$IBB broke out of the bull flag but running into some resistance that goes back to 2022. Watch for whether it can breakout here, or pulls back as a result of a failed break. . $IBIT bull flag breakout here, representing a continuation of the current trend-line off of the January lows.

$IBB bouncing off of the rising trend-line from October '22. You'll still want to be mindful of overhead resistance. $CVS for a second straight day testing key support that if broken goes back down to 2019 & 2020 prices. $VIX running into heavy resistance at the 200-day moving average. $TNX 10 year yields showing rejection

$ACI nearing a break through resistance that hasn't been broken since last November. Huge gap that remains unfilled. Very overbought at this juncture, but still a promising chart to keep an eye on. Tough to play that breakout level on $LHX at $190 with that declining resistance in play still. $IBB pulling back and retesting

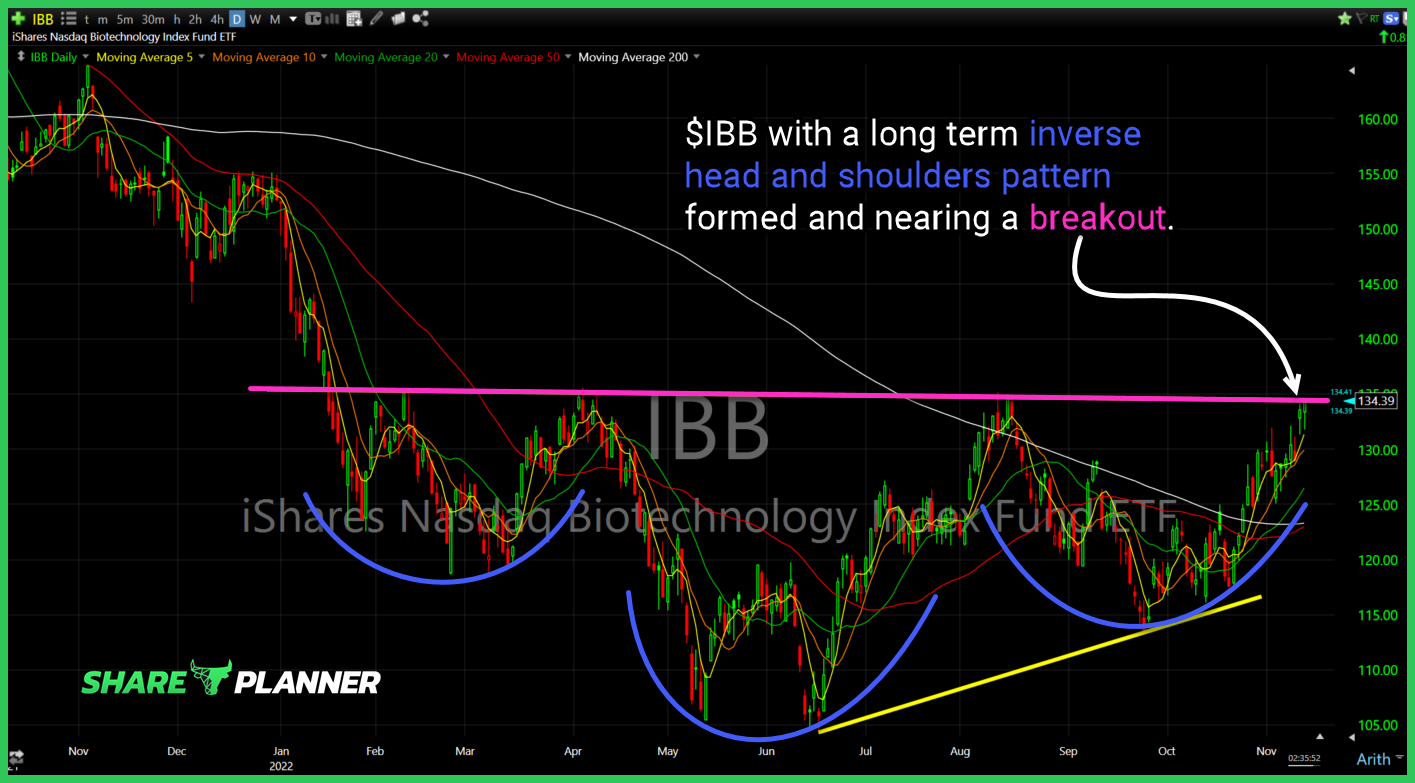

$IBB with a long term inverse head and shoulders pattern formed and nearing a breakout.

Massive support on $IBB getting tested here. Problematic if it breaks.

Swing Trade Approach: Big day for my long positions – the smaller amount of short positions that I held previously overnight didn’t fair too well, all but one at least. I closed my short on the biotechs (IBB) for a -3% loss. It was a great pattern that was showing a lot of weakness,

The market is trying to crash again like what we saw back in Q4 of last year, how are you going to be swing-trading it and most importantly preserving profits along the way. I go over the possibilities of a market crash, my swing-trading update, and the technical analysis of the most important stocks currently

My Swing Trading Approach Closed out IBB yesterday for a +3.8% profit, while adding two additional trades from the hottest sector right now: technology. Indicators

Thursday’s swing-trades: Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the Splash Zone and start making some profits for yourself! Long iShares Nasdaq Biotechnology (IBB)

The key to July’s swing trading success was in managing the losses and keeping them SMALL! I did that well, and it is something I am very happy. My winning percentage was right there at my historical average, but I didn’t place as many trades as I usually do. There were only 18 trades made