Royal Caribbean (RCL) getting close to a breakout of a well-developed, short-term base.

Royal Caribbean (RCL) testing some support in the short-term, but may have bigger problems if it can't hold.

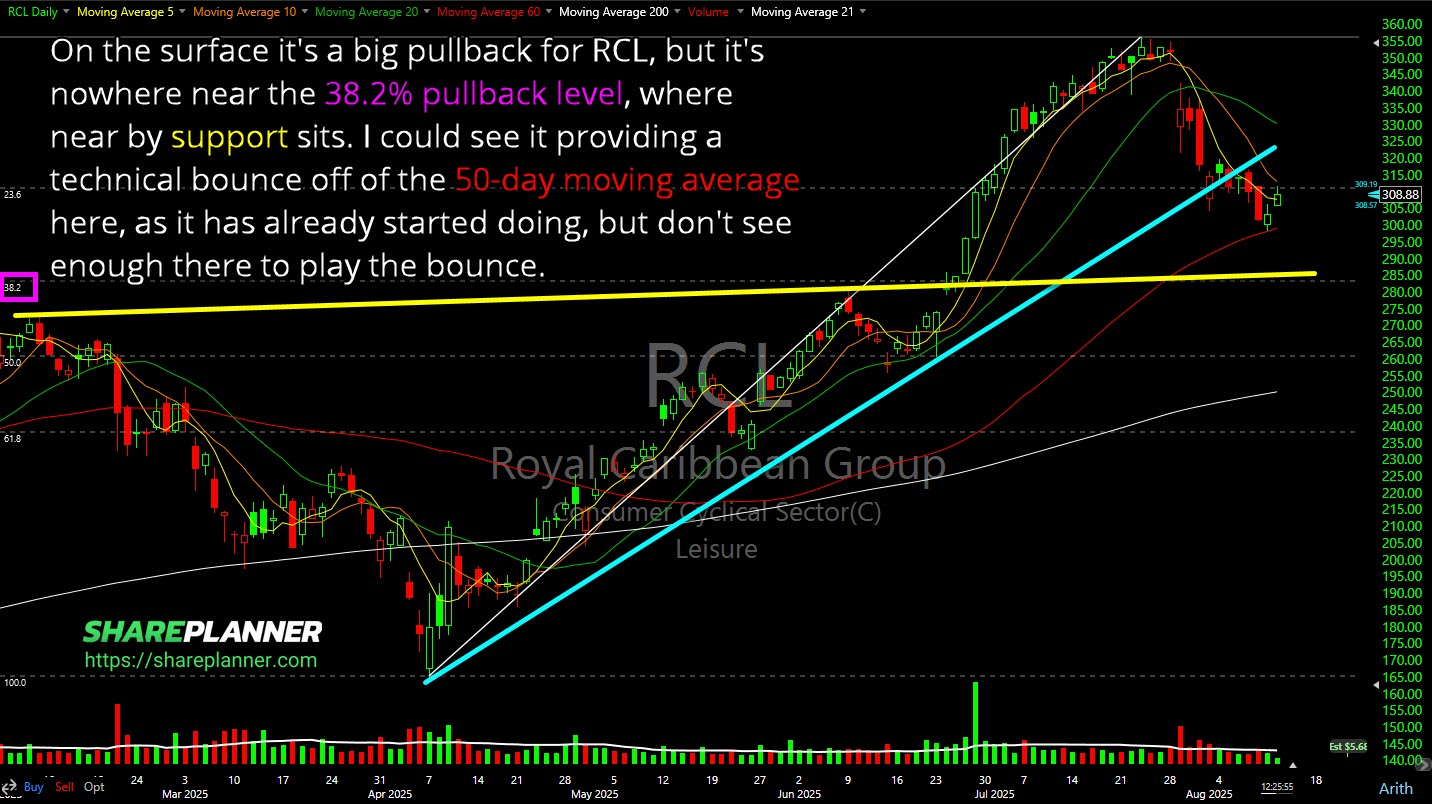

I'm not sure Royal Caribbean (RCL) has pulled back far enough to be bounce worthy.

