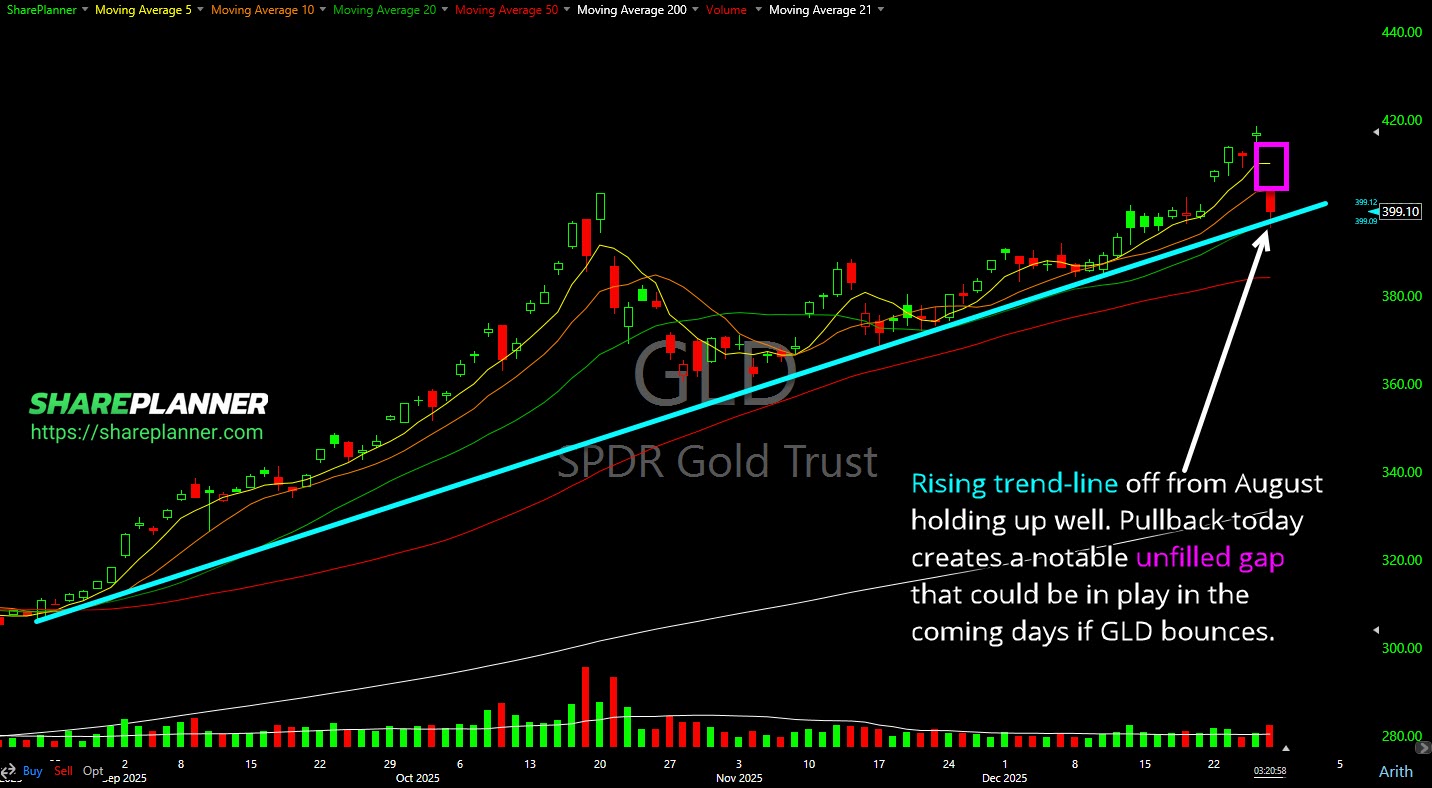

The Gold ETF (GLD) is pulling back to its rising trend-line and so far holding that level.

Edison International (EIX) with a basing pattern that it's attempting to breakout of.

Arcelor Mittal (MT) with a brief pause and bull flag. Sets up well for another leg higher.

Breadth is looking pretty stagnant of late on the T2108 (% of stocks trading above their 40-day moving average), at just below 50%, despite a market sitting just below their all-time highs.

This cup and handle pattern nearing a break out in Meta Platforms is getting interesting.

