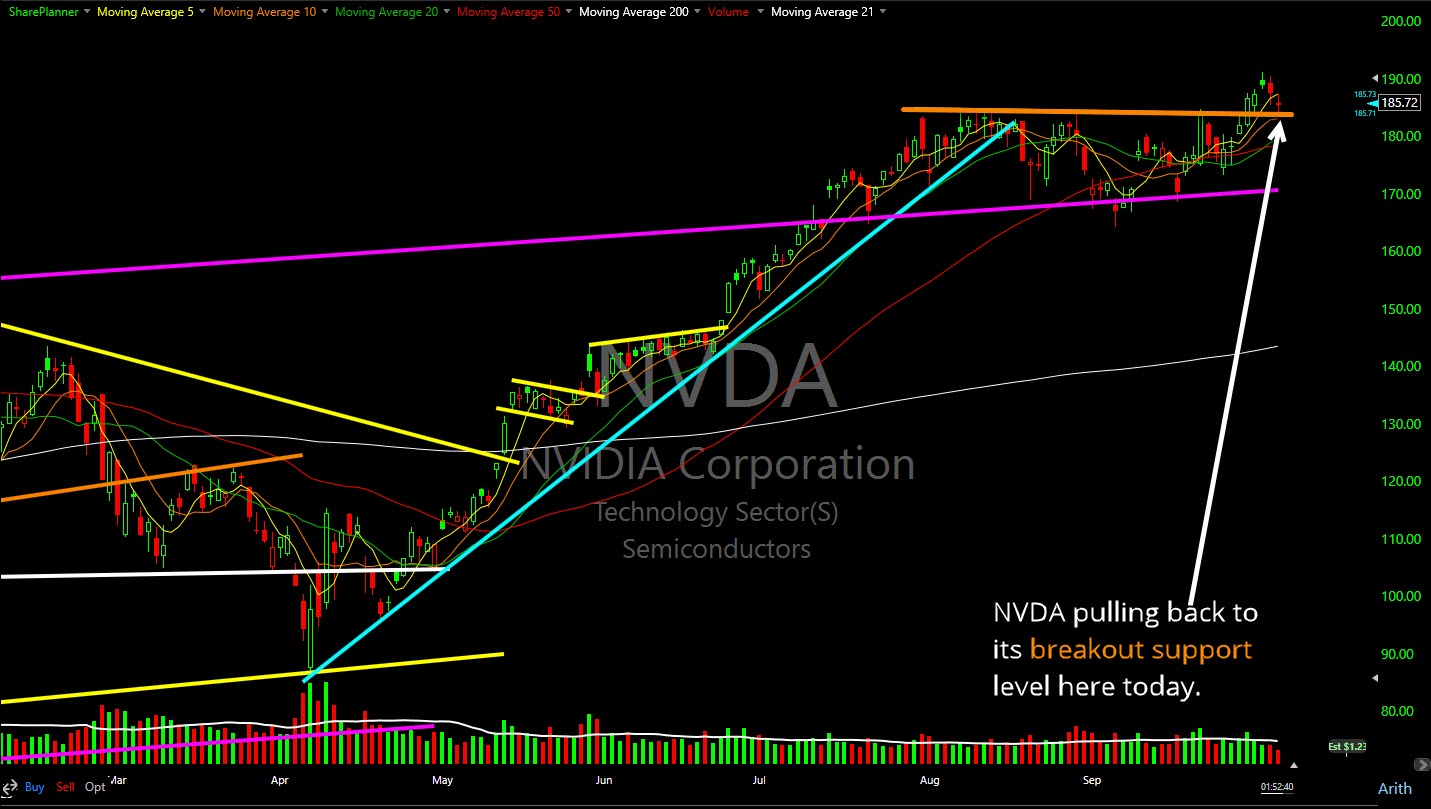

With news from Advanced Micro Devices (AMD) up over 25% today, Nvidia (NVDA) is pulling back to is breakout support level.

