My Swing Trading Approach

I expect to be conservative in my trading approach today, booking gains where it makes sense, and finishing out the year strong.

Indicators

VIX – Fell 2.8%, but still above 10. Look for a potential year-end close below 10.

T2108 (% of stocks trading below their 40-day moving average): Small bump yesterday of 1.5%, closing at 64%. Still indicating a lot of sideways price action.

Moving averages (SPX): Managed to rally at the end of the day, to hold on to the 5-day moving average.

RELATED: Patterns to Profits: An Intro Trading Course

Industries to Watch Today

Basic Materials remains the strongest sector right now, while Financials are starting to wake up. Utilities and Real Estate showing some life, while Technology continues to struggle.

My Market Sentiment

Emerging out of a bull flag pattern. Last day of the trading year tends to have some volatility in both directions and can even see above average volume.

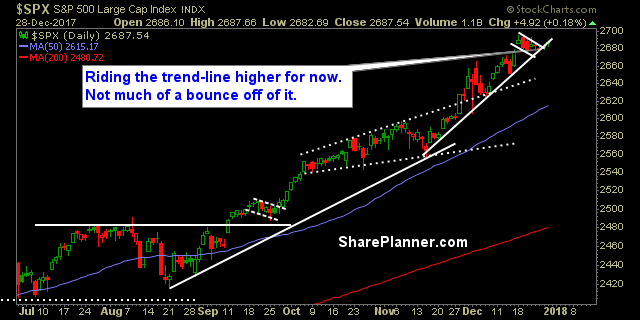

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 4 long positions

Recent Stock Trade Notables:

- Square (SQ): Long at $41.28, sold at 42.29 for a 2.2% profit.

- Twitter (TWTR): Long at 20.34, sold at 22.06 for an 8.5% profit.

- Micron (MU): Long at 45.61, sold at 47.91 for a 5.1% profit.

- TNA: Long at $61.00, sold at $64.08 for a 5.1% profit.

- Micron (MU) Long at $43.20, sold at $44.78 for a 3.7% profit.

- Alibaba (BABA): Long at $186.42, sold at 179.29 for a 3.8% loss.

- Paypal (PYPL): Long at $74.18, sold at $73.29 for a 1.2% loss.

- Square (SQ): Long at $36.00, sold at $37.35 for a 3.8% profit.

- Adobe (ADBE) : Long at $175.20, sold at $179.62 for a 2.5% profit.

- Alibaba (BABA): Long at $187.00, sold at 181.77 for a 2.8% loss.

- Paypal (PYPL): Long at $71.94, sold at $72.98 for a 1.5% profit.

- Lam Research (LRCX): Long at 210.41, sold at $205.20 for a 2.4% loss.

- Baidu (BIDU): Long at $242.80; sold at 248.29 for a 1% profit.

- Nvida (NVDA): Long at $195.17, sold at $204.88 for a 5% profit.

- Humana (HUM): Long at $248.73, sold at $261.20 for a 5% profit.

- Square (SQ): Long at $32.92, sold at $34.36 for a 4.4% profit.

- Nvida (NVDA): Long at $198.17, sold at $194.06 for a 2% loss.

- Lennar Homes (LEN): Long at $56.63, sold at $58.10 for a 2.6% profit.

- Lam Research (LRCX): Long at $185.23, sold at $192.24 for a 3.8% profit.

- Starbucks (SBUX): Long at $55.59, sold at $54.94 for a 1.1% loss.

- Illinois Tool Works (ITW): Long at $148.63, sold at $151.23 for a 1.8% profit.

- Nvdia (NVDA): Long at $180.18, sold at $187.38 for a 4% profit.

- Olin Corp (OLN): Long at $34.37, sold at $36.14 for a 5.2% profit.

- Lowe’s (LOW): Long at $77.97, sold at $81.52 for a 4.6% profit

- IBB: Long at $330.91, sold at $338.25 for a 2.2% profit.

- Seagate Technologies (STX): Long at $34.35, sold at $33.89 for a 1.3% loss.

- Wynn Resorts (WYNN): Long at $149.65, sold at $147.14 for a 1.7% loss.

- Imax Corp (IMAX): Long at $23.03, sold at 22.26 for a 3.3% loss.

- Marriott International (MAR): Long at $106.26, sold at $108.26 for a 1.9% profit.

- Alibaba Group (BABA): Long at $170.63, sold at $170.29 for a 5.0% profit.

- Workday (WDAY): Long at $106.91, sold at $104.90 for a 1.8% loss.

- Nvdia (NVDA): Long at $170.45, sold at $187.94 for a 10.3% profit.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Which trading platform in 2026 should you be using? In this podcast episode Ryan talks about all the major platforms out there from TC2000 to TradingView, to TrendSpider and the Bloomberg Terminal. What are the perks and benefits to each one, and Ryan will also go over his lower-tier platforms that you might want to consider as well.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.