The stock market has experienced a lot of selling of late, and for swing-traders the prospect of knowing whether to hold a trade over night or multiple trades for that matter is very difficult. But this video has been put together to help you determine how to trade these difficult markets and to know when

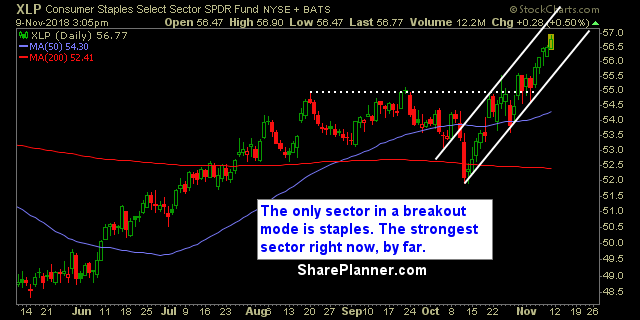

Sectors overall in rough shape, but promising charts emerge. Today the market made a dramatic turnaround off of its lows of the day. It was a much needed boost for the market which had yet to produce a green day even once in the previous five trading sessions. However, I’m concerned that it could be

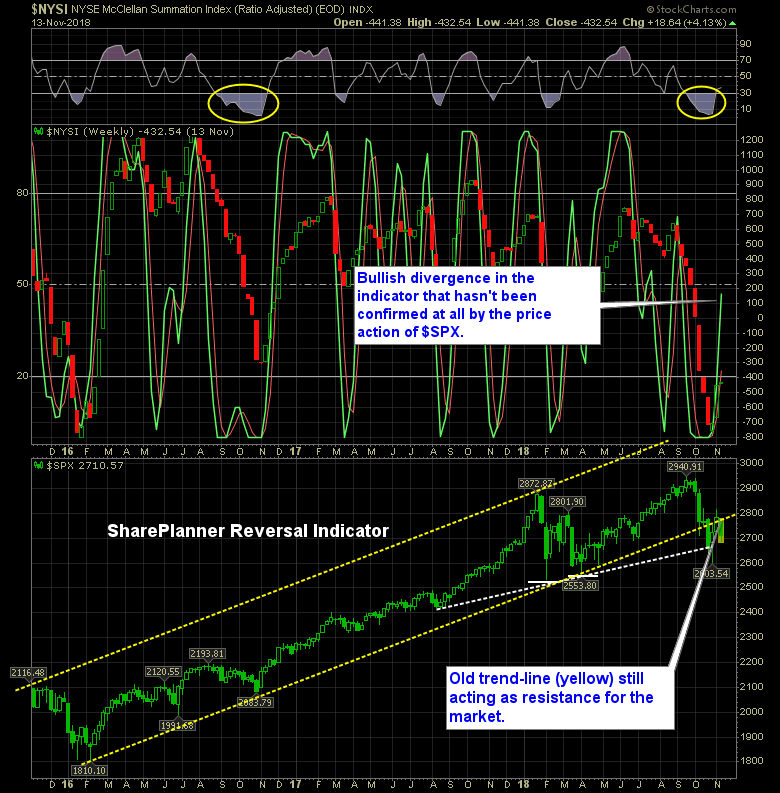

October’s sell-off had plenty of drama. Headlines and tons and tons of volume and extreme oversold readings on pretty much every indicator that ever existed. November hasn’t been anything like that, which has been what has made it so complicated. The breadth has not been bad at all. In fact, the T2108 indicator, which measures

Old and broken trend lines trying to stall out the current market rally. The market is trying to sell off, though since the 2:30 turn, the bulls have been on an ungodly buying spree, wiping out half of the day's losses, and inspiring the bulls that the worst may be behind it. Where this market

Information received since the Federal Open Market Committee met in September indicates that the labor market has continued to strengthen and that economic activity has been rising at a strong rate. Job gains have been strong, on average, in recent months, and the unemployment rate has declined. Household spending has continued to grow strongly, while

