Market couldn't care less about this once trillion dollar company, Oracle (ORCL) falling 31% in the last two months.

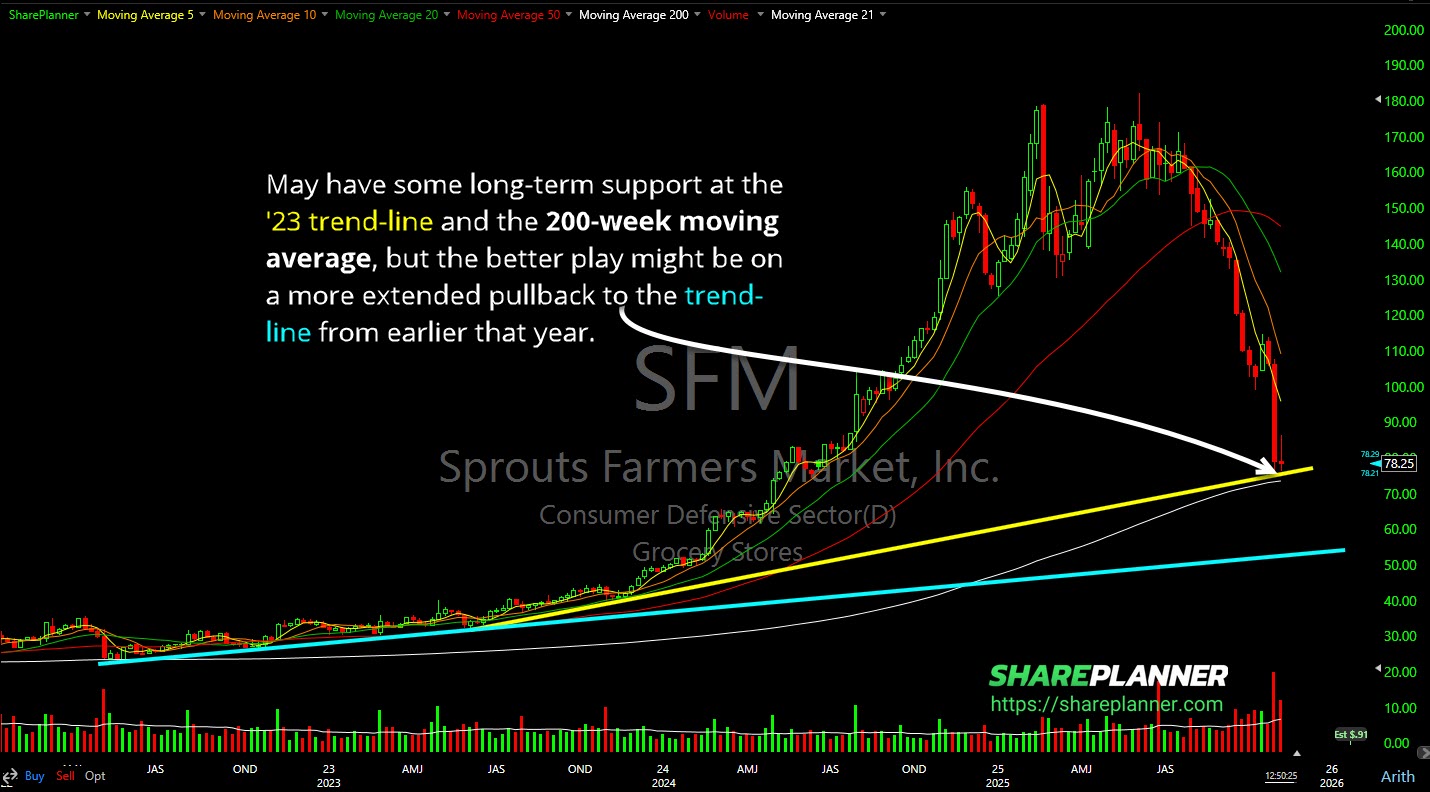

Sprouts Farmers Market (SFM) may have some long-term support at the '23 trend-line and the 200-week moving average, but the better play might be on a more extended pullback to the trend-line from earlier that year.

