One thing I don't like about this cup and handle pattern on Microsoft (MSFT) is the resistance overhead from an old trend-line.

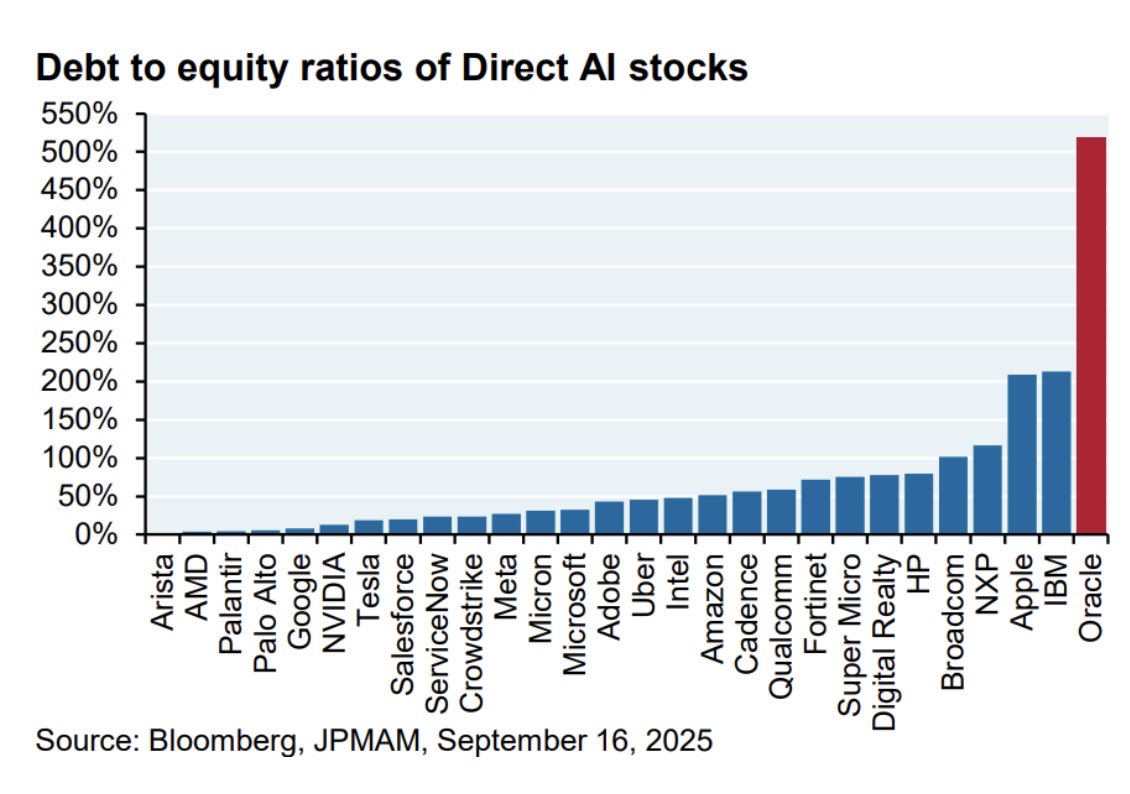

Oracle (ORCL) is pushing all of its chips into the middle on this AI craze with its debt-to-equity ratio. Going to be ugly if this bubble pops!

Royal Caribbean (RCL) testing some support in the short-term, but may have bigger problems if it can't hold.

