the equity market has even opened, is far greater than what we have become used to seeing. One thing I will add here is that, based on my experience and years of observations, the

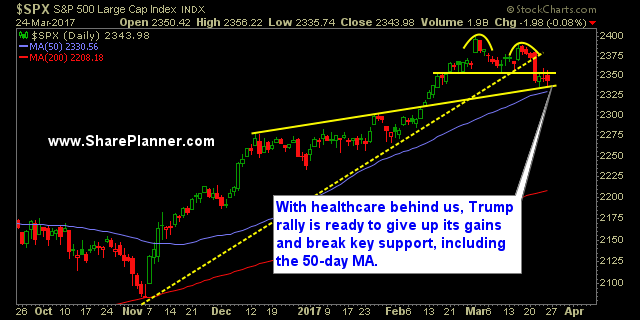

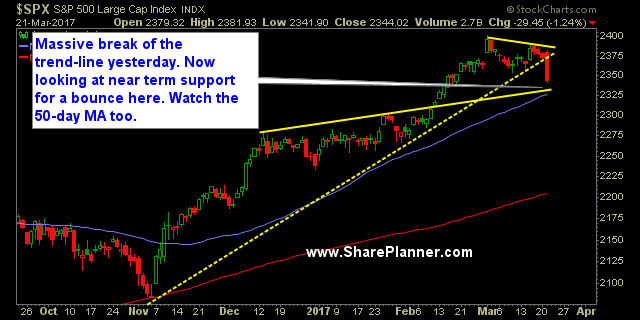

That’s why I say managing risk is so important Yes, it not a fun subject to talk about, but it is not something you cannot afford to ignore. From the highs to the lows of the day, SPX sold off 40 points and broke its key trend line. That is a massive swing considering

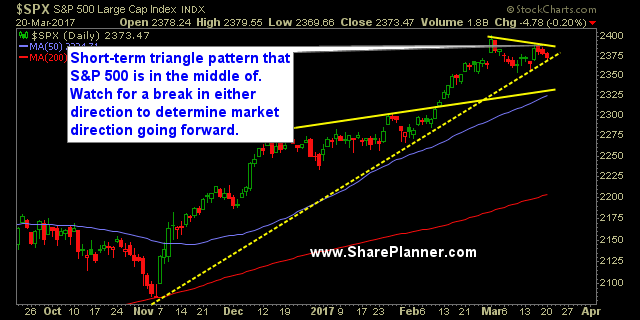

Short-term triangle pattern on SPX SPX has been coiling in a triangle pattern the past three weeks now, or essentially, this entire month of trading. It has pulled back to the rising trend-line that forms the bottom half of the triangle pattern. However, it has only experienced a mild, light volume pullback over the past

Watch the trend-line on the chart of the S&P 500 A lot can change here today or this week if the rising trend-line as noted in the chart of the S&P 500 below fails to hold. You have a potential topping pattern – emphasis on “potential” – with a new all time high that was

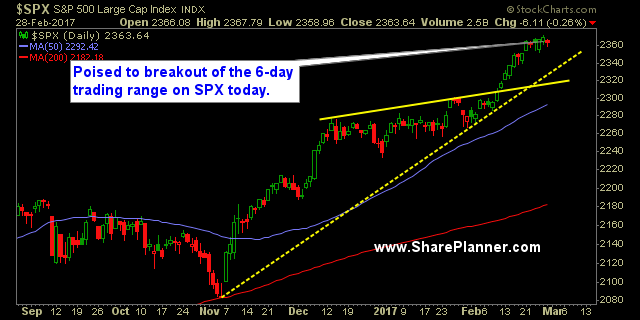

My Trading Journal for the Stock Market Today: I’m not talking about the speech itself, though I did think the speech was a pretty darn good one, and blew away everyone’s expectations. But I am talking about whether the Trump Rally itself can follow through into additional gains tomorrow. History says, “Sure”. I mean C’mon, the