Episode Overview What should the long term goals of a swing trader be and how should one plan for life as a part time and full time swing trader? 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan kicks off the episode, sharing the goal of teaching profitable and consistent trading

Episode Overview What are the Pro's and Con's to swing trading with your IRA? Should you do it? Also, how does one avoid the pattern day trading rule and is it even possible? In this episode, Ryan explains the cold hard truths to both questions as it pertains to swing trading. 🎧 Listen Now: Available

Episode Overview One of the biggest mistakes that swing traders make is the desperate attempt to get back what they once had in their trading accounts. In this podcast episode, Ryan explains how this kind of move can lead to some disastrous results for your trading and how it is imperative that you accept where

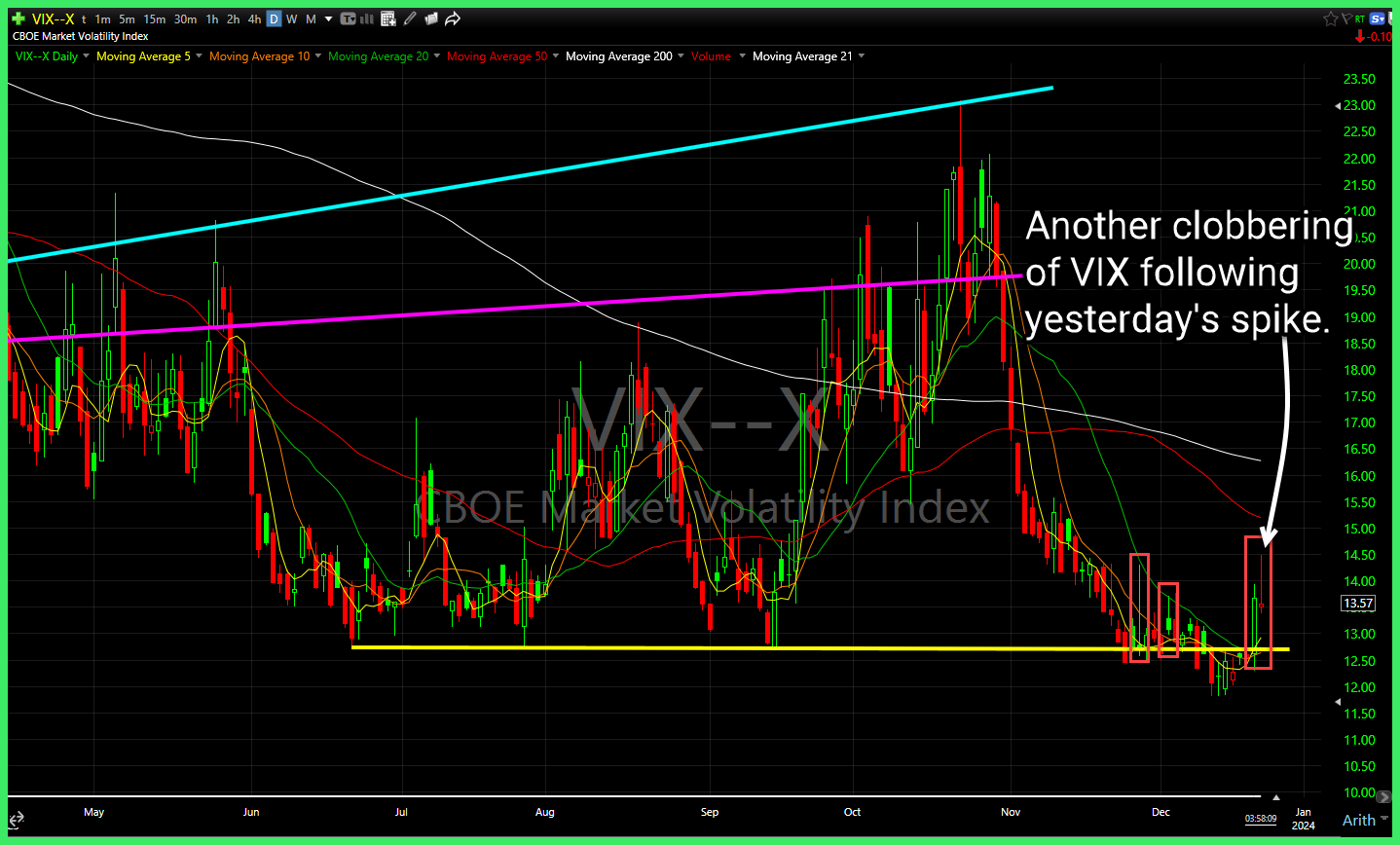

Two day pop out of $VIX following a test of rising support, but still range bound and doesn't mean much in terms of future direction. . $AI descending triangle breakout, following a non-stop, 25% move off the lows of the pattern, making it a difficult one to tightly manage the risk on. Double top on