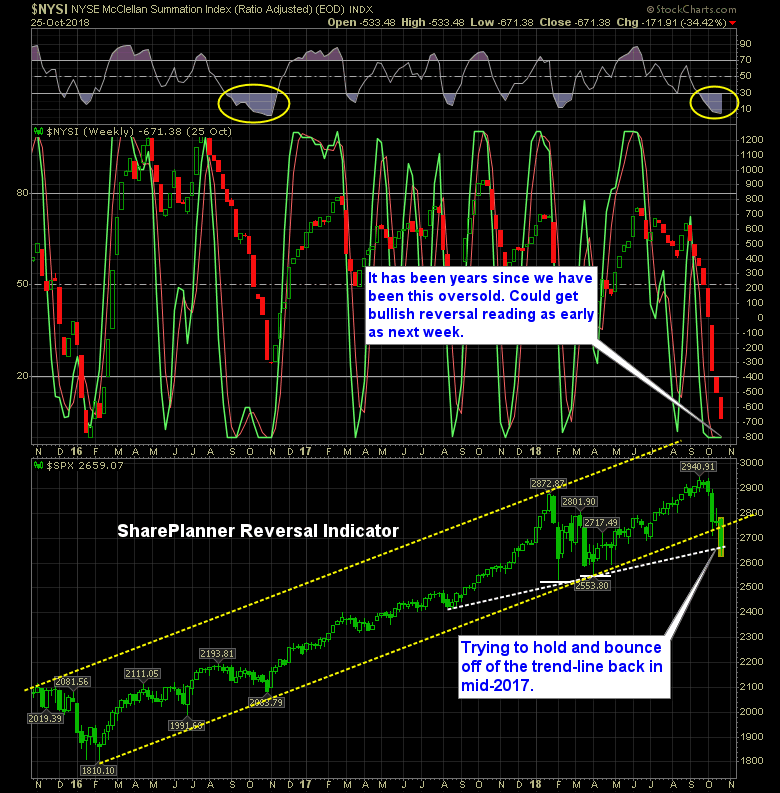

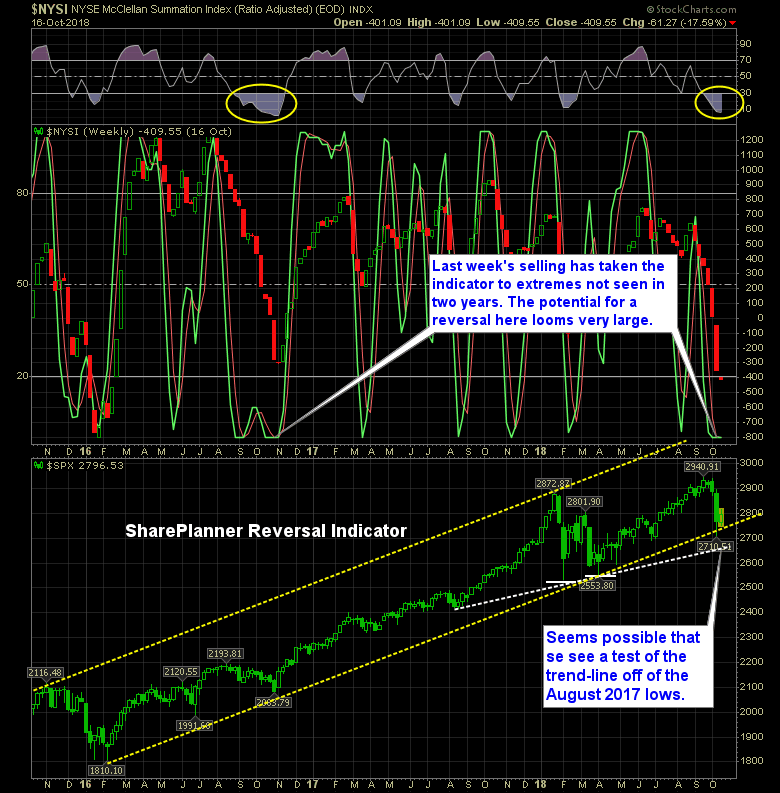

October was a hard market for the bulls, but their time may finally have arrived. The latest installment of the SharePlanner Reversal Indicator shows that the bulls have finally managed to trigger a bullish reversal. The previous two times this happened at extremes, the reversals were short lived and failed to hit bullish extremes, and

If my aim is to be totally PC about all of this, I would answer with “I don’t know” or the classic economic line of “it depends”. What I personally think though, is that this market is clearly as oversold as it has been in ages. A full month of non-stop selling. In fact there

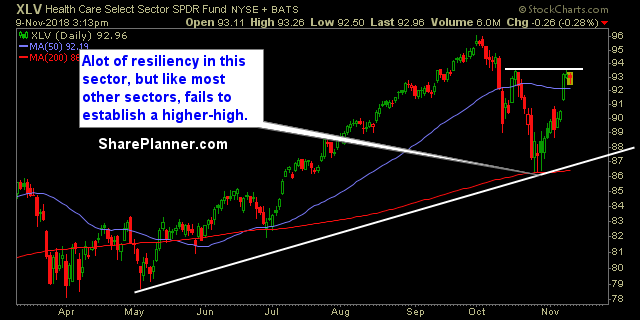

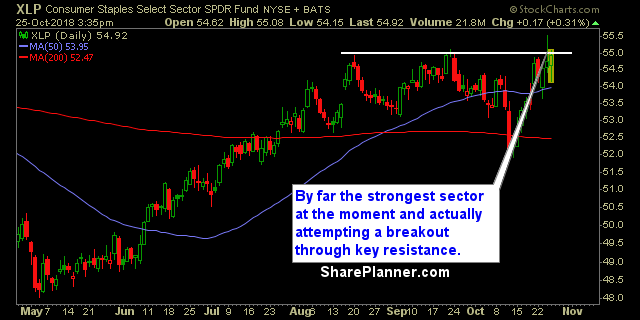

Technicals are pretty much a disaster for all the sectors. Except for Staples and Utilities, which are actually on the up and up, but that is to be expected when the street is looking for safe havens for its capital. The bulls have suffered for five weeks strong, and it is showing on the charts

I know there are a lot of you bears out there dying to reshort this market, assuming it is just a dead cat bounce. And you may get that change eventually, but be patient. Don't try to force it. These bounces take time to play out. The bounce, following the February lows being established on

The stock market is seeing huge amounts of selling, and in some cases even crashing. How do you know when a bottom has been put in place and buy the dip? In this video I lay out my entire approach to trading a stock market crash and how to identify a bottom and do so