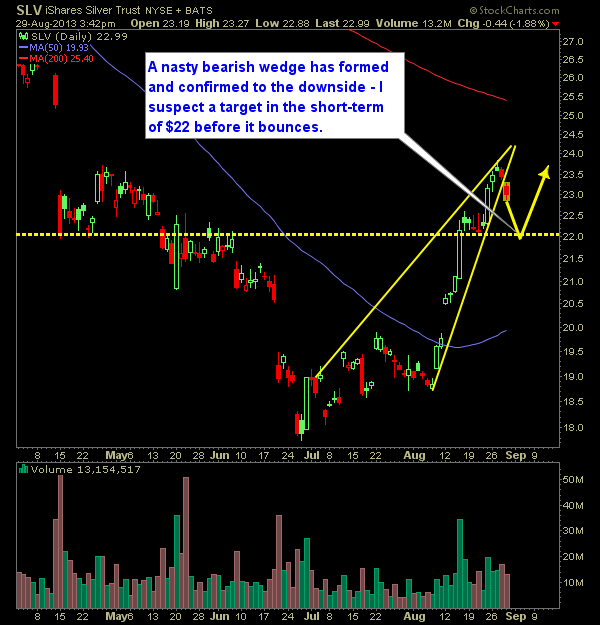

I’ve been bullish on commodities of late, but the recent action in iShares Silver (SLV) where a strong bearish wedge has confirmed to the downside, makes it more than likely that ETF will see $22 in the short-term. So hold off on adding any new positions in this stock. Here’s the technical analysis for

Until this market improves and gets back above 1670, I’m going to be somewhat nervous about the long side of this market.

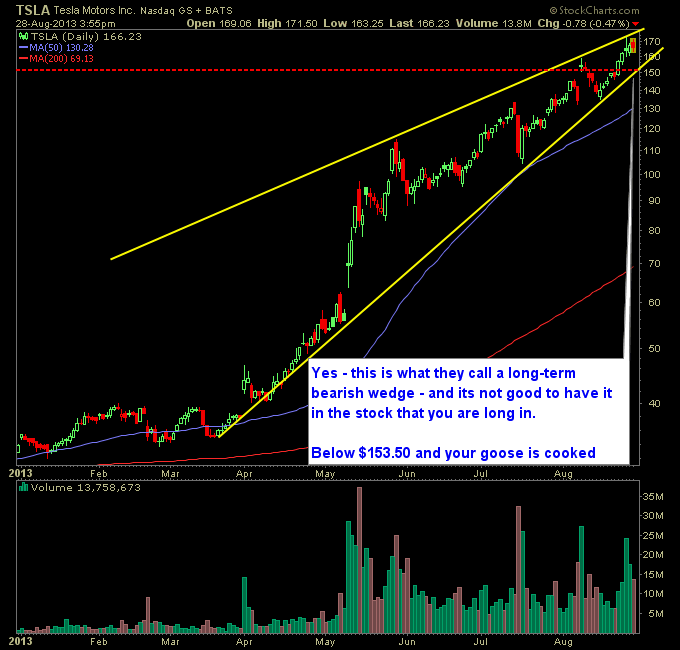

Yeeeeeeaaaaah….. I think I’m going to have to get bearish on Tesla Motors (TSLA). Its not that it can’t go higher from here, and it may still do that, its just that the price pattern casts a major cloud over that assertion. The stock is losing momentum trying to make new highs, and quickly

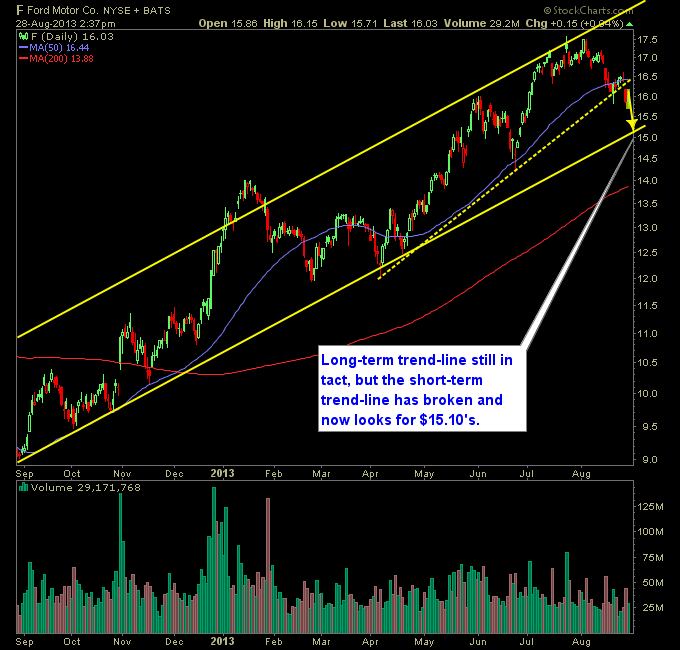

Still a very healthy looking chart. Needs to hold at the very least $15.10 or this stock will get ugly really fast. Here’s the Ford (F) technical analysis:

