Episode Overview Ryan fields a number of questions from one of his swing trading listeners. Ryan discusses what to do when your capital exponentially increases, one of his more memorable good and bad swing trades, and how his trading strategy has developed over time. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps

Episode Overview How does Ryan invest in dividend stocks and how does he manage the risk on each of his dividend plays. You'll be surprised to find out that he doesn't use stop-losses on any of his dividend setups - so then how does he manage risk exactly? 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube

Episode Overview What can a trader do to minimize the number of stocks that they get in their screening, as well as what can one do to grow their account faster? Also in this podcast episode, Ryan addresses why he doesn't take every trade setup that he follows and the reasons for it.

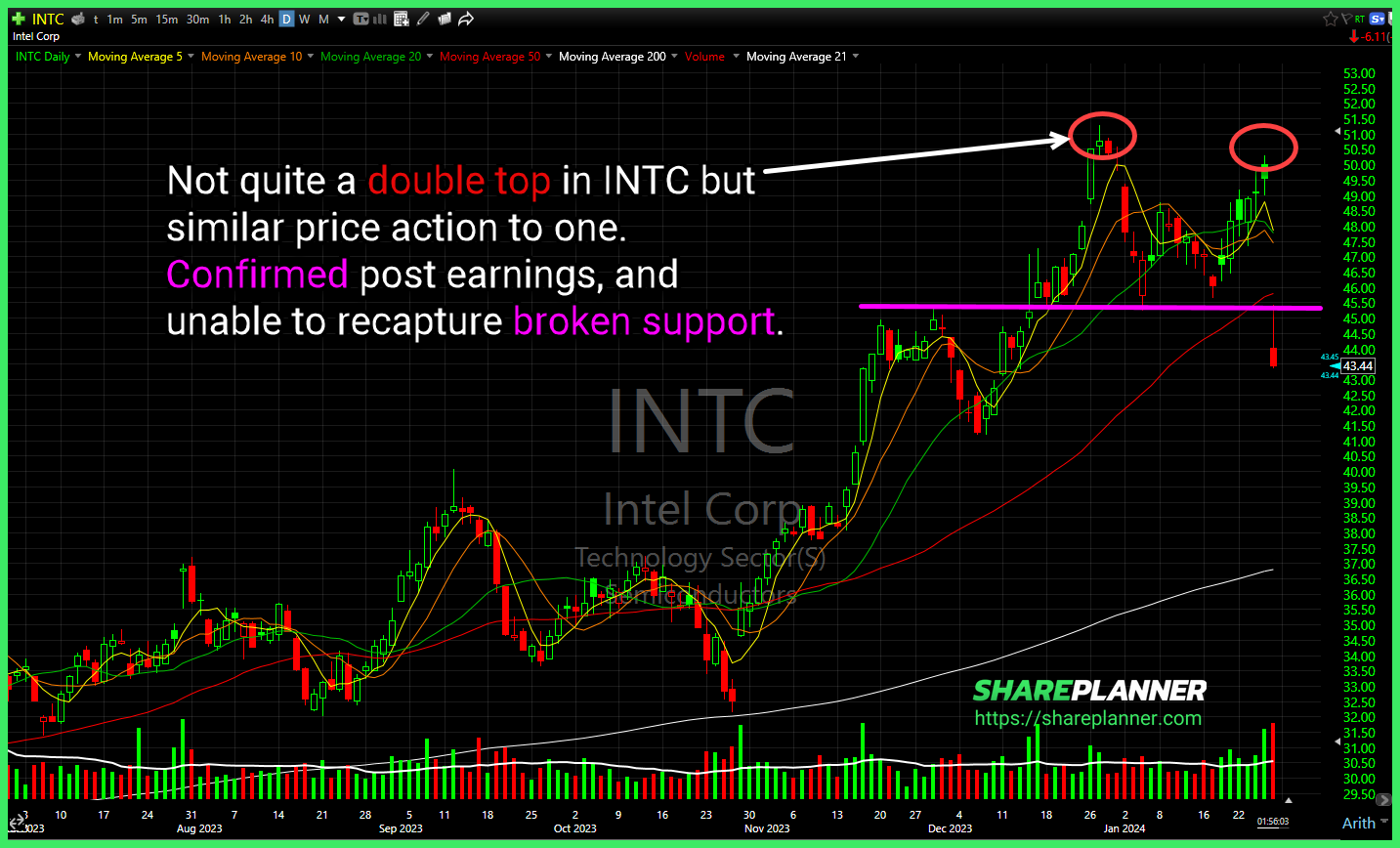

Not quite a double top in Intel (INTC) but similar price action to one. Confirmed post earnings, and unable to recapture broken support. A lot of consolidation of late in staples Staples Sector (XLP) - and possible that yesterday and today's strength could lead to an upside breakout. Good consolidation in ZipRecruiter (ZIP)

