$SNOW with a strong move initially today, but still getting rejected at resistance. Can't seem to sustain a move above it, just like the previous 4 times. $ZS potential for an oversold bounce, but so far struggling. Push below support nullifies any bounce attempt. $OSTK approaching a major resistance level in a breakout attempt. Nice

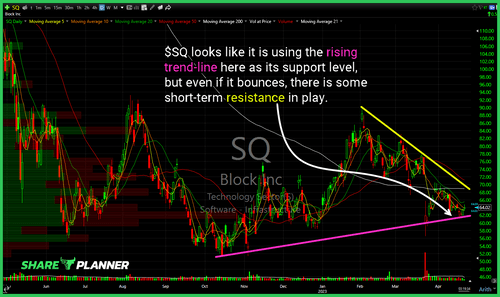

$SQ looks like it is using the rising trend-line here as its support level, but even if it bounces, there is some short-term resistance in play.

$UNH rejection at the broken trend-line, waiting for a pullback to key support.

$XOM attempting the breakout of the triangle here.

$XLK struggling to reclaim broken support.

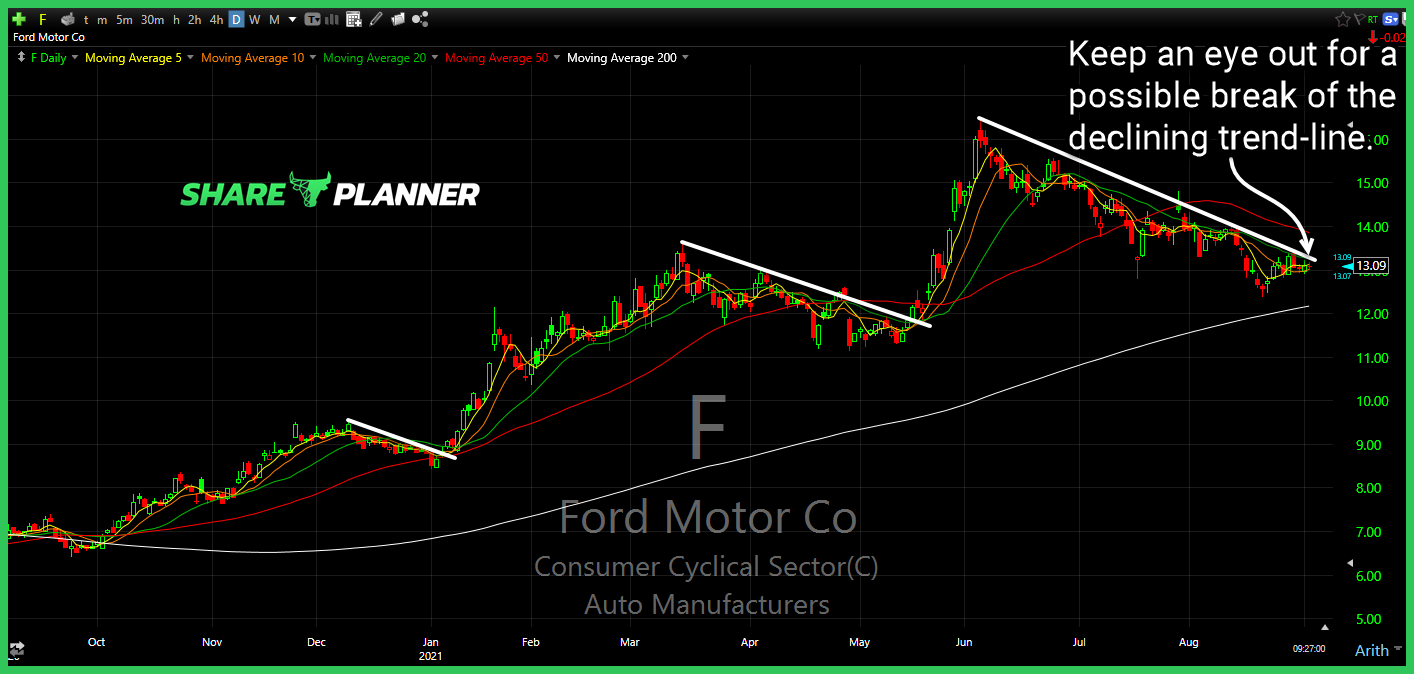

Agco (AGCO) with a double bottom and nearing a break of the declining trend-line. Exxon Mobile (XOM) breaking a major declining resistance level. Trinity Industries (TRN) finally able to get through resistance. Railroad stocks are doing well and making a big move as a whole. Names to consider: Union Pacific (UNP), CSX (CSX)

Each night I provide a recap of the charts and technical analysis of some of the most intiruging market development. Call it "cleaning out of the notebook" per se. Here you will get a hodge-podge of analysis on different stocks, sectors, ETFs, and market indices. Some of them, may have been requests from members of

Episode Overview Do you ever wonder if certain swing trading setups work better in certain stock market conditions vs others? In this Episode, Ryan Mallory will discuss what you need to know about various trade setups and how they work, depending on the type of market you care trading 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube

Episode Overview The stock market is having a full-on meltdown right now due to the Coronavirus spreading worldwide and the likelihood it turns into a pandemic. I have managed to trade this stock market quite well over the last couple of weeks being both short and long at the right moments, and taking profits along

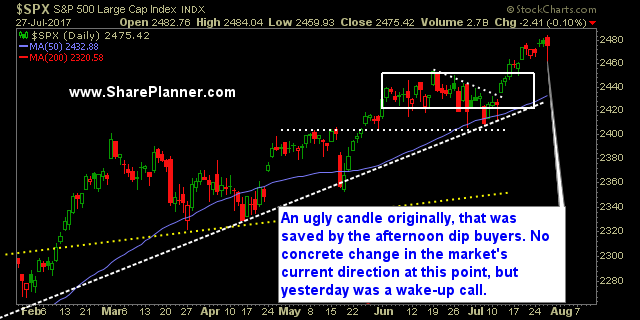

My Swing Trading Approach I plan to play it cool today. Right now, I have one short position as I exited my long positions yesterday. I could get heavily long on this dip, but I need to see some evidence out of this market that the lows from yesterday want to hold into today.