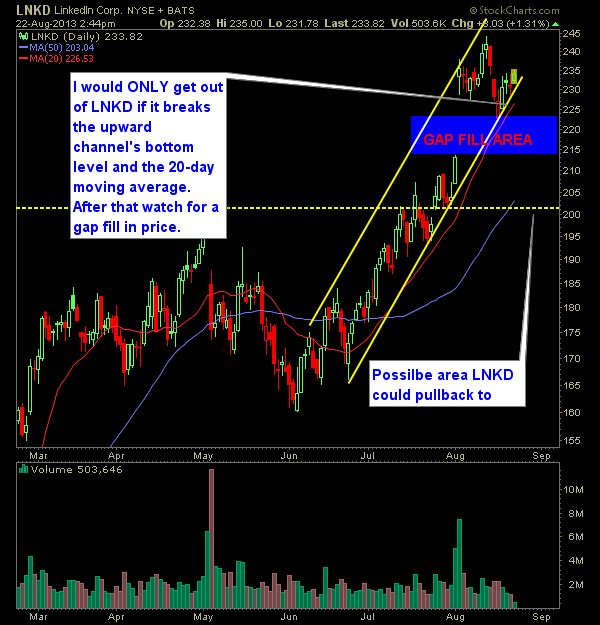

I’ve got no issues with the LNKD chart as you can see my markups below. That is assuming it can hold the 20-day moving average and the the rising channel it is perfectly trading inside of. Once that happens, all hell could easily break lose on this stock and a pullback to $200 is possible

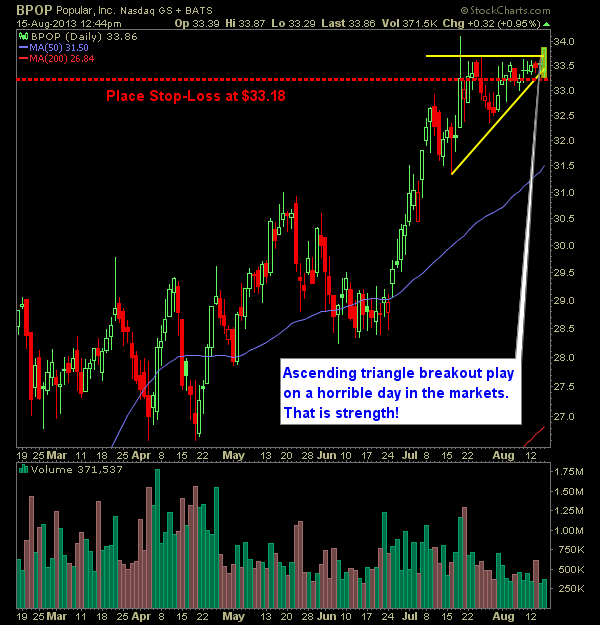

Last week I posted a trade I was taking in Popular Inc. (BPOP) and the favorite setup of mine it was exhibiting: The Ascending Triangle Breakout. The stock broke out in a major way today. While it is trading outside the Upper Bollinger Band, it has has a history of doing so, and doesn’t warrant

Last week I posted a trade I was taking in Popular Inc. (BPOP) and the favorite setup of mine it was exhibiting: The Ascending Triangle Breakout. The stock broke out in a major way today. While it is trading outside the Upper Bollinger Band, it has has a history of doing so, and doesn’t warrant

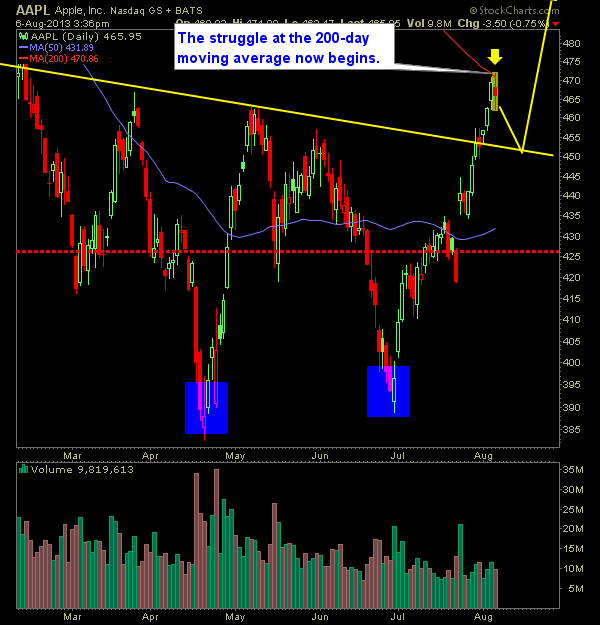

We are finally seeing some concern among Apple (AAPL) bulls today as the stock has sold off with the rest of the market. You could write it off as AAPL simply falling in sympathy with the rest of the market but I'm not buying it. The stock has been so disattached from the market