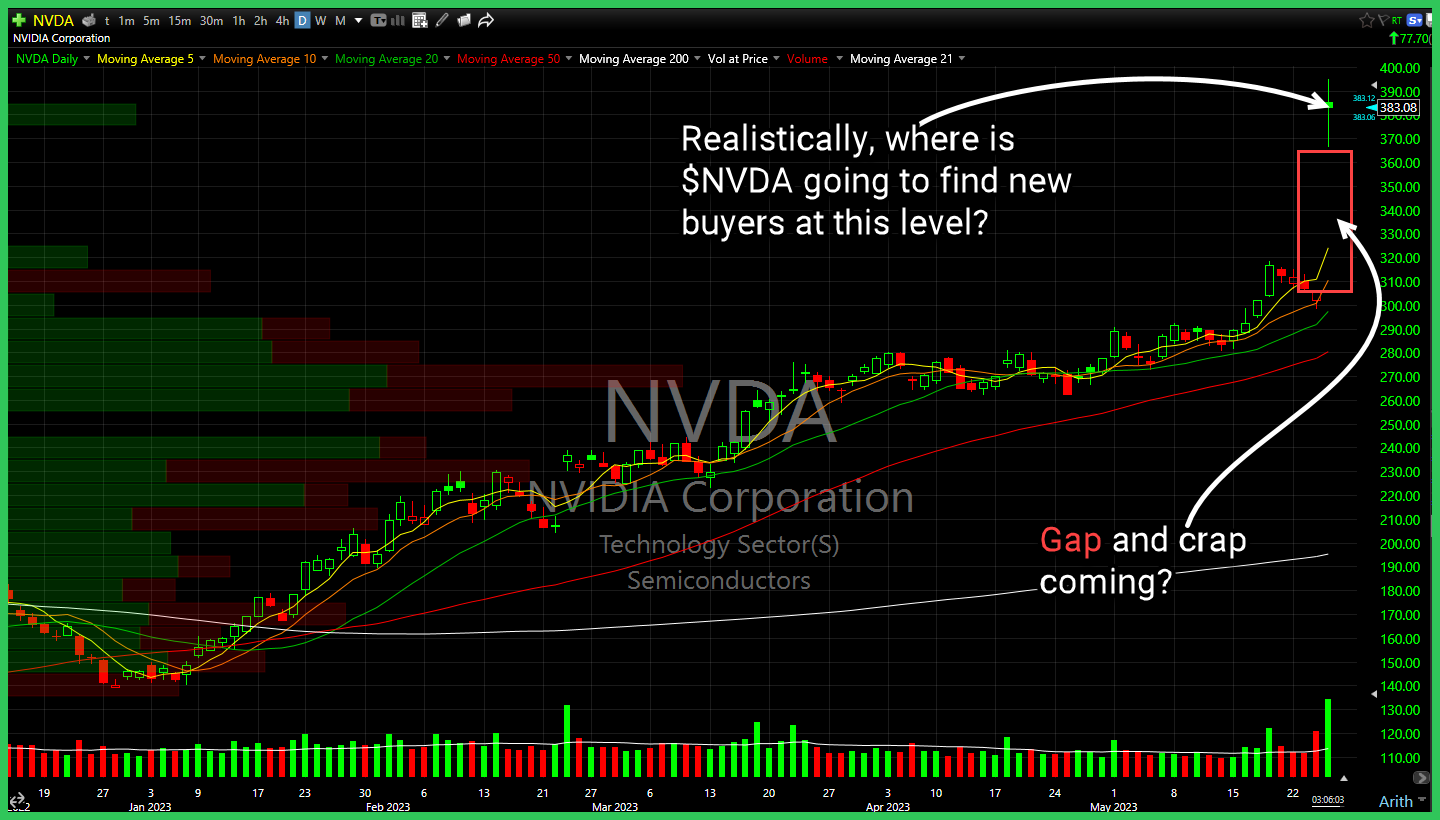

Realistically, where is Nvidia (NVDA) going to find new buyers at this level? Descending triangle pattern breaking to the downside on Alibaba Group (BABA) Significant breakdown taking place on Target (TGT) as it pushes below the lower channel band. Intel (INTC) breaking down through the triangle, and looking at a possible retest of