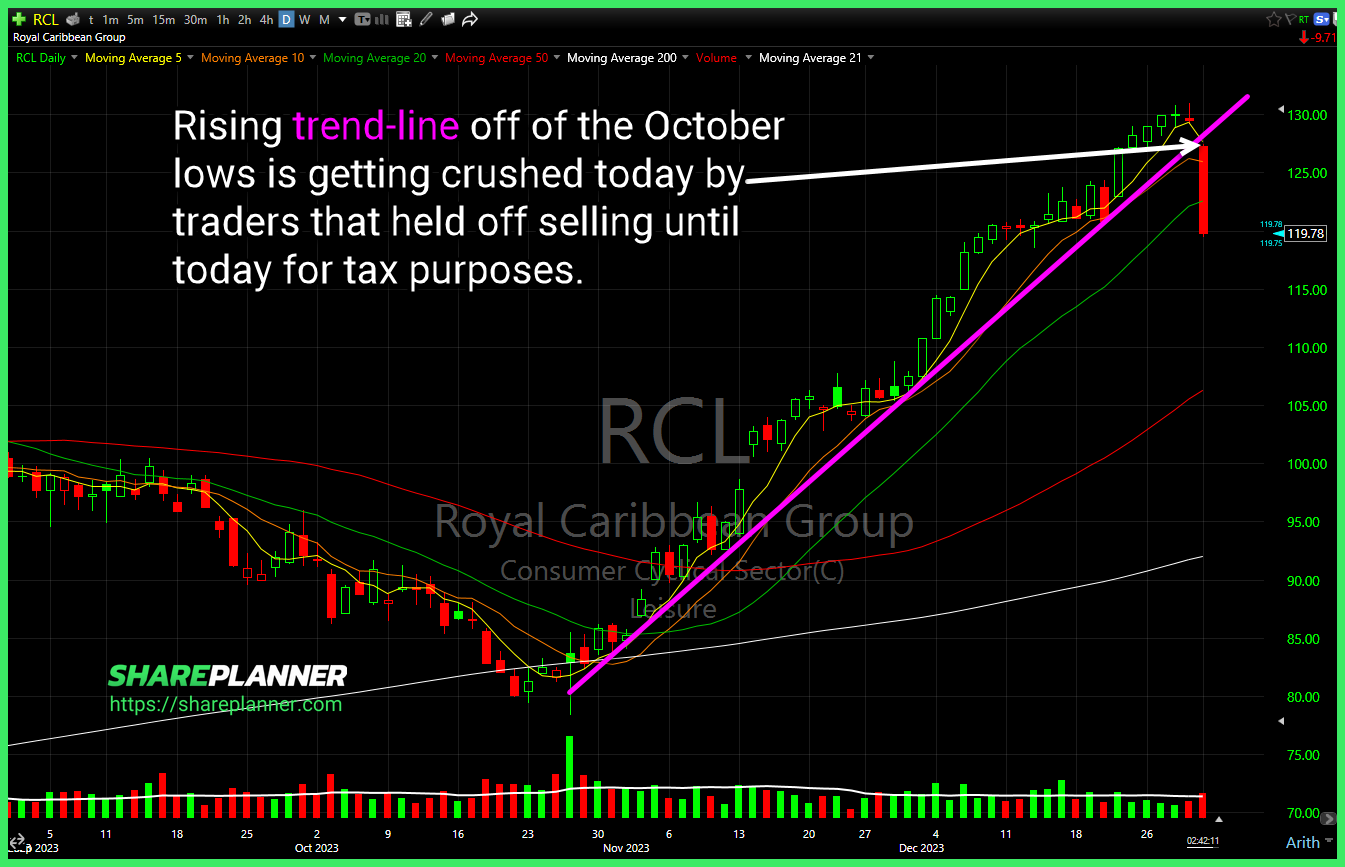

$RCL rising trend-line off of the October lows is getting crushed today by traders that held off selling until today for tax purposes. $ALGT holding the rising trend-line off of the November lows, despite breaking below it intraday. Will be key for it to hold this level into the close. $NEM pullback to its breakout

$VIX once again killed. $MP Strong breakout today for MP through resistance. $RCL recapturing the steep rising trend-line following CCL earnings coming in strong.

