My Swing Trading Approach

I plan to play it cool today. Right now, I have one short position as I exited my long positions yesterday. I could get heavily long on this dip, but I need to see some evidence out of this market that the lows from yesterday want to hold into today.

Indicators

VIX – VIX above 10 finally for the first time since July 12th. But still extremely depressed and unable to hold any sizable move on the daily charts.

T2108 (% of stocks trading below their 40-day moving average) – Showing some vulnerability, but still above 60%. Not a great reading though.

Moving averages: Incredible! Despite yesterday’s sell-off, the 5-day MA on SPX held, despite trading well below the 10-day MA earlier in the day.

Industries to Watch Today

Financials are not improving at this point. It is still salvagable at this point.

Energy has plenty of potential, but Exxon Mobil (XOM) earnings could create some problems.

Technology turned bearish in an instant. Ugly chart with yesterday’s candle pattern.

My Market Sentiment

Skeptical of being long or short, let the market show me here. Right now, very-short-term momentum has given the bears an opportunity.

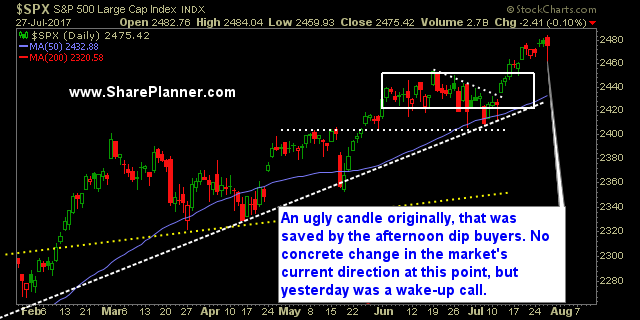

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance:

- 1 Short position

Recent Stock Trade Notables:

- Autodesk (ADSK): Long at $106.45, closed at $111.34 for a 4.6% profit.

- Bank of America (BAC): Long at $23.99, closed at $24.23 for a 1% profit.

- IBB: Long at $313.18, closed at $324.25 for a 3.5% profit.

- SPXU: Long at $14.82, closed at $14.58 for a 1.6% loss.

- Alibaba Group (BABA): Long at $143.65, closed at $150.40 for a 4.7% profit.

- American Airlines (AAL): Long at $49.26, closed at $51.84 for a 5.2% profit

- Intel (INTC) Short at $35.21, covered at $34.46 for a 2.1% profit.

- Nvdia (NVDA): Long at $155.57, closed at $157.53 for a 1.3% profit.

- IBB: Long at $298.24, closed at $303.74 for a 1.8% profit.

- SPXU: Long at $15.68, closed at $15.25 for a 2.7% loss.

- Whirlpool (WHR): Long at $190.46, closed at $195.19 for a 2.5% profit.

- Ferrari (RACE): Long at $84.60, closed at $89.93 for a 6.3% profit.

- Amazon (AMZN): Long at $964.70, closed at $1001.23 for a 3.8% profit.

- American Airlines (AAL): Long at $49.18, closed at $50.62 for a 2.9% profit

- Alibaba Group (BABA): Long at $124.95, closed at $137.51 for a 10.1% profit.

- Starbucks (SBUX): Long at $61.78, closed at $63.68 for a 3.1% profit.

- Western Digital (WDC): Long at $91.24, closed at $89.29 for a 2.1% loss.

- Broadcom (AVGO): Long at $236.65, closed at $241.15 for a 2% profit.

- SPXU: Long at 16.60, closed at $16.98 for a 2.3% profit.

- JP Morgan Chase (JPM): Long at $87.84, closed at $85.98 for a 2.1% loss.

- Micron Technology (MU): Long at $29.00, closed at $28.04 for a 3.3% loss.

- Alibaba Group (BABA): Long at $116.25, closed at $124.09 for a 6.7% profit.

- Southwest Airlines (LUV): Long at $58.35, closed at 57.23 for a 1.9% loss.

- Broadcom (AVGO): Long at $223.63, closed at $228.65 for a 2.2% profit.

- Workday (WDAY): Long at 86.00, closed at 90.32 for a 5% profit.

- Univar (UNVR): Long at $30.96, closed at $32.20 for a 4% profit.

- Alibaba Group (BABA): Long at $111.91, closed at $115.48 for a 3.2% profit.

- Redhat (RHT): Long at $85.21, closed at $87.21 foor a 2.4% profit.

- Darling Ingredients (DAR): Long at $15.19, closed at $14.90 for a 1.9% loss.

- Apple (AAPL): Long at $143.82, closed at $147.11 for a 2.3% profit.

- Teradyne (TER): Long at $31.16, closed at $33.03 for a 6.0% profit.

- UPRO: Long at $92.75, closed at $94.78 for a 2.2% profit.

Sign up for Trading Block here.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Which trading platform in 2026 should you be using? In this podcast episode Ryan talks about all the major platforms out there from TC2000 to TradingView, to TrendSpider and the Bloomberg Terminal. What are the perks and benefits to each one, and Ryan will also go over his lower-tier platforms that you might want to consider as well.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.