Something about those regional banks selling off that doesn't look right Anybody else seeing this? Zions (ZION) -13.5% Western Alliance (WAL) -11.3% Great Sothern (GSBC) -9.6% Truist Financial (TFC) -5.5% Regions Financial (RF) -6.1% Has all the feelings of the March '23 sell-off when the banks came crashing down and the Fed had to create

Only one showing any relative strength is XLF... but even it has been getting pummeled over the last 3 days.

Episode Overview Ryan goes over one listener's swing trading journey, analyzes the trading strategy being employed, and answers questions on everything from short squeezes and short floats to insider and institutional buying and sector rotations. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan kicks off the episode by explaining why he

Episode Overview In this podcast episode Ryan provides some simple solutions to focusing in on what is moving in the stock market on a daily basis and debunking the claim that following sector movements is a method of trading that is behind the curve of trading. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights &

AT&T (T) breaking through heavy resistance from the past 9 months. Worst trading day in almost 4 years, Aflac (AFL) though could be looking to stabilize at price level support and its long-term trend-line. Just like before, Financial Sector (XLF) couldn't sustain a move outside the upper channel band. Rising trend-line off of

Episode Overview This episode focuses on Ryan's sector analysis and what he's looking for when determining which sectors to trade from. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan kicks off the episode by setting the tone on managing complexity in trading, particularly around sector analysis. [1:13] Listener Question: Otis from

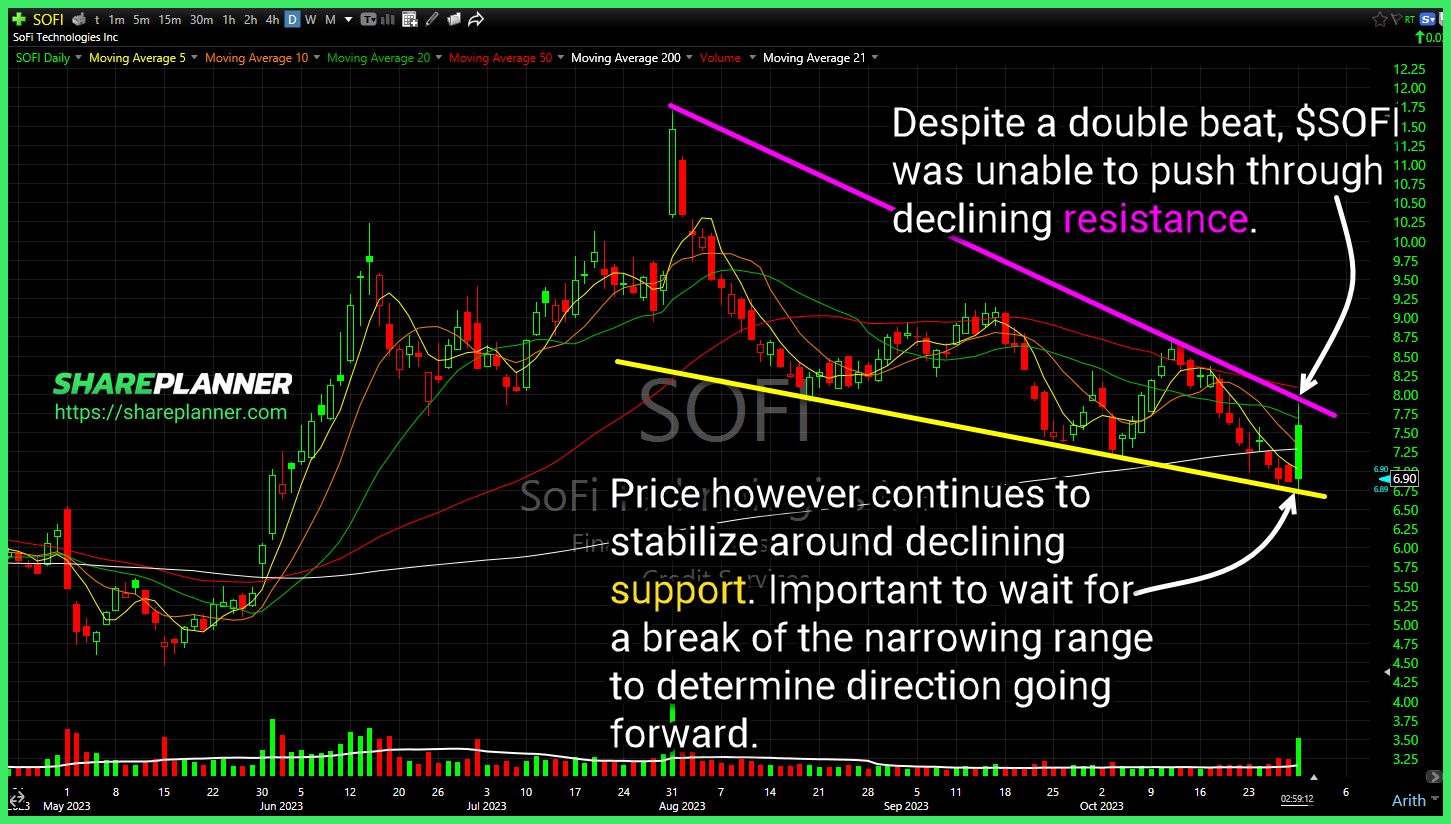

Despite a double beat, SoFi Technologies (SOFI) was unable to push through declining resistance. CBOE Market Volatility Index (VIX) giving up a lot of its gains from the past three days. A break back below support could signal a dead-cat bounce for equities underway. Become a Self-Made Trader Today: Two developments in Rivian Automotive (RIVN)

Long-term support on Ford Motor (F) broken today. This is a scenario where trying to guess at where support might loom is not worth it. Best to let the stock start to base first instead of guessing where it might bounce. Financial Sector (XLE) nearing a potential bounce area here. Alphabet (GOOGL) slicing