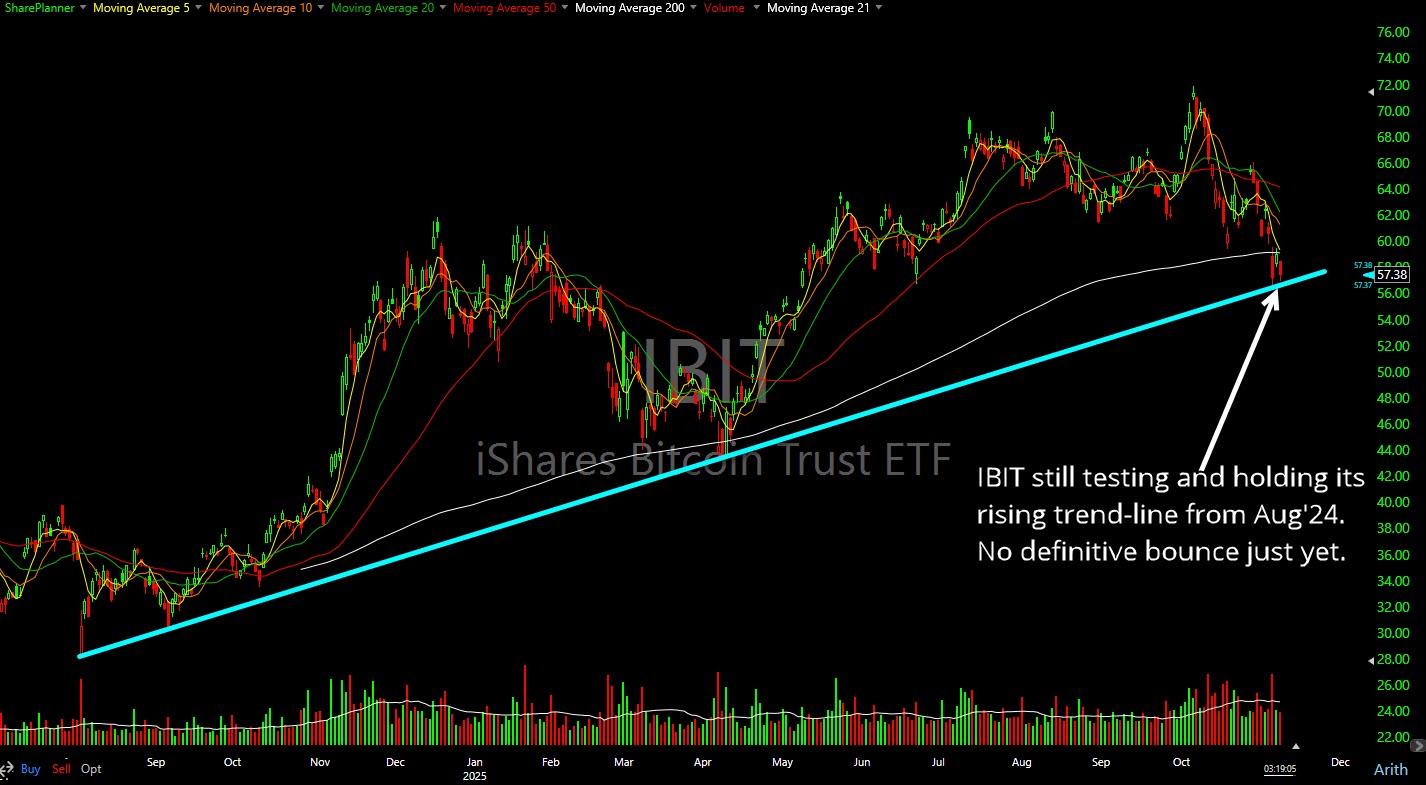

Pullback in the Bitcoin ETF (IBIT) continues to, so far, test and hold the rising trend-line, but yet to get a solid bounce out of it.

