![]() I’m always trying to make for your use as much of my personal research as possible that I do everyday in order to successfully trade the stock market. With that said, I have revamped and relaunched my morning newsletter that I send out every day. And it is huge. I guarantee you, nobody puts this much time and effort into a daily email to make sure you have every bit of market data conveniently delivered to your inbox each and every day and to top it all off, it is FREE. You’ll get updates on all the major indices, my favorite indicators, earnings and who’s reporting this week, the economic calendar, pre-market movers, and much, much more. So sign up at the top of the right hand column on this page here. When you sign up you’ll also be provided with a link where you can download my free ebook of my six favorite trading setups (3 long setups, 3 short setups). So sign up today!!!

I’m always trying to make for your use as much of my personal research as possible that I do everyday in order to successfully trade the stock market. With that said, I have revamped and relaunched my morning newsletter that I send out every day. And it is huge. I guarantee you, nobody puts this much time and effort into a daily email to make sure you have every bit of market data conveniently delivered to your inbox each and every day and to top it all off, it is FREE. You’ll get updates on all the major indices, my favorite indicators, earnings and who’s reporting this week, the economic calendar, pre-market movers, and much, much more. So sign up at the top of the right hand column on this page here. When you sign up you’ll also be provided with a link where you can download my free ebook of my six favorite trading setups (3 long setups, 3 short setups). So sign up today!!!

This was the email that I sent out this morning:

“The Fed is very smart, but it doesn’t run the markets. In the end, the markets will run the Fed. The markets are bigger than any man or any group of men. The markets can even break a president” ~ Richard Russell

– Latest Trades

Join me each day for all my real-time trades & alerts in the SharePlanner Splash Zone

- Covered ORCL at $35.20 for a 1.1% gain.

- Covered DIA at $160.36 for a 0.4% loss.

- Did not add any new swing-trade positions to the portfolio.

- Currently 100% Cash

- Market is starting to weaken significantly again, and looking to add 1-2 new short positions today.

Billionaires Dumping Oil Stocks

Oil is caught in an absolute death spiral. And a handful of billionaires are quietly dumping oil stocks at an alarming clip… Pundits would have you believe a temporary “global supply glut” is to blame. The real reason is much more ominous and could push oil as low as $10 per barrel, completely decimating Big Oil and sending the broader markets into a full-blown collapse.

