Stock market breadth, as seen on T2108 is rapidly declining.

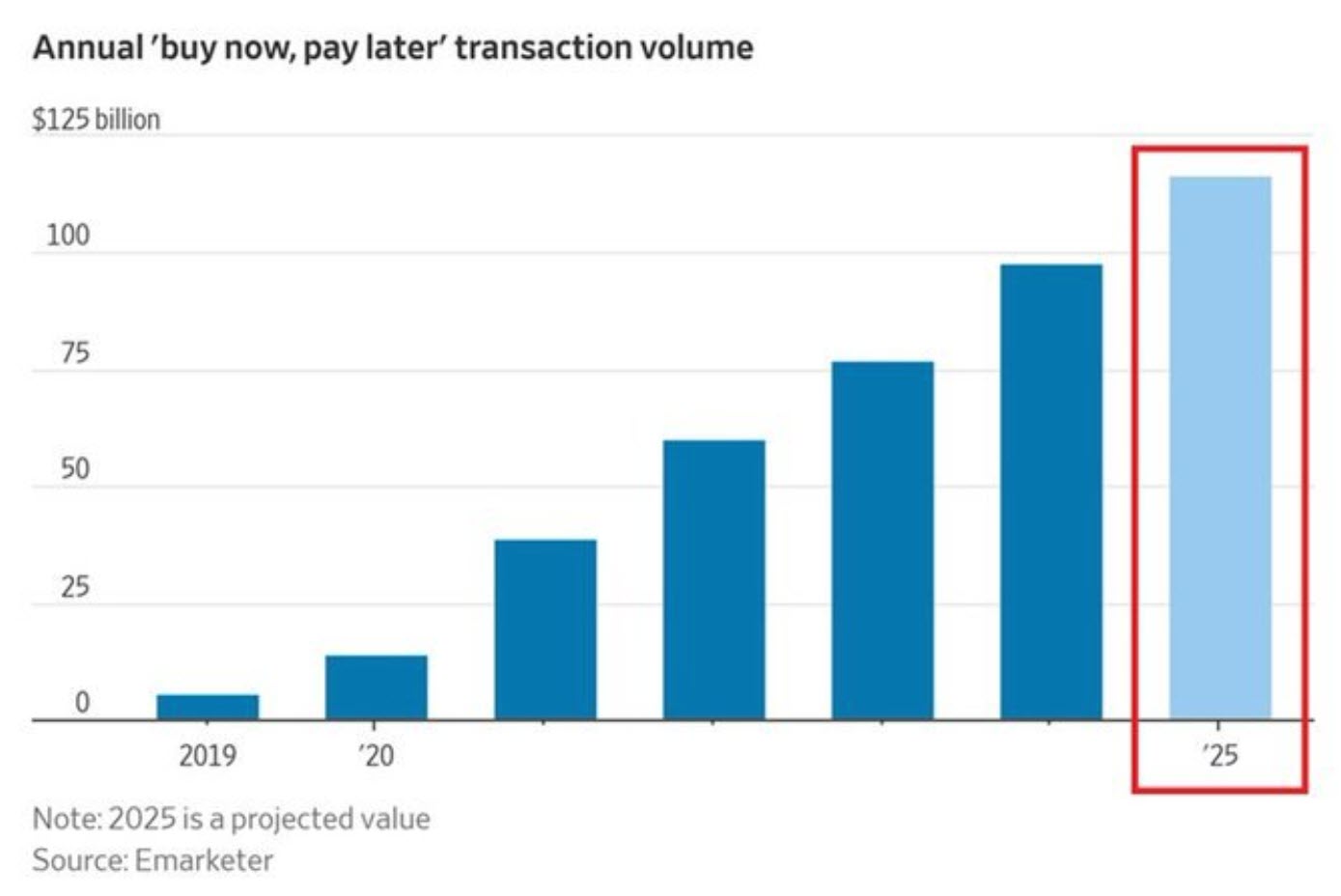

This can't go on forever, before it blows up in their faces...

Backblaze (BLZE) breaking out of an ascending triangle today.

