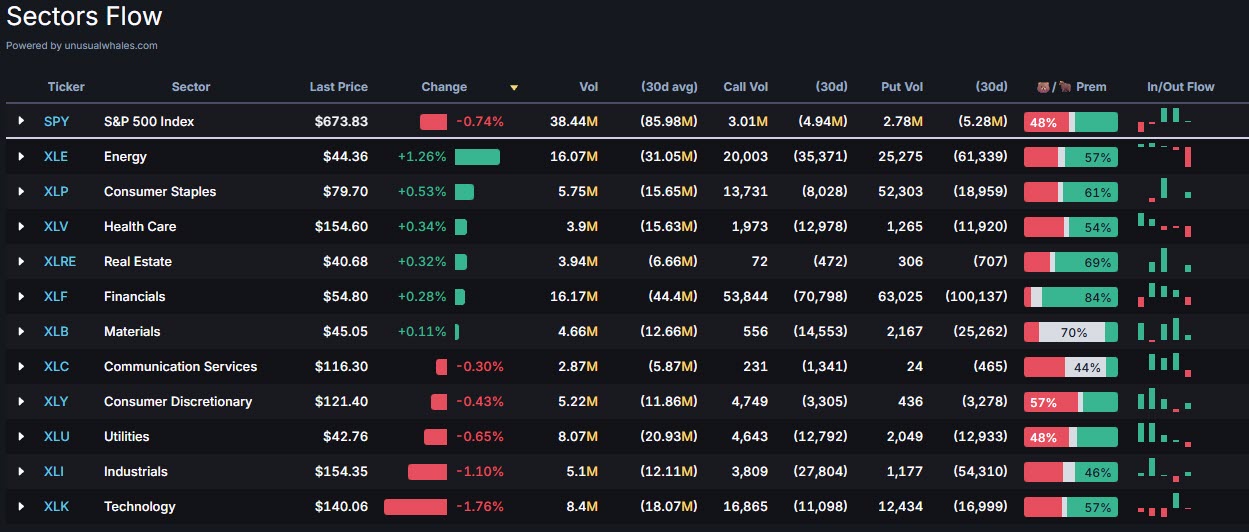

Energy Sector (XLE) leading the way, while the Technology Sector (XLK) is getting railroaded

Bitcoin (BTC) confirming that bear flag pattern I've been talking about. Watch for a move into the 70's.

Waste Management (WM) sporting an inverse head and shoulders pattern but yet to confirm.

Lemonade (LMND) sporting the ascending triangle and trying to confirm the breakout.

T2108 still below the 50% mark of stocks trading above their 40-day moving average and over the last two weeks it has been non directional.

With a short-term higher-high forming, Amazon (AMZN) could breakout above the declining resistance.

