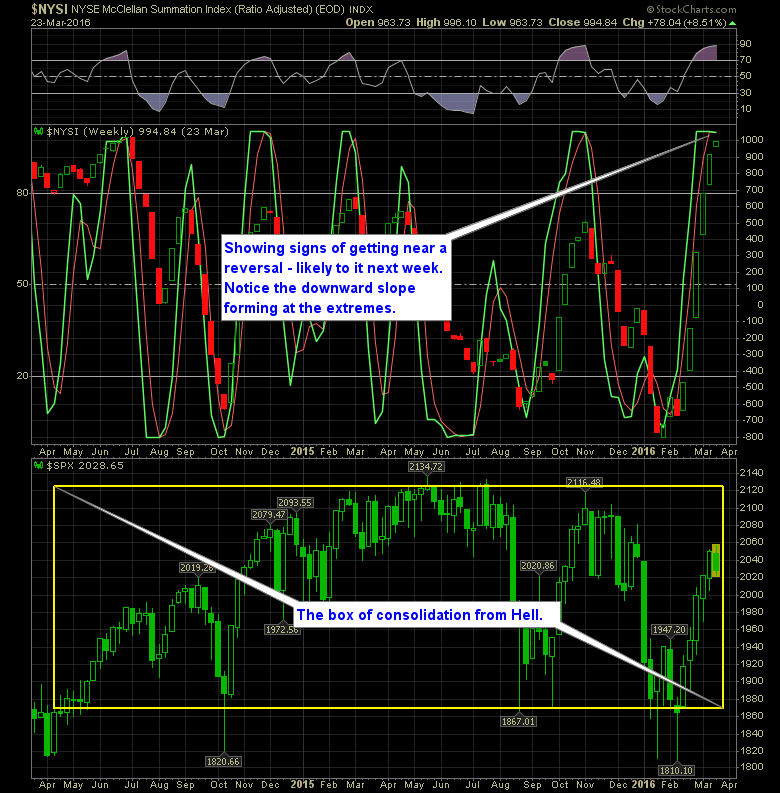

When you’ve had the rally that the market has had the past five weeks, you start to become guarded when it comes to risking too much of your capital on gains that will be difficult and hard fought going forward. But then day-after day, the bulls keep rallying the market off of the lows of

Bulls still hanging on today, they are doing everything they can to hold on to the 2042 intraday level that is an obvious short-term support level on the 5 and 30 minute charts. But the bigger theme here is the declining trend-line off of the November highs that the bulls have repeatedly unable to break

Information received since the Federal Open Market Committee met in January suggests that economic activity has been expanding at a moderate pace despite the global economic and financial developments of recent months. Household spending has been increasing at a moderate rate, and the housing sector has improved further; however, business fixed investment and net exports

