Nice head and shoulders pattern forming on SPX 5 minute chart going back to the past two days of trading. A break below the lows of the day at 2095 would confirm the pattern and likely result in an even bigger downside move. Here’s the action:

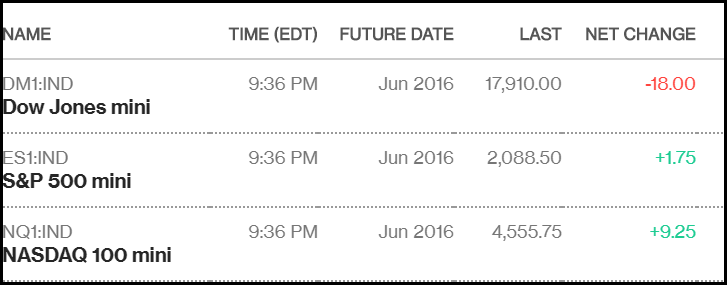

There’s definitely a couple of points of fair market value to calculate into this that brings the futures down a bit, but still, despite negative reactions to Netflix (NFLX) and IBM (IBM) earnings reports, the market isn’t giving up much ground.

The one question I would have you ask yourself, and I’ll leave my commentary at this… “Would you buy an individual stock after it ran 15% simply because it is starting to finally break through a major resistance level?” I wouldn’t either, and that is what traders are faced with deciding here on the S&P

It is one of those rare occasions where the SharePlanner Reversal Indicator for the Daily and Weekly time frames coincide with each other at the exact same moment. As of this morning, both the charts are flashing reversal signals for the market. Now it is worth remembering that there are two types of reversals –

I am a little bit surprised the the market has shown no willingness to follow through on Friday’s rally off the the lows. So far today it has simply been a steady decrease in price across all the indices and stocks in general. In fact the decliners are holding a 3:1 advantage over the advancers,

This is a beautiful inverse head and shoulders pattern that SPX is close to breaking through here. Once it confirms there is a good chance there is another additional 20 points of upside before the index reaches its pattern target. Here’s the IH&S pattern:

We had a very light and shallow sell-off last week, and sometimes that is as good as you will get in a monster rally like we are in. When the bears have every opportunity to kill a rally and pull the market back some and they fail to do so, that isn’t the time to

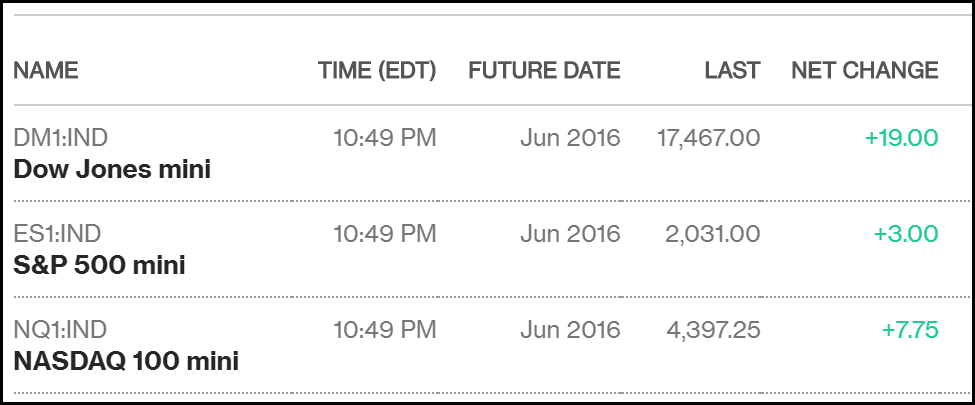

Futures steadily higher as we start to approach the early morning trading action. Stocks have been on he decline of late, but the pullback has been extremely shallow and nothing that invokes fear from traders near and far. Even if the market opens lower tomorrow, there is little reason to believe that the dip buyers

When you’ve had the rally that the market has had the past five weeks, you start to become guarded when it comes to risking too much of your capital on gains that will be difficult and hard fought going forward. But then day-after day, the bulls keep rallying the market off of the lows of