Yesterday, during an interview with CNBC, Donald Trump said that he would most likely replace Janet Yellen, stating: “She is not a Republican, When her time is up, I would most likely replace her because of the fact that I think it would be appropriate.” That would be when Yellen’s term as chairwoman ends in

The market action today has been incredibly choppy, and if you are a bull in this market looking to buy the dip, you can’t be liking the action you are seeing. Let’s face it, the bulls had everything going in their favor this morning:

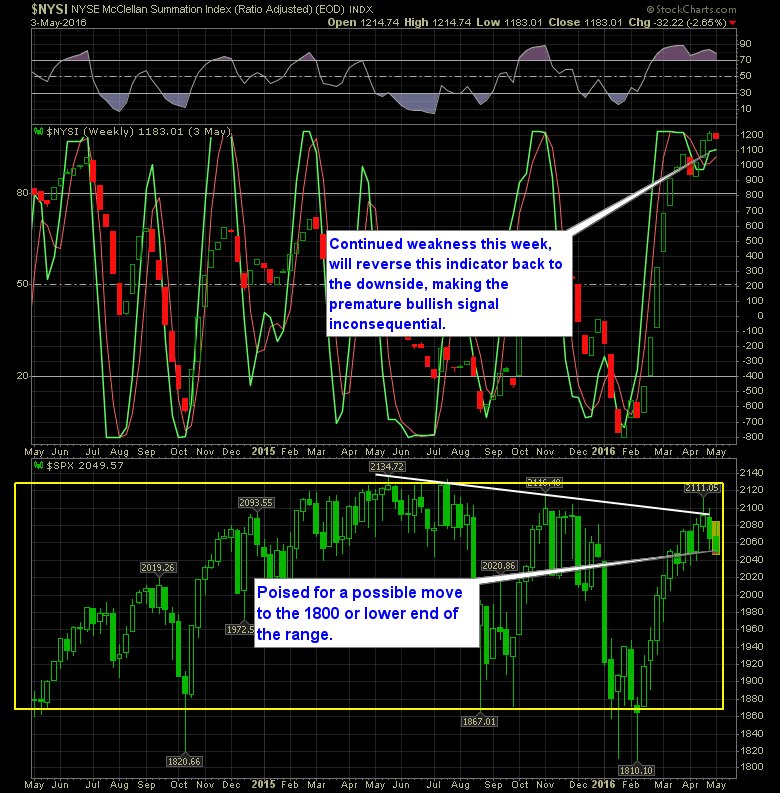

If you remember from two weeks ago, the SharePlanner Reversal Indicator had gone from flashing a bearish signal to another bullish signal. The problem was that this signal was at the top of the range and I had my doubts about its legitimacy. Fast forward to today, where the market is working on its second

The VIX indicator has been very interesting to watch of late. First, you have a text book double bottom that has formed. But it hasn’t confirmed the pattern in the form of a breakout. That break out level is around 16.30/40 and should it close above that level, I think it is very possible

We might just see further weakness tomorrow. That has been the trend of late anyways. Also the trend of late is to consistently mitigate the losses by using the afternoon for the bulls to buy up any and all weakness in the market. We saw it again today, and we seem to be seeing it

It just amazes me that there hasn’t been any demands for an investigation into this sell-off today, and with 23 minutes left of trading, I may be even speaking to soon to assume that we’ll even close in the red today. Knowing recent history, the algos may very well decide to ramp it up in

Information received since the Federal Open Market Committee met in March indicates that labor market conditions have improved further even as growth in economic activity appears to have slowed. Growth in household spending has moderated, although households’ real income has risen at a solid rate and consumer sentiment remains high. Since the beginning of

The bearish reversal signal that the SharePlanner Reversal Indicator flashed earlier this month seemed a bit premature as it has reversed back up and stopping the reversal from ever starting. When you get that quick of a reversal following another reversal, it is safe to say that the original reversal never actually reversed (say that

Futures are looking ‘okay’ right now, but there is some fair value cooked into them. For instance, the Nasdaq isn’t down only a few points, instead, it is down about 1% from where it closed the day at 4pm eastern. From the looks of things with Google (GOOGL) and Microsoft (MSFT) putting

SharePlanner Reversal Indicator is trying to point north again. However, no confirmation has occurred, but it won’t take much for it to do so if Friday results in a significant rally or we have another similar rally next week to what the market has become accustomed to of late. Not factored into the Weekly SPRI