Shopify (SHOP) pulling back to the lower channel band and long-term support simultaneously. Watch for a bounce here.

Solid move, but still 68% of stocks remain below their 40-day moving average - a total garbage market.

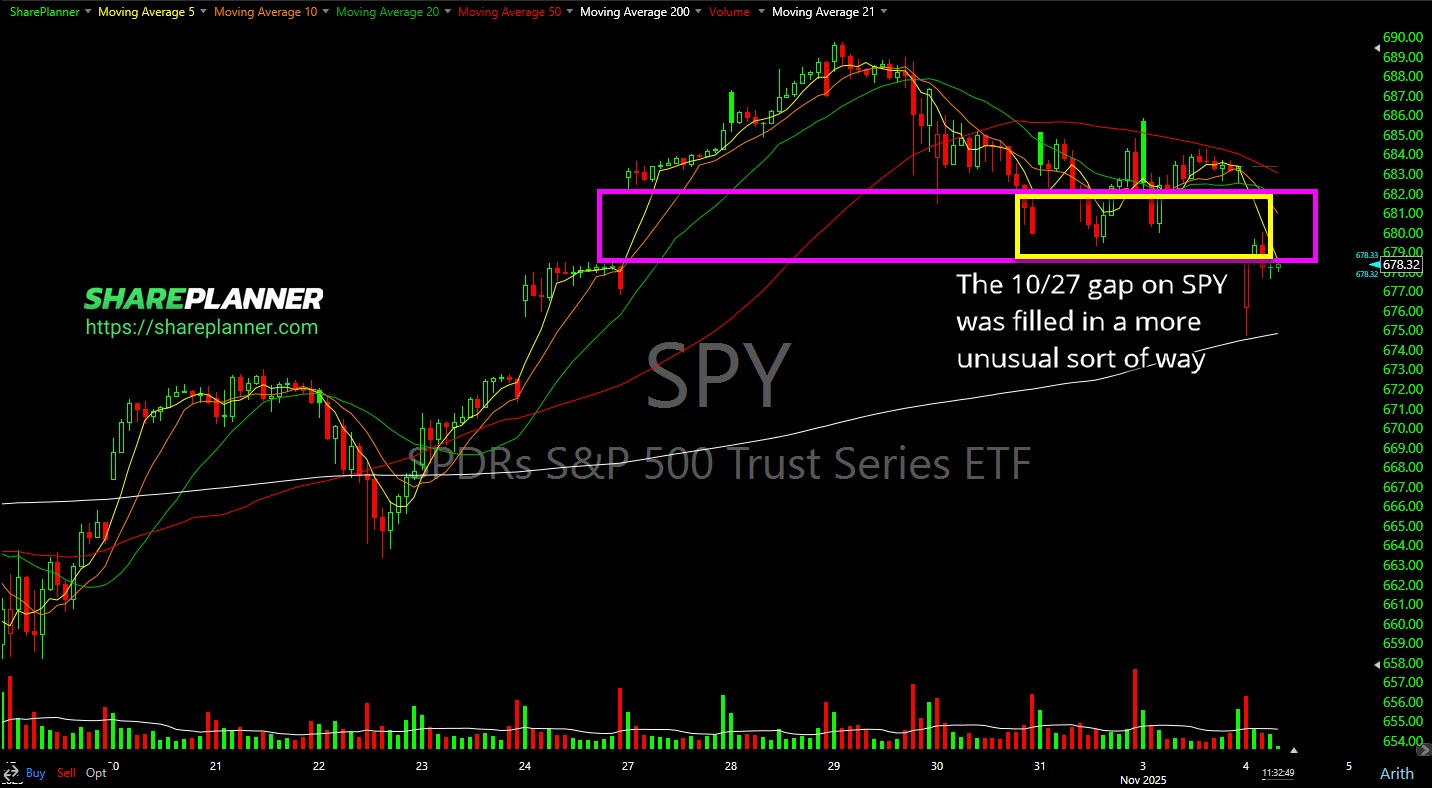

SPY filled the gap in a most unusual sort of way.

