Chalk up another great month of swing-trading in the SharePlanner Splash Zone!

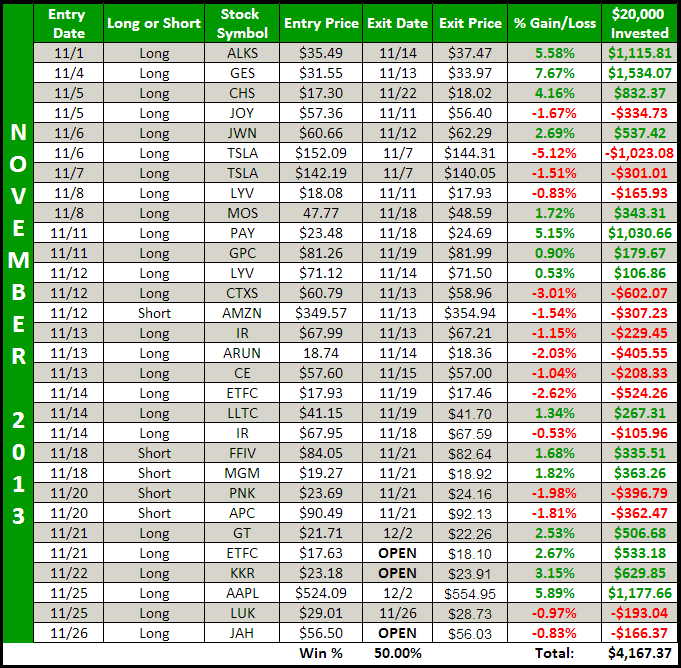

Our portfolio was up another $4,167 in November bringing my total for the year to $31,445.94 in total profits and $156,114.45 since 2011 for our subscribers.

Unlike 99.9% of subscription newsletters out there, I do not hide my past performance. Show me a letter that does not make its results public and I’ll show you a newsletter that is likely just another scam service promising you the world and only taking your hard earned money as a result.

So vet me, vet our day-trading that comes with the SharePlanner Splash Zone, because we have nothing to hide and stand proudly behind the quality service that we provide, with a high-quality chat-room , real-time text and email alerts, it’s hard to beat what we have to offer!

Even if you don’t have the time to mirror our trades, then you should give strong consideration to automating our newsletter with our partner brokerage Ditto Trade. We don’t receive any kickbacks from them, only to provide you with the most opportunity to succeed in this ever-changing stock market.

So check out my results below, and decide for yourself what do you have to lose by signing up for our Free 7-Day Trial to the SharePlanner Splash Zone.

Here’s November’s Swing-Trading Results:

With The Splash Zone, you will get low risk and high probability trade setups that no other trading service can offer.

Start Your Free 7-Day Trial Today!

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Is it better to be lucky or skillful when it comes to being a good trader? I would argue you can have it both ways, but it requires that skill manages the luck, and at times when luck is simply against you too.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.