Episode Overview How to trade a stock split: in this podcast episode Ryan talks about the impact of what an announced forward stock split means for a stock that you are considering swing trading, or may already be trading. Also covered are the risks, and the strategy behind stock splits for investors and traders alike.

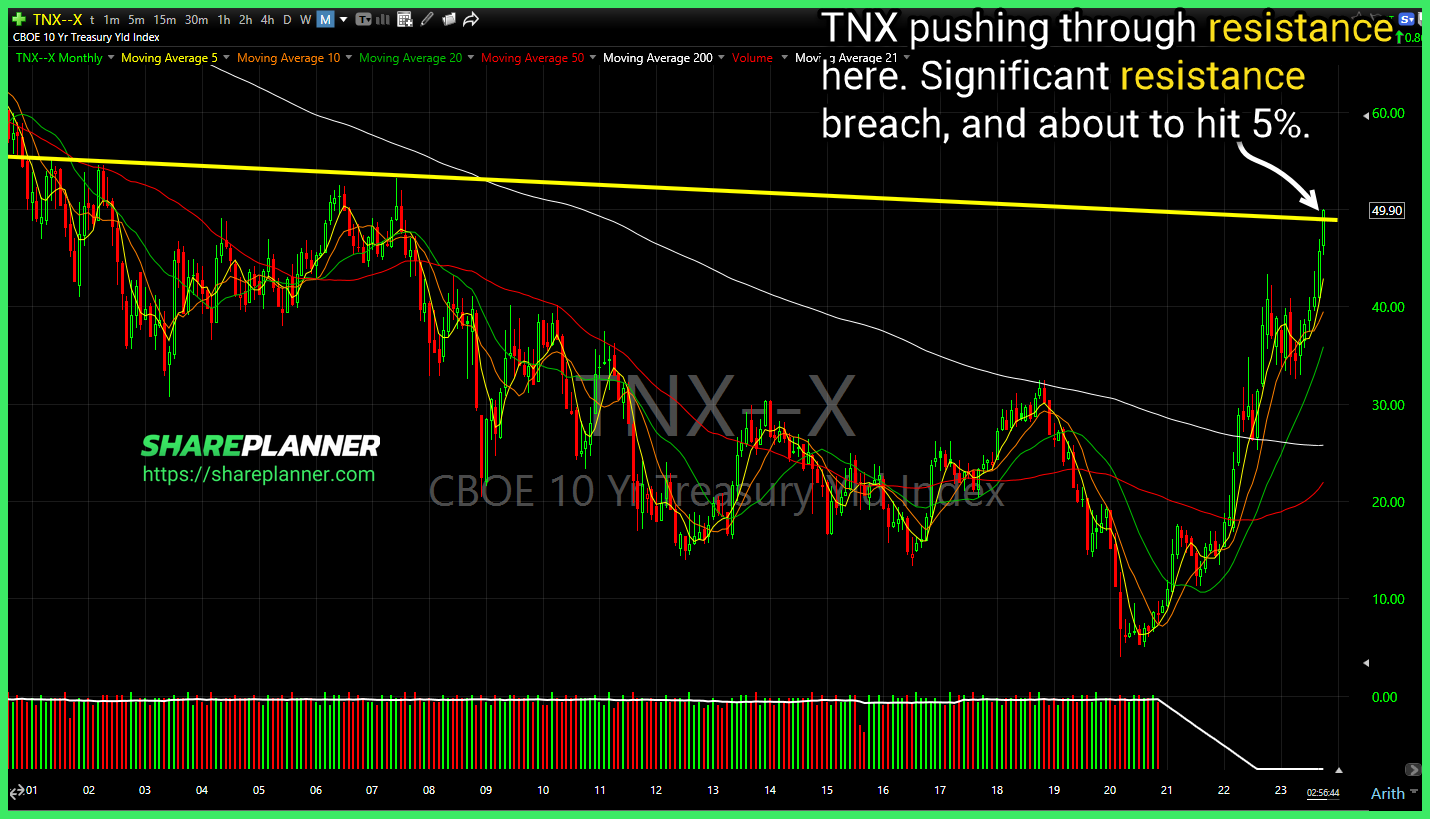

CBOE 10-year Treasury Yield Index (TNX) pushing through resistance here. Significant resistance breach, and about to hit 5%. SoFi Technologies (SOFI) Price breaking back below major support levels. A significant market sell-off could take SOFI back below $5. Triangle pattern in Healthcare Sector (XLV) nearing a break to the downside. Bounce play if