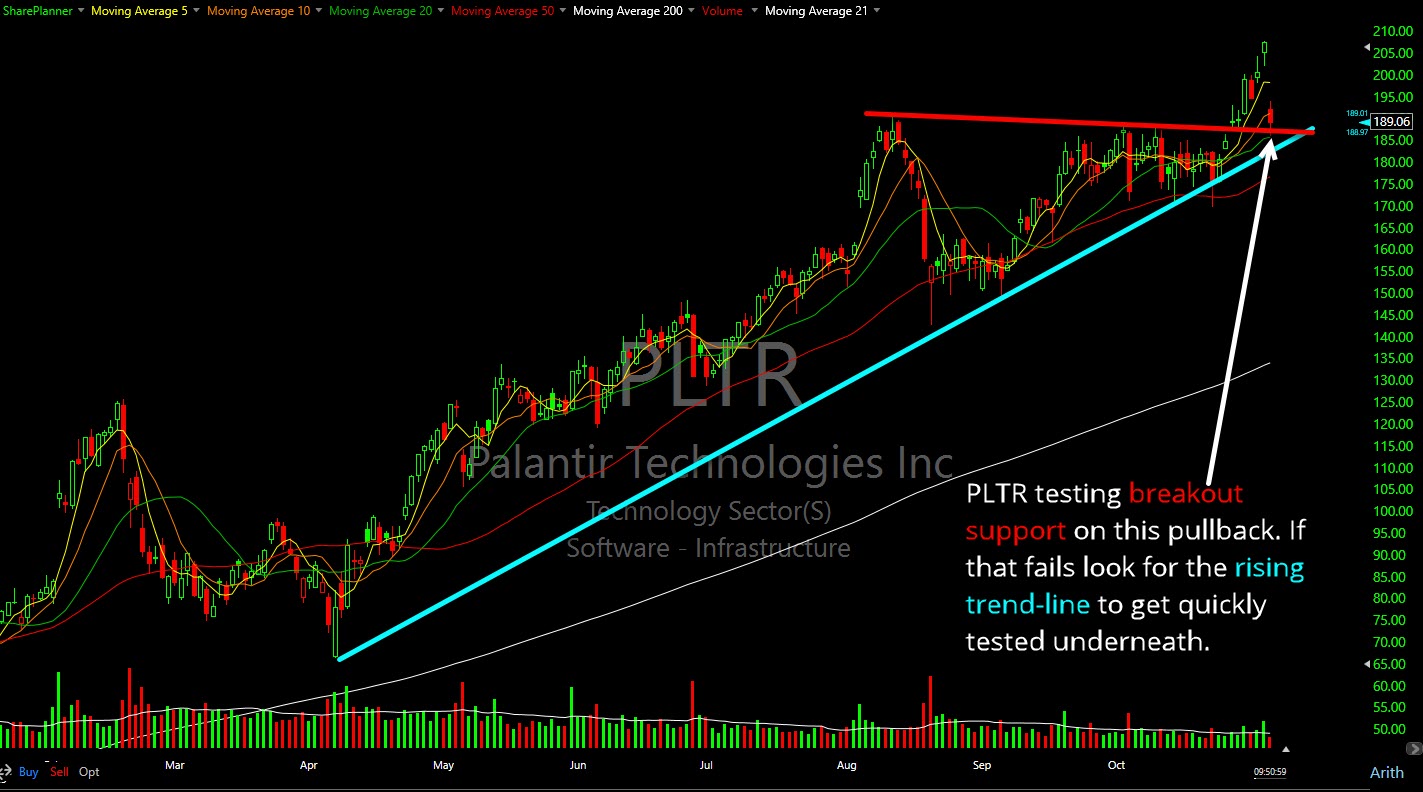

Palantir Technologies (PLTR) testing breakout support on this pullback. If that fails look for the rising trend-line to get quickly tested underneath.