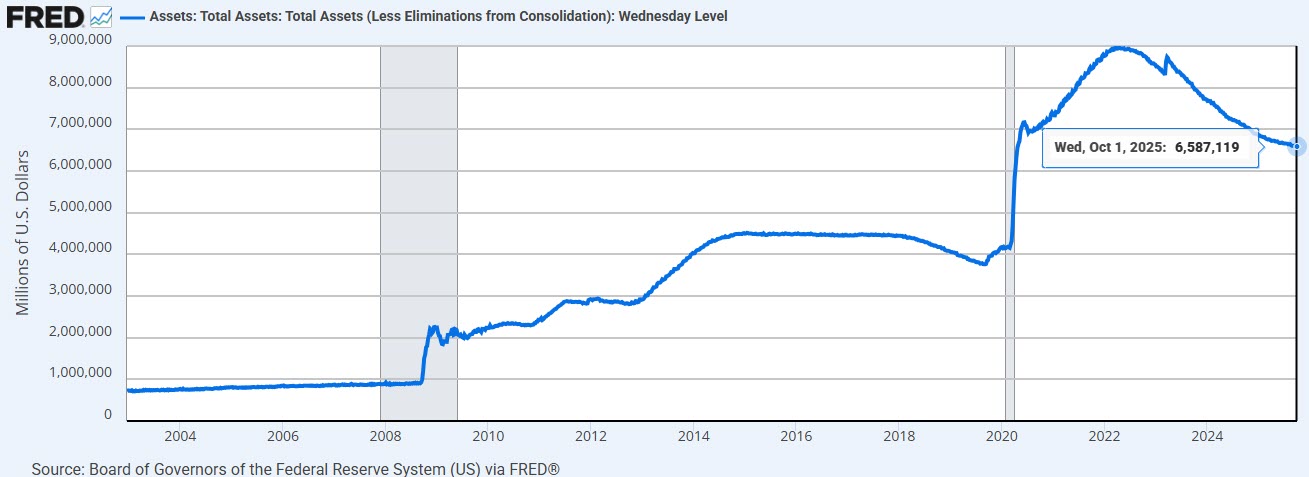

The Fed is still very much uninterested in fighting inflation...If they were, their balance sheet wouldn't still be so astronomically high.

China Internet ETF (KWEB) may be starting to break out of a multi-year basing pattern.