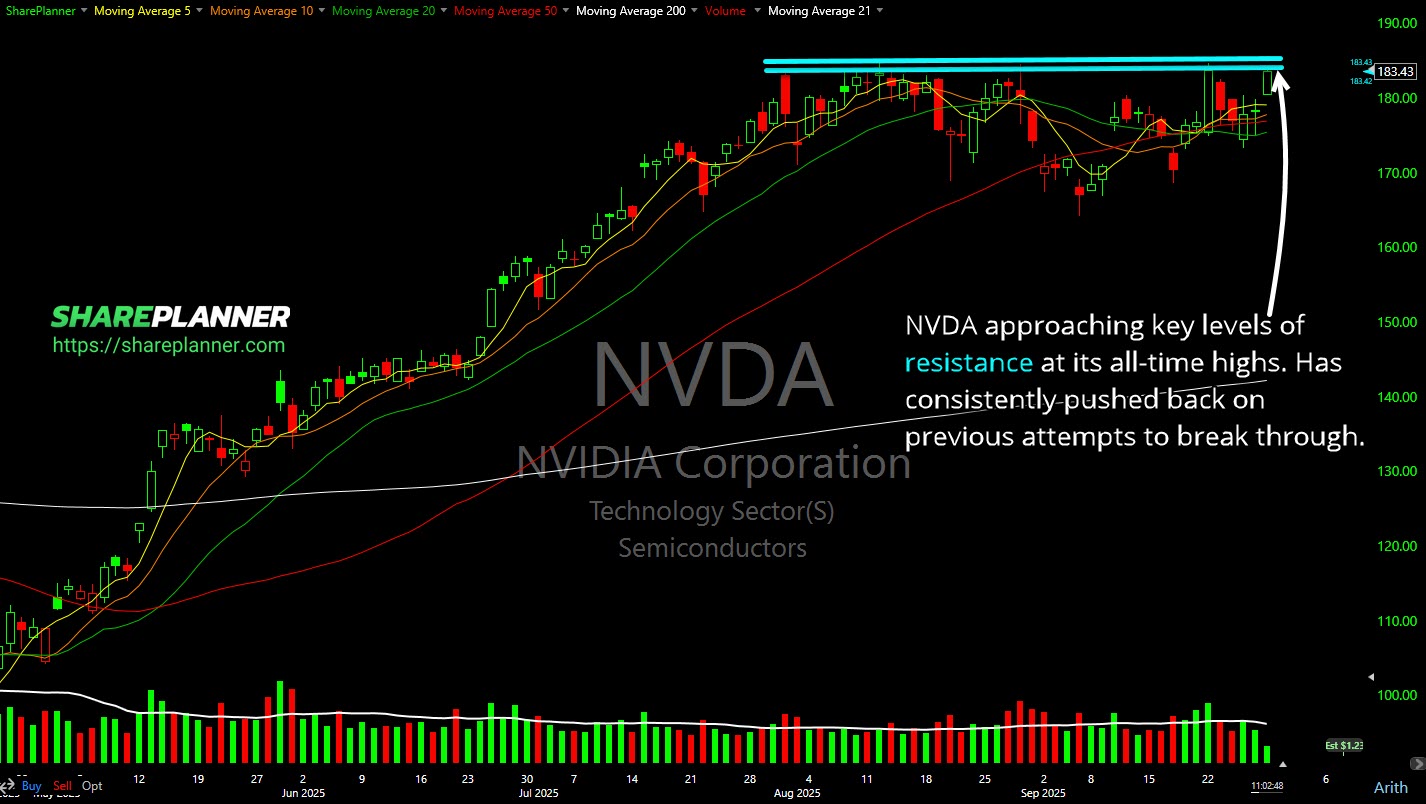

This level at all-time highs continues to push back as resistance on Nvidia (NVDA).

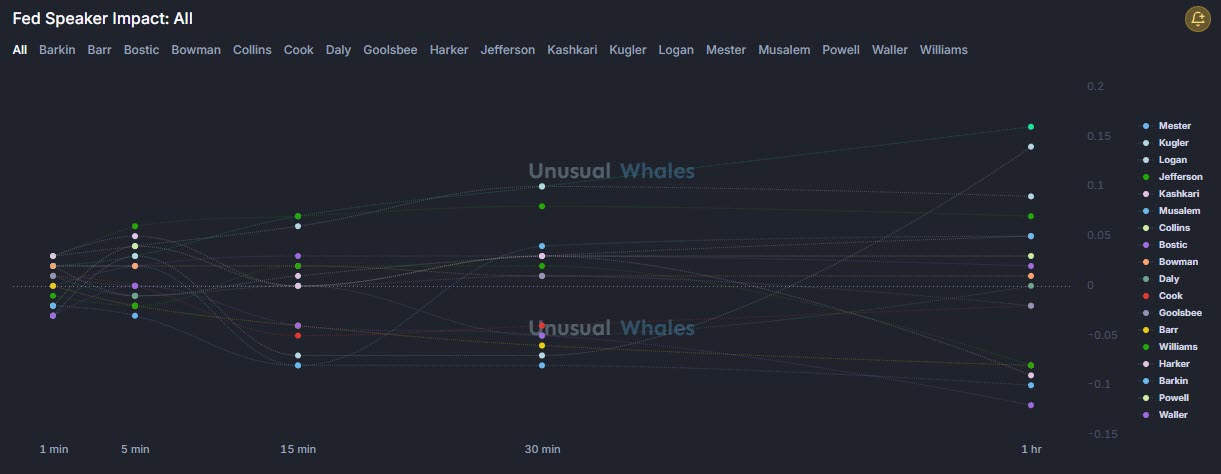

According to the facts here, Loretta Mester is the most bullish while Jerome Powell and Christopher Waller are the most bearish.