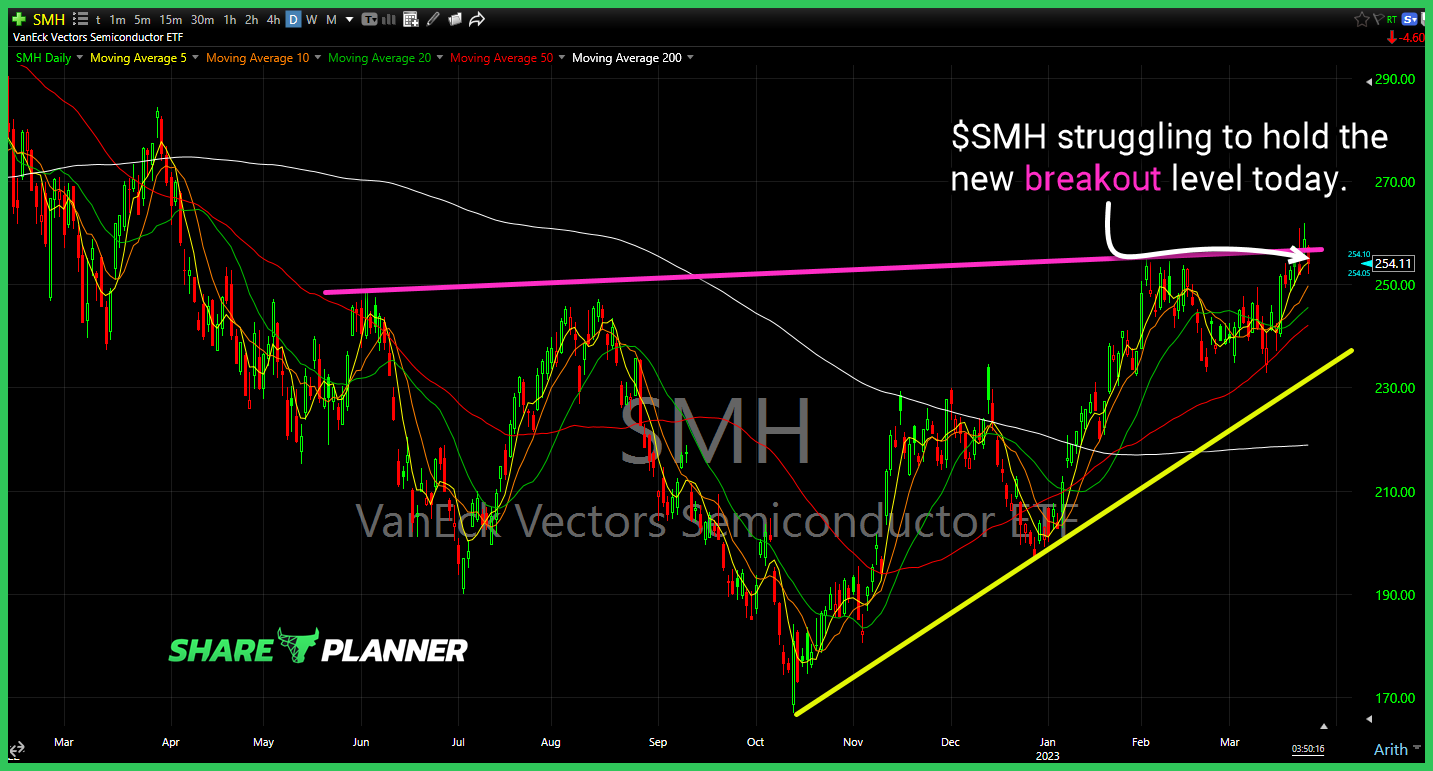

$SMH struggling to hold the new breakout level today.

Intel (INTC) making a run towards its upper channel band. Amazon (AMZN) clawing its way back to hold a critical level of support today. Not every day you see McDonalds (MCD) go parabolic like this... Home Depot (HD) breaking out and confirming the double bottom.