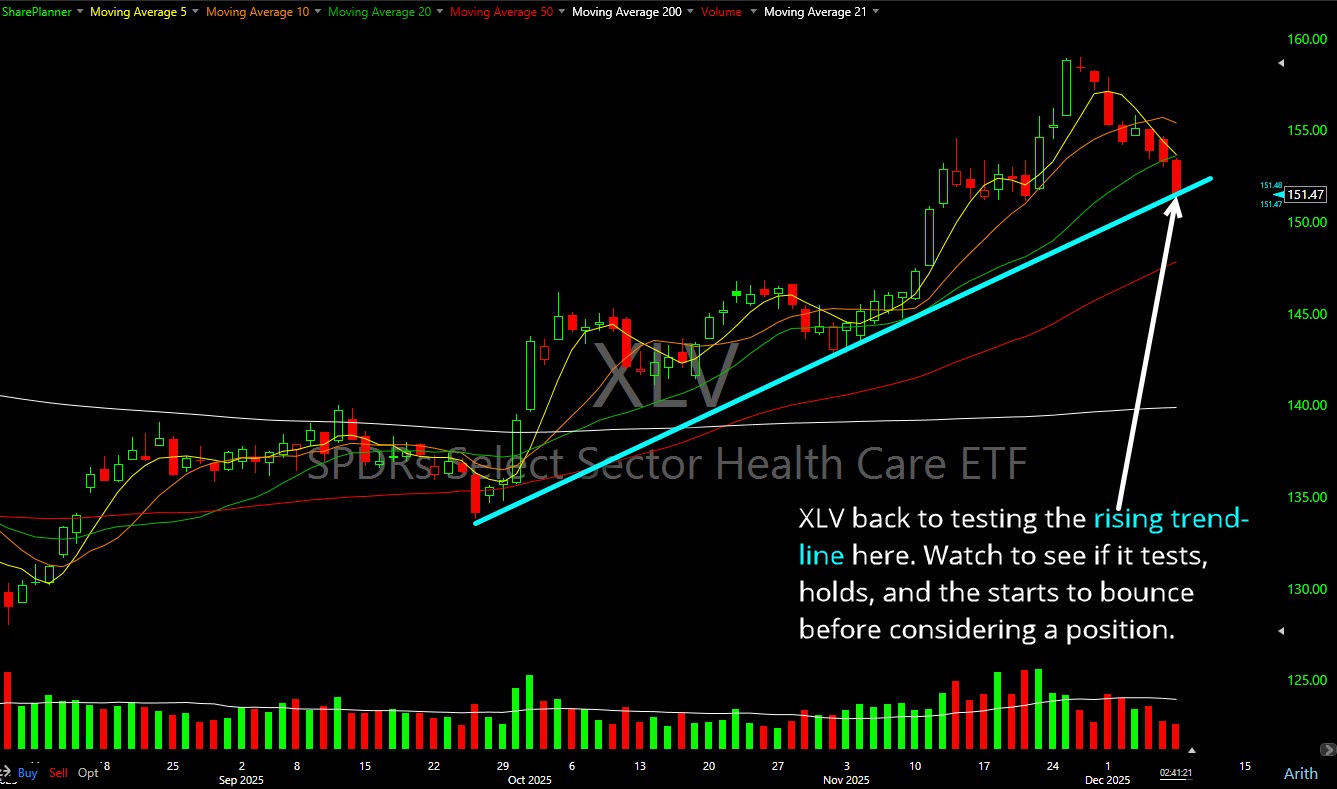

XLV breaking below its rising trend-line and failing to bounce off support.

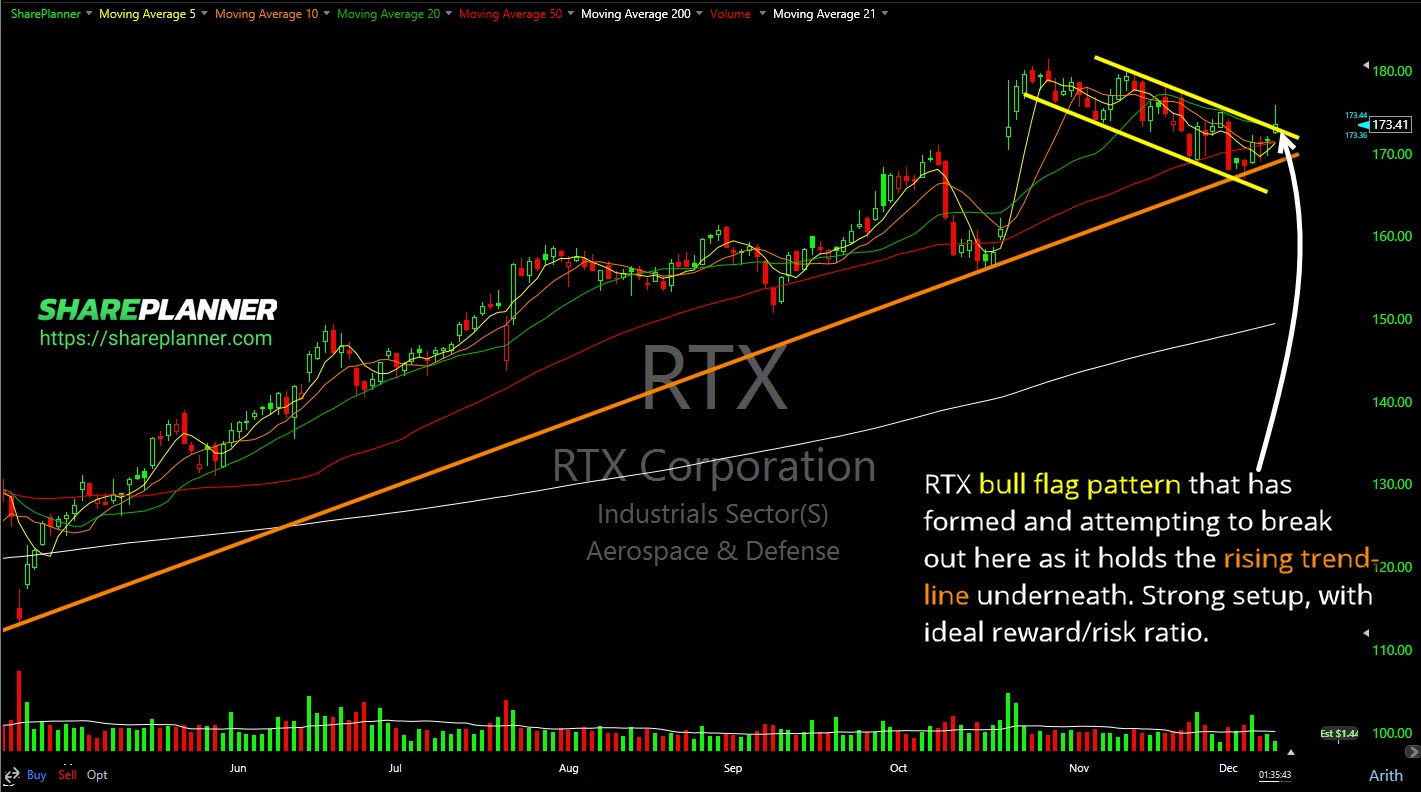

RTX bull flag pattern that has formed and attempting to break out here as it holds the rising trend-line underneath. Strong setup, with ideal reward/risk ratio

The Healthcare Sector (XLV) has pulled back to its rising trend-line in the short-term. It'll be interesting to see whether this can materialize into an actionable setup.

Still Tech holding this market up. Semis trading higher, everything else, minus small caps, trading lower.