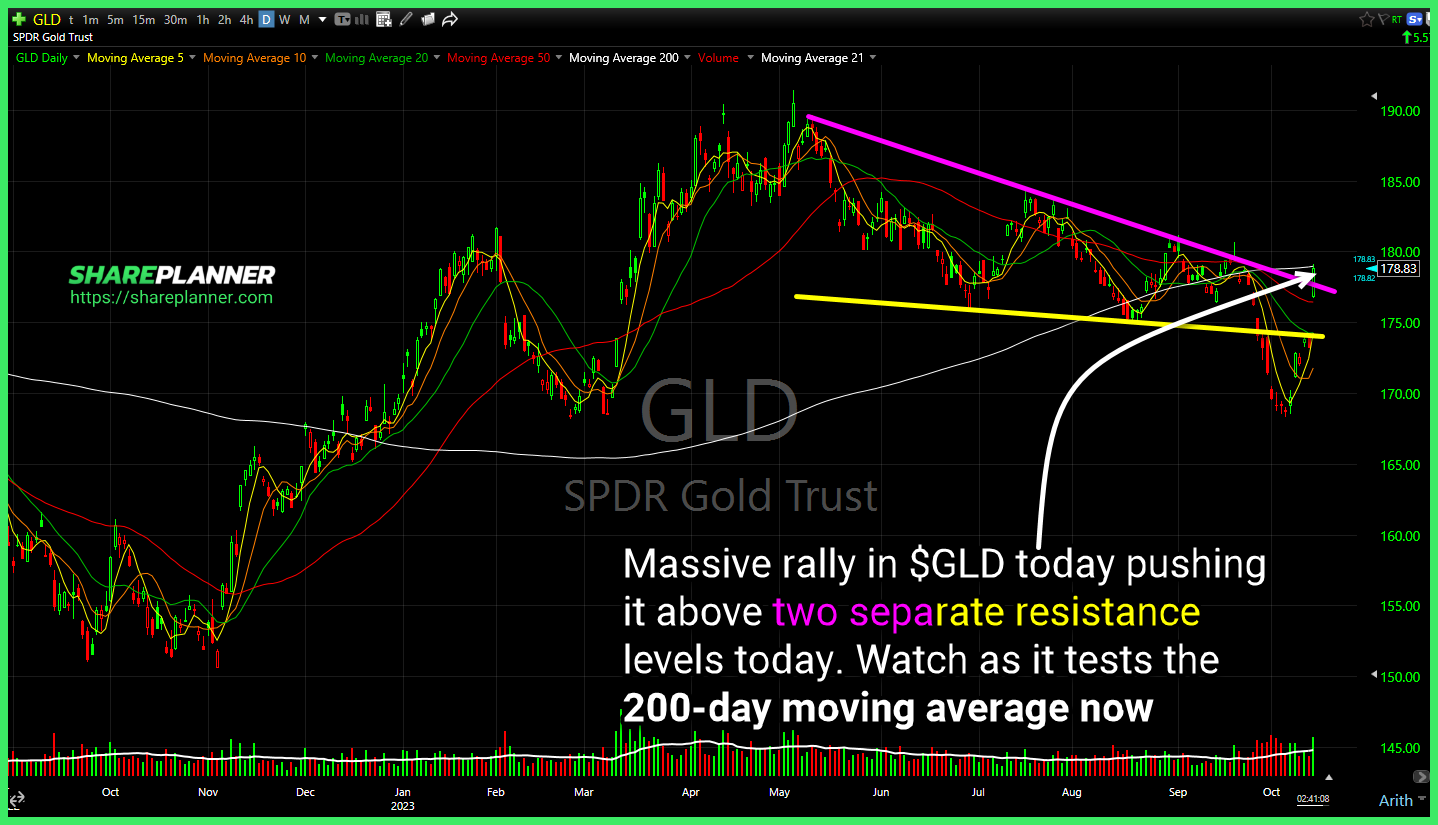

Massive rally in $GLD today pushing it above two separate resistance levels today. Watch as it tests the 200-day moving average now $VIX with a break back above major resistance. Key is to hold that level into the close. Rising resistance could prove important next week. A new layer of resistance is forming for $JPM