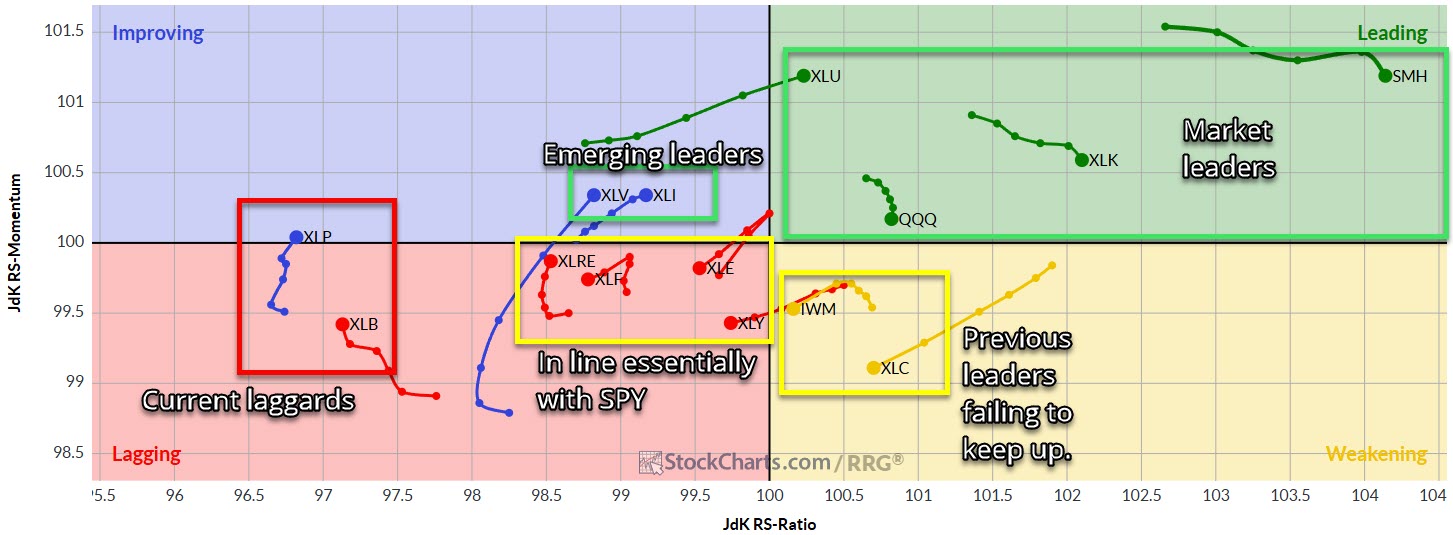

Technology Sector (XLK) still dragging this market higher, led by the one, and only, Nvidia (NVDA)

While the market continues to push higher, the VIX has been somewhat abnormal in also rising for a fourth straight day, but still unable to break through the declining resistance.

