My Swing Trading Approach

I have a balanced portfolio at this moment and need to see whether the bulls can bounce this market or not, before adding additional long positions to the portfolio.

Indicators

VIX – Broke a 6 day winning streak, finishing 3% lower to 11.33, despite the market being bearish overall.

T2108 (% of stocks trading below their 40-day moving average): Significant amount of selling wiping out the previous four days of gains, dropping 7% down to 56%.

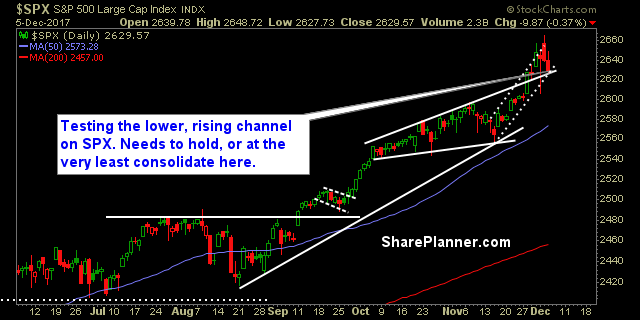

Moving averages (SPX): 5-day moving average broken yesterday, now looking to test the 10-day moving average at the market open today.

RELATED: Patterns to Profits: An Intro Trading Course

Industries to Watch Today

Technology was the only industry that was up yesterday, and it was barely up too. There should be some opportunities for a bounce in the coming days with tech. Consumer Defensive chart still very strong. Healthcare continues to take a significant beating over the last two days, and may be trying to roll over here. Financials still look solid. Utilities took the biggest hit, with Basic Materials falling in just behind.

My Market Sentiment

It would seem to me, that following a three-day pullback in SPX, which hasn’t been seen since August 10th, that the market may garner some buying interest here, and pop the indices yet again. Yesterday, looked to do that, but spent the entire afternoon giving up all of its gains. Right now, I think the market still leans bullish, as there has yet to be any real panic or fear that has entered into the market.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 5 long positions

Recent Stock Trade Notables:

- Square (SQ): Long at $41.28, sold at 42.29 for a 2.2% profit.

- Twitter (TWTR): Long at 20.34, sold at 22.06 for an 8.5% profit.

- Micron (MU): Long at 45.61, sold at 47.91 for a 5.1% profit.

- TNA: Long at $61.00, sold at $64.08 for a 5.1% profit.

- Micron (MU) Long at $43.20, sold at $44.78 for a 3.7% profit.

- Alibaba (BABA): Long at $186.42, sold at 179.29 for a 3.8% loss.

- Paypal (PYPL): Long at $74.18, sold at $73.29 for a 1.2% loss.

- Square (SQ): Long at $36.00, sold at $37.35 for a 3.8% profit.

- Adobe (ADBE) : Long at $175.20, sold at $179.62 for a 2.5% profit.

- Alibaba (BABA): Long at $187.00, sold at 181.77 for a 2.8% loss.

- Paypal (PYPL): Long at $71.94, sold at $72.98 for a 1.5% profit.

- Lam Research (LRCX): Long at 210.41, sold at $205.20 for a 2.4% loss.

- Baidu (BIDU): Long at $242.80; sold at 248.29 for a 1% profit.

- Nvida (NVDA): Long at $195.17, sold at $204.88 for a 5% profit.

- Humana (HUM): Long at $248.73, sold at $261.20 for a 5% profit.

- Square (SQ): Long at $32.92, sold at $34.36 for a 4.4% profit.

- Nvida (NVDA): Long at $198.17, sold at $194.06 for a 2% loss.

- Lennar Homes (LEN): Long at $56.63, sold at $58.10 for a 2.6% profit.

- Lam Research (LRCX): Long at $185.23, sold at $192.24 for a 3.8% profit.

- Starbucks (SBUX): Long at $55.59, sold at $54.94 for a 1.1% loss.

- Illinois Tool Works (ITW): Long at $148.63, sold at $151.23 for a 1.8% profit.

- Nvdia (NVDA): Long at $180.18, sold at $187.38 for a 4% profit.

- Olin Corp (OLN): Long at $34.37, sold at $36.14 for a 5.2% profit.

- Lowe’s (LOW): Long at $77.97, sold at $81.52 for a 4.6% profit

- IBB: Long at $330.91, sold at $338.25 for a 2.2% profit.

- Seagate Technologies (STX): Long at $34.35, sold at $33.89 for a 1.3% loss.

- Wynn Resorts (WYNN): Long at $149.65, sold at $147.14 for a 1.7% loss.

- Imax Corp (IMAX): Long at $23.03, sold at 22.26 for a 3.3% loss.

- Marriott International (MAR): Long at $106.26, sold at $108.26 for a 1.9% profit.

- Alibaba Group (BABA): Long at $170.63, sold at $170.29 for a 5.0% profit.

- Workday (WDAY): Long at $106.91, sold at $104.90 for a 1.8% loss.

- Nvdia (NVDA): Long at $170.45, sold at $187.94 for a 10.3% profit.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

What do you do when the best trade setup that you can find is a stock that you already have a position in? Should you trade a stock that you already have a position in and exponentially increase the size of that position? In this podcast episode Ryan explains the circumstances that allows you to increase your position size in an already profitable trade and how to manage the risk in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.