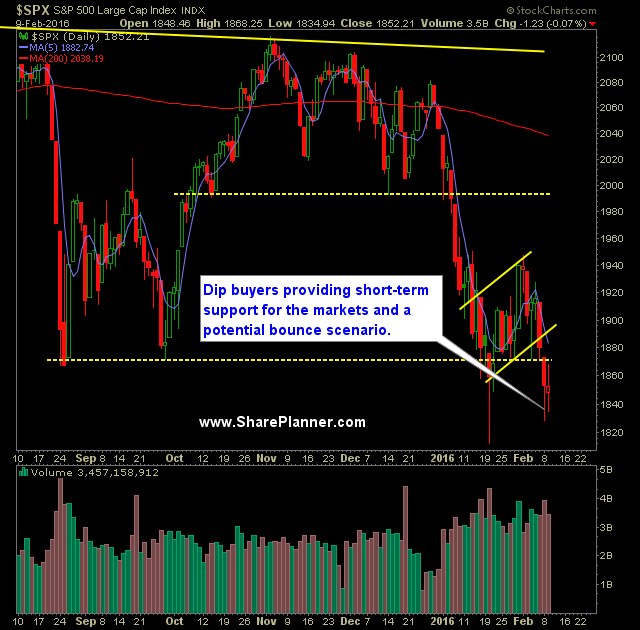

– Market Charts & Updates

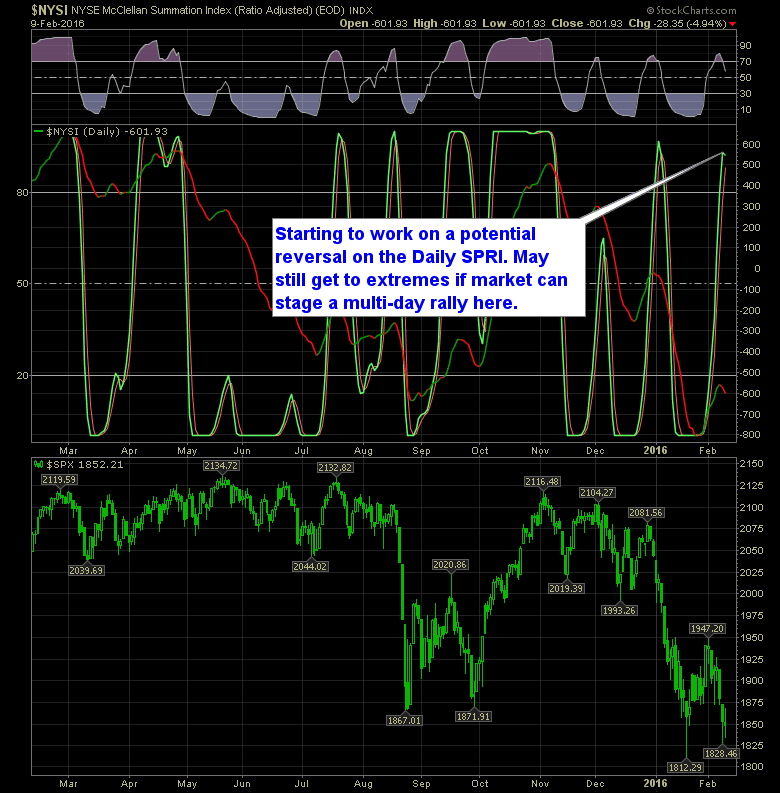

– Indicators

SharePlanner Reversal Indicator (Daily)

Volatility Index (VIX)

– Market Barometer

Overnight futures suggest a possible bounce.

– Earnings:

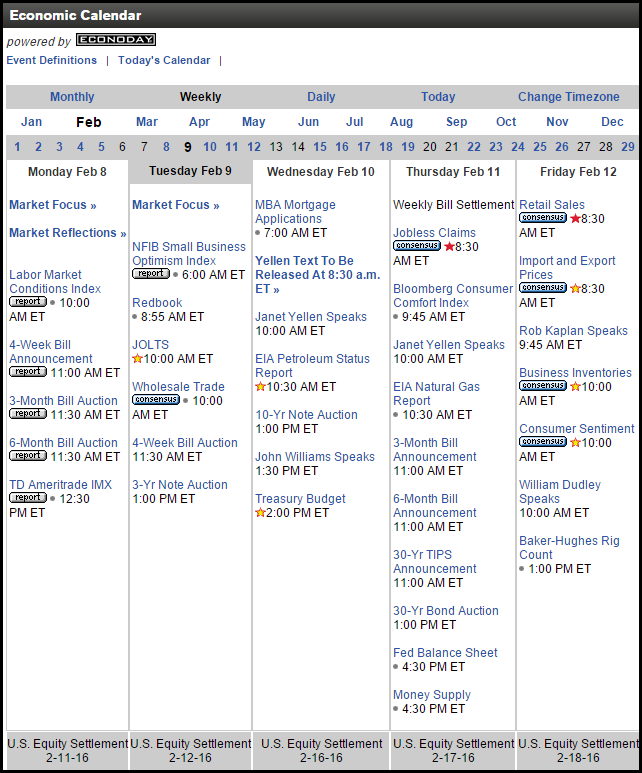

– Economic Calendar

The World’s Greatest Genius’s Most Powerful Discovery

– Pre-Market Movers and Stocks to Watch

SCTY, DIS, DUST, DB, TSLA, ARMH, SEDG, CSIQ, GDX, WFM

Some of the Day’s Best Insights

* Today’s Trading Plan: A Fed Kind of Day

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.