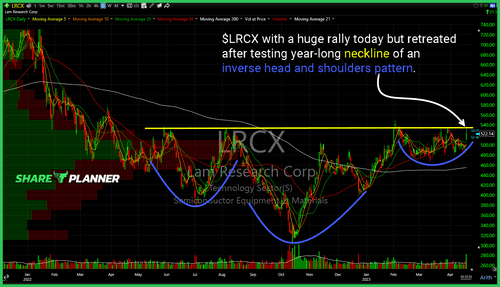

Lam Research (LRCX) with a huge rally today but retreated after testing year-long neckline of an inverse head and shoulders pattern. Nvidia (NVDA) boxed in at the recent highs. Nearing a breakout, but yet to confirm it. Big time breakout for Marsh & McLennan (MMC) today. Apple (AAPL) making a run for positive

$LRCX clearing significant resistance both short-term and mid-term.

$LCID doing a good job of sustaining its momentum all month long. If the market can hold itself together, potential is for a move up to $60.

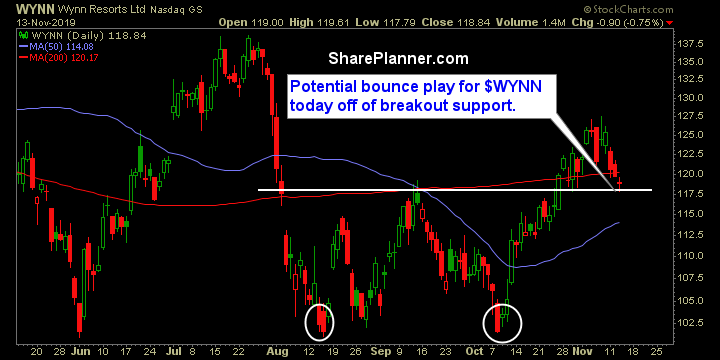

Thursday’s Swing-Trades: $WYNN $LRCX $NWS Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Wynn Resorts (WYNN)

First off, a big salute to the veterans who read this blog and are either serving this country or have served in the past. There was a lot of commotion outside my office window this morning and then heard all of this great patriotic music and so I looked and outside a parade was starting.

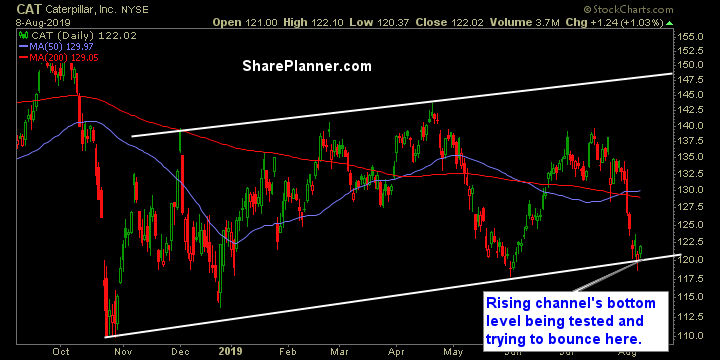

Friday’s Swing-Trades: $CAT $LRCX $RCL Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Caterpillar (CAT)

My Swing Trading Strategy I did not add any new positions yesterday as the market’s price action simply didn’t warrant it. Instead I raised my stops where I could. I will be open to adding another long position today, but won’t hold out hope for it, if the market decides to fade tech strength today.

My Swing Trading Approach First, I’ll manage the profits in my existing positions, primarily by raising the stop-losses. Then I will look to add additional long exposure as the market permits. Indicators