Not banking on this trend-line with Devon Energy (DVN) holding up that well.

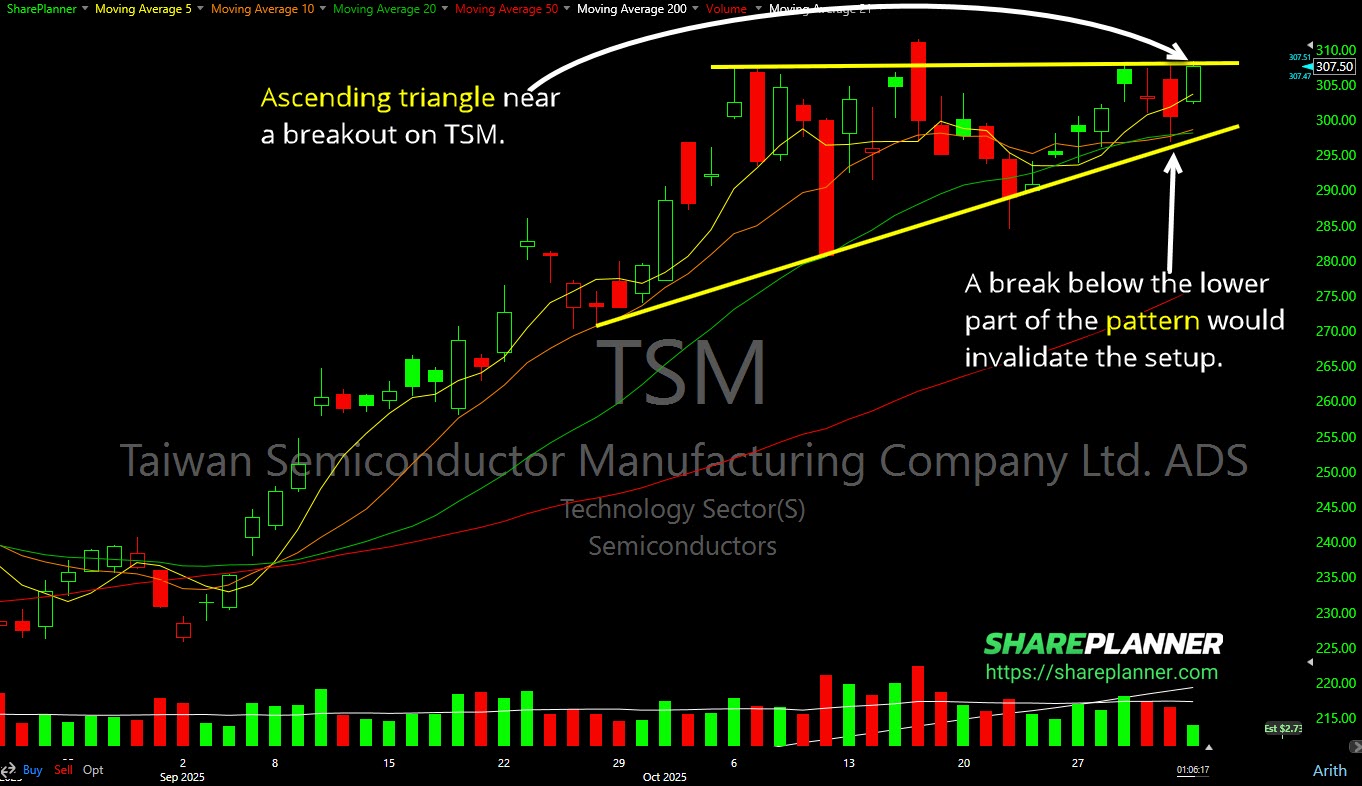

Ascending triangle near a breakout on Taiwan Semiconductor (TSM).

Goldman Sachs (GS) has repeatedly struggled with resistance overhead, even as it comes out of its bull flag pattern. Particularly this week, every move to the upside has been faded.