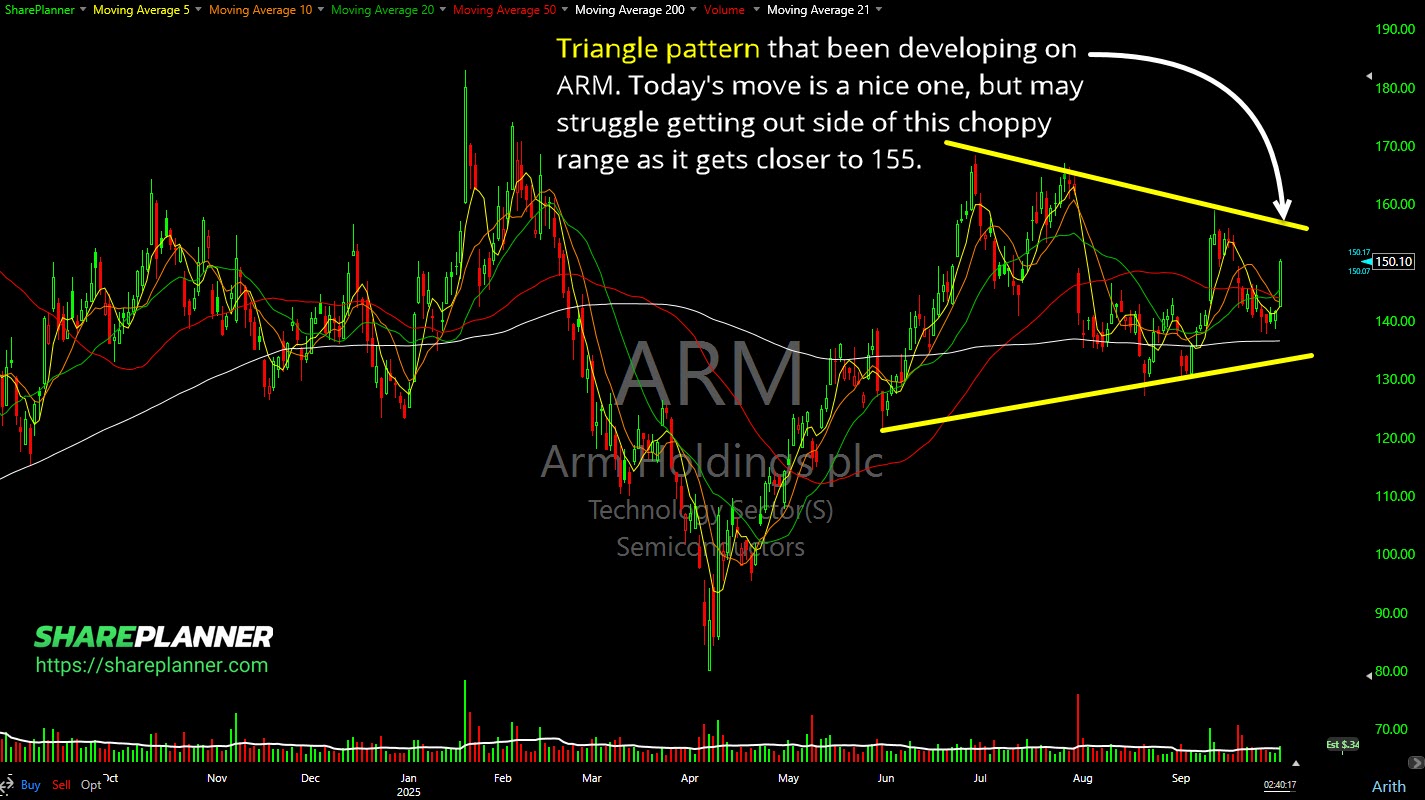

I think Arm (ARM) may struggle here to break through this symmetrical triangle range.

SPDR Gold Trust (GLD) seeing price hit rising resistance.

One thing I don't like about this cup and handle pattern on Microsoft (MSFT) is the resistance overhead from an old trend-line.

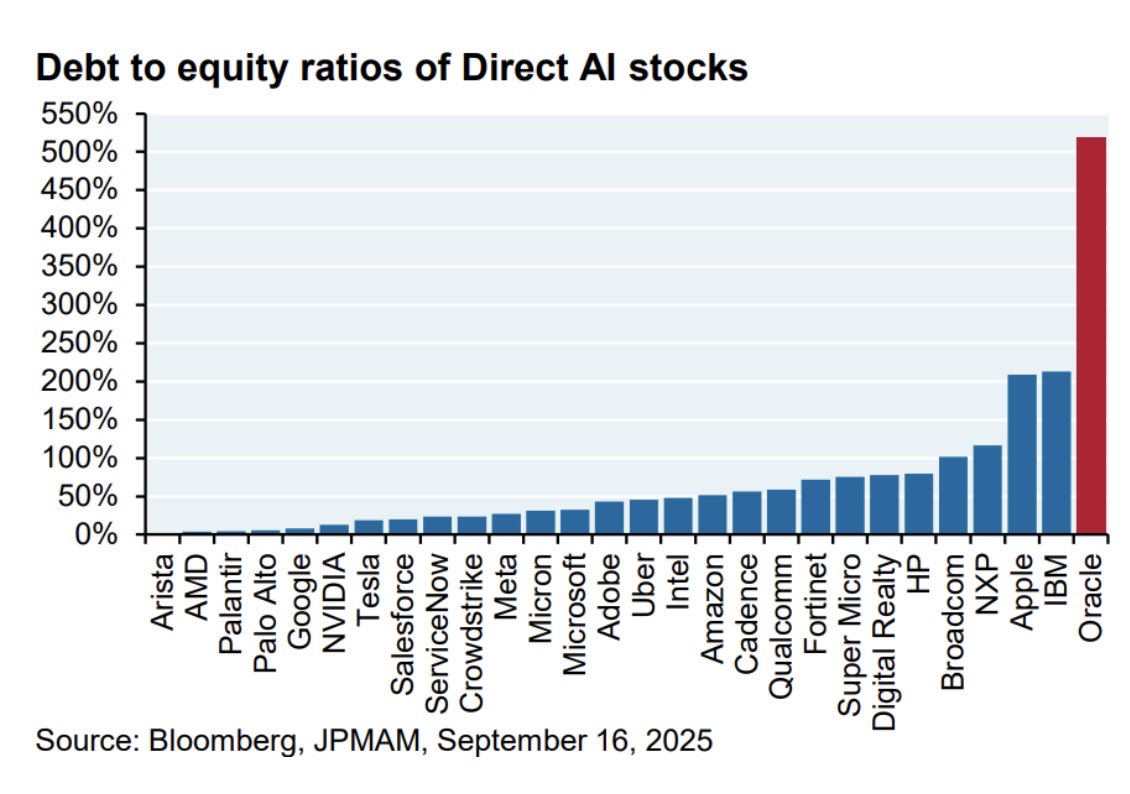

Oracle (ORCL) is pushing all of its chips into the middle on this AI craze with its debt-to-equity ratio. Going to be ugly if this bubble pops!

Royal Caribbean (RCL) testing some support in the short-term, but may have bigger problems if it can't hold.