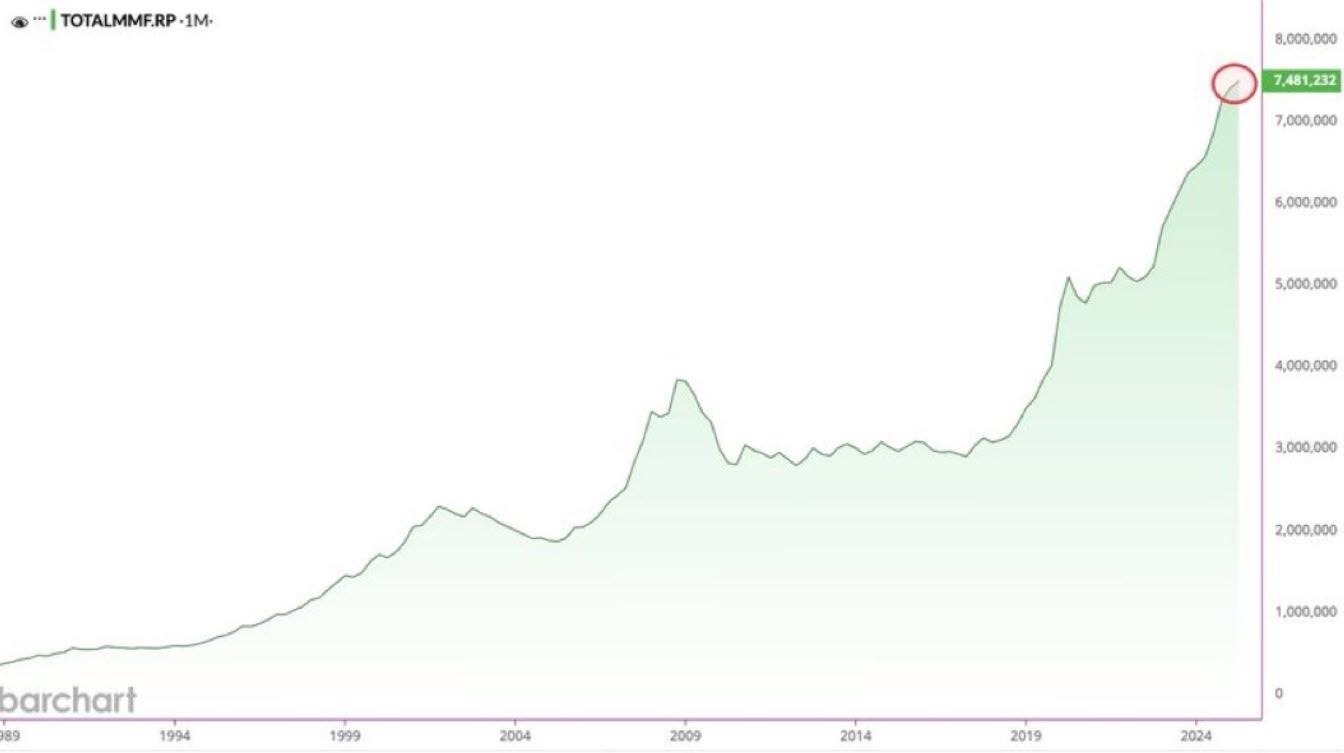

Since Covid, my gosh, the rise in money market funds has been parabolic.