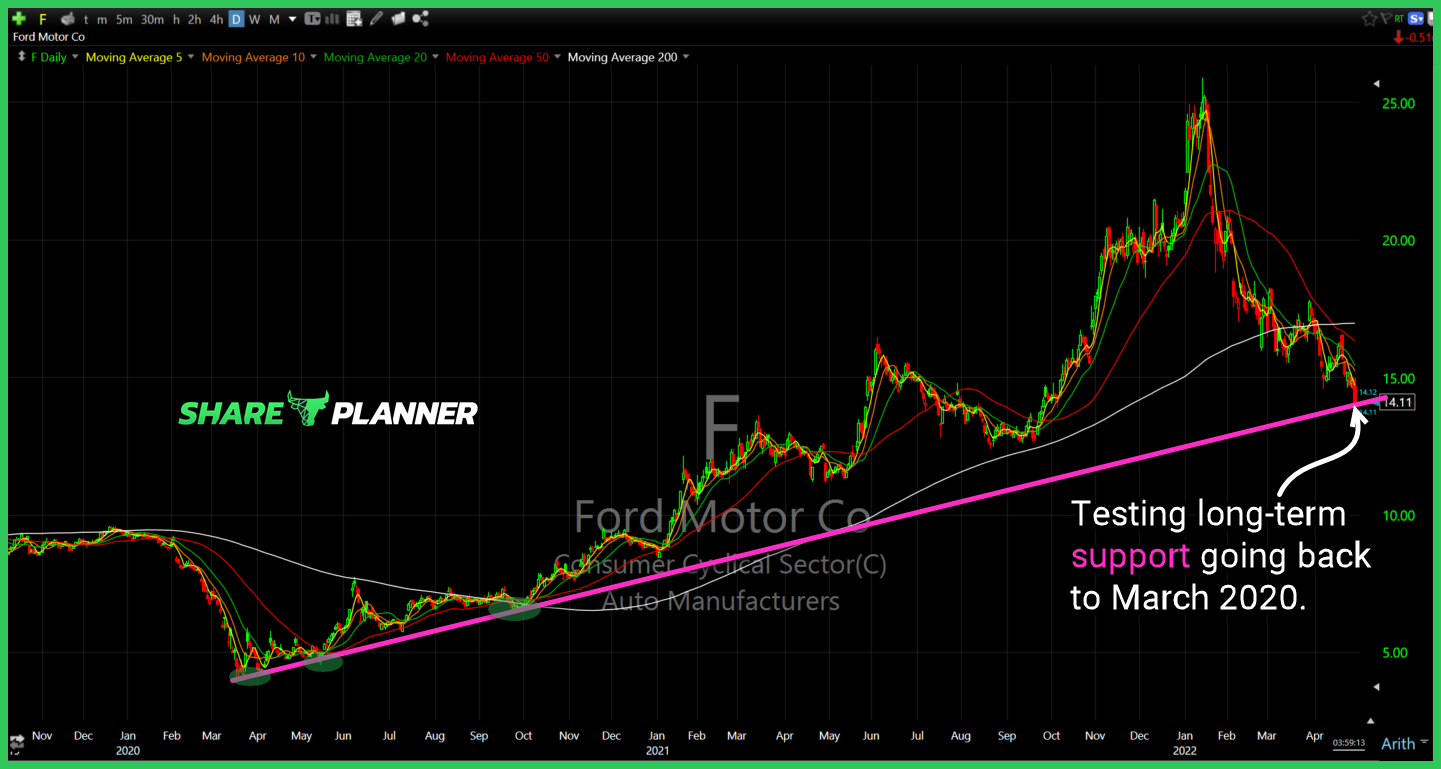

$F testing its long-term trend-line here.

Each night I provide a recap of the charts and technical analysis of some of the most intiruging market development. Call it "cleaning out of the notebook" per se. Here you will get a hodge-podge of analysis on different stocks, sectors, ETFs, and market indices. Some of them, may have been requests from members of

Each night I provide a recap of the charts and technical analysis of some of the most intiruging market development. Call it "cleaning out of the notebook" per se. Here you will get a hodge-podge of analysis on different stocks, sectors, ETFs, and market indices. Some of them, may have been requests from members of