Ulta Beauty (ULTA) breaking out here of a continuati9on triangle, but beware of the resistance that lingers overhead.

Bear flag forming on Netflix (NFLX). Setting up for another move lower if the pattern confirms.

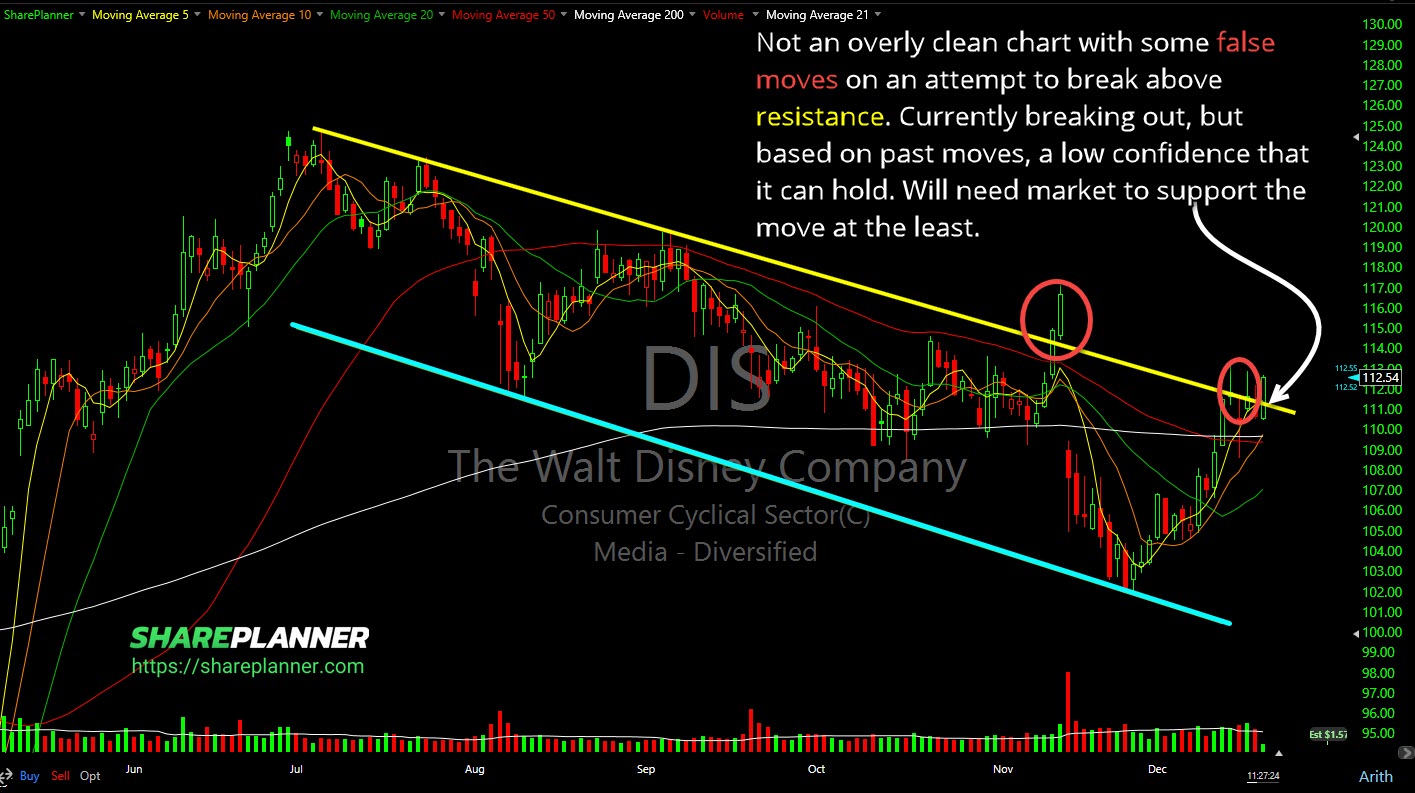

Walt Disney (DIS) currently breaking out, but based on past moves, a low confidence that it can hold.

Exlservice (EXLS) right there on the verge of breaking out and through the declining channel it has been in all year long.

Sideways channel intact, but Charles Schwab (SCHW) currently testing the upper band, and nearing a breakout. Overall a pretty good chart. Stop-loss placement is a bit difficult but below the 12/8 lows is probably the best location that I can find.