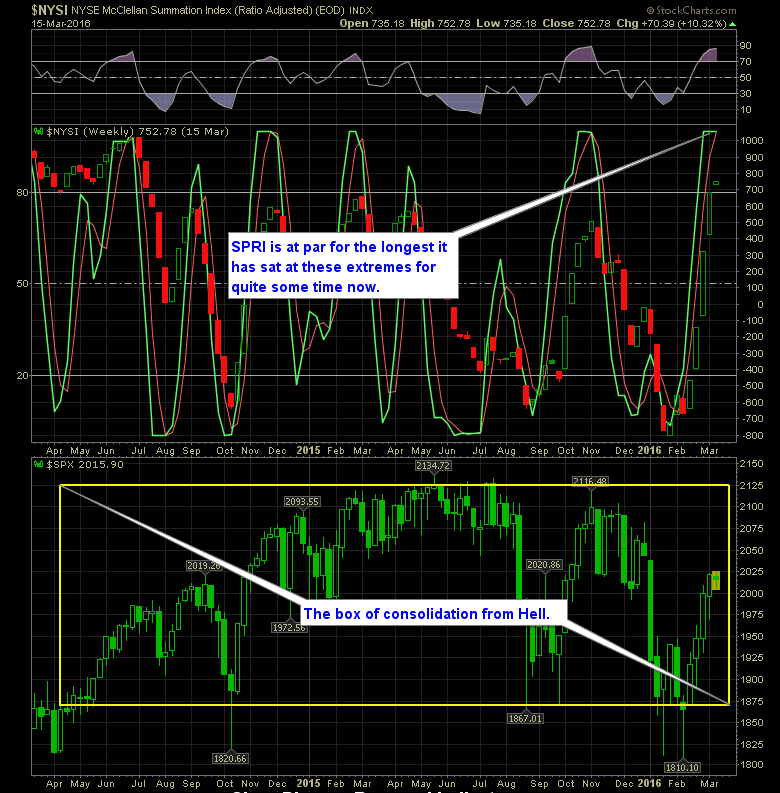

Alright folks. This market isn’t giving and it isn’t taking away either. The bears find motivation overnight only to see it quickly dissipated within the first 30 minutes of each trading session. The bulls make a nice comeback, but there’s nothing being added to the recent gains the market has put together. Instead it just

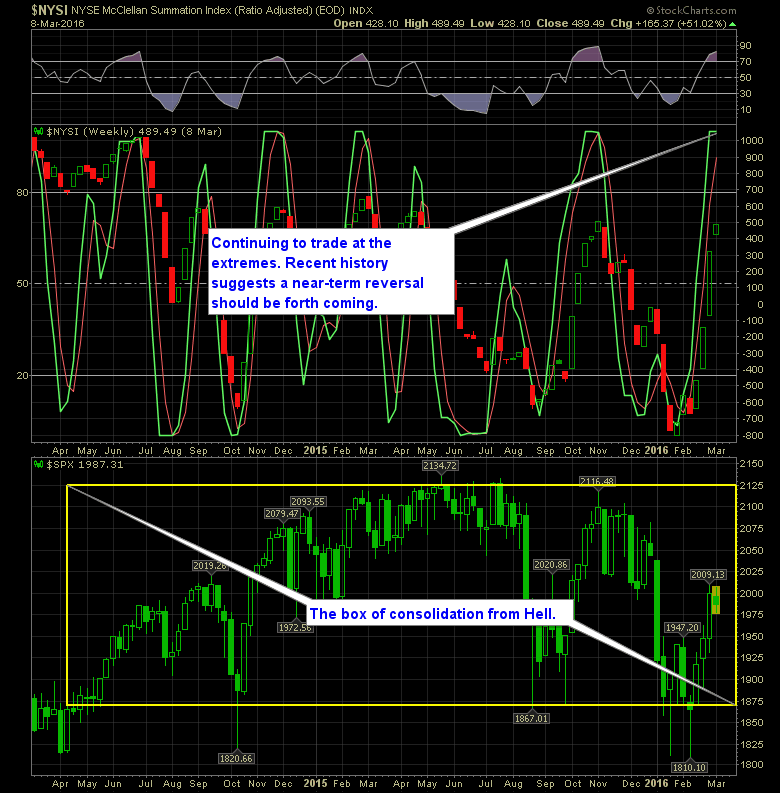

FOMC Statements in 2016 So the question is what dates are the best for raising rates in 2016? January 26th: No change March 16th: Best opportunity to raise rates, though most are not expecting it. Market up +8% off of the February lows.

This rally has come out of nowhere, and it is doing it completely overbought prior to today. The run-up into two key resistance points that conjoined at one specific price point, creates the potential for the market to fail here and not have anything left in the tank that would allow for it to break

Intraday the Q’s took a bit of a hit today. On the daily it is finding support at the 50-day moving average. But when you zoom in on the 30 minute chart, there is some weakening taking hold and with the break below $104, there is a good chance that we see at least a

This a market you have to be careful with in terms of getting heavily long….or short for that matter. The bears are not showing enough strength to merit a descent amount of short exposure and the bulls are so overbought that the risk:reward ratio is heavily skewed against them. As a result, I have to

You’d think this market is exhausted and it probably is, but apparently it still has some fight left in it, because it refuses to stay down for very long. Like Rocky Balboa taking punch after punch from Ivan Drago, yet still picking himself up off the canvas and remaining on his feet at round’s end.

The market is still trying to rally today, and up barely a smidge, and this is despite Facebook (FB), Amazon (AMZN), Netflix (NFLX), Google (GOOGL) and Apple (AAPL) being ghastly in the red today. Internals are not that great either. Nothing great or trendy with the TICKS, VIX is elevated by 3.5% and the advancers