Been a long week for the longs, but dip buyers finally showing up on Friday.

Still seeing less participation from stocks as only 52% of stocks are now trading above their 40-day moving average.

Selling the semis and tech in general.

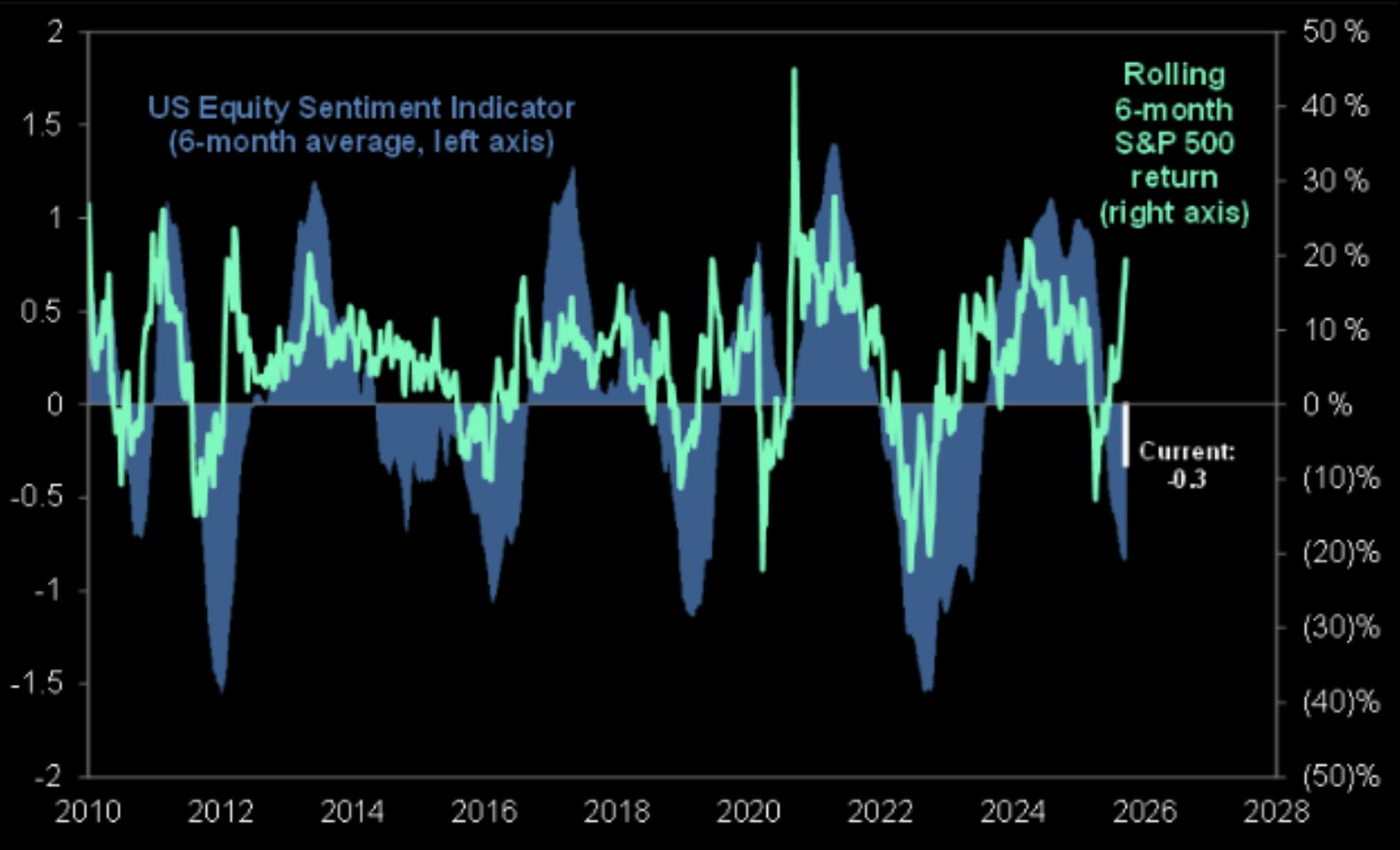

Equity sentiment vs returns for the S&P 500 couldn't be further apart than it is right now.

Long-term, buying S&P 500 (SPY) at the 200-week moving average has produced incredible long-term results.