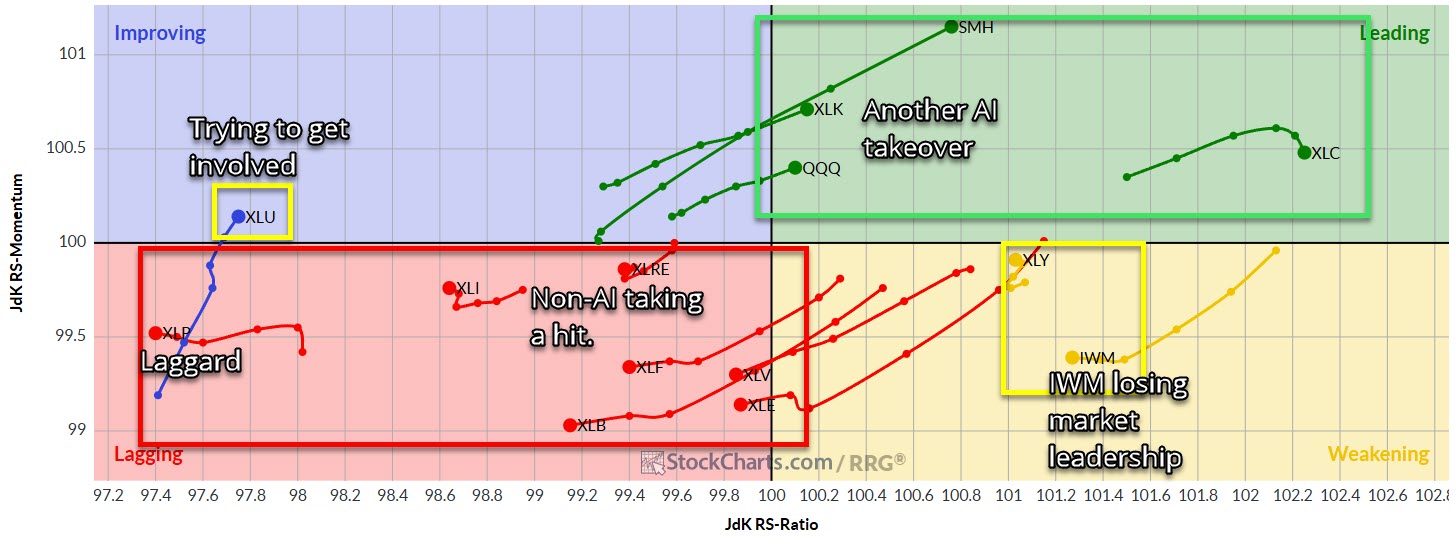

Usual sectors taking over again, with Semiconductors (SMH) taking the lead.

Two standard deviations of S&P 500 (SPY) 50-day moving average, has price moving back inside of it again.

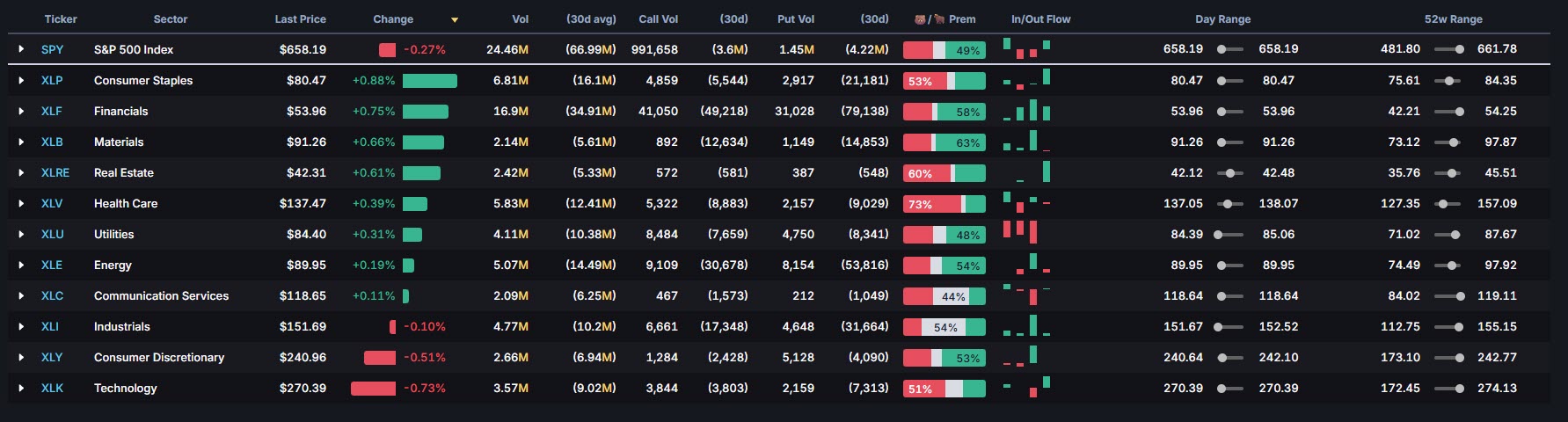

Looks like we are getting fresh rotation back into "Everything Else" with the Staples Sector (XLP) leading the way.

Volatility Index (VIX) still rising over the last few days. Worth paying attention to here.

Could be a good pick-me-upper for stocks like D.R. Horton (DHI) and Lennar (LEN).

If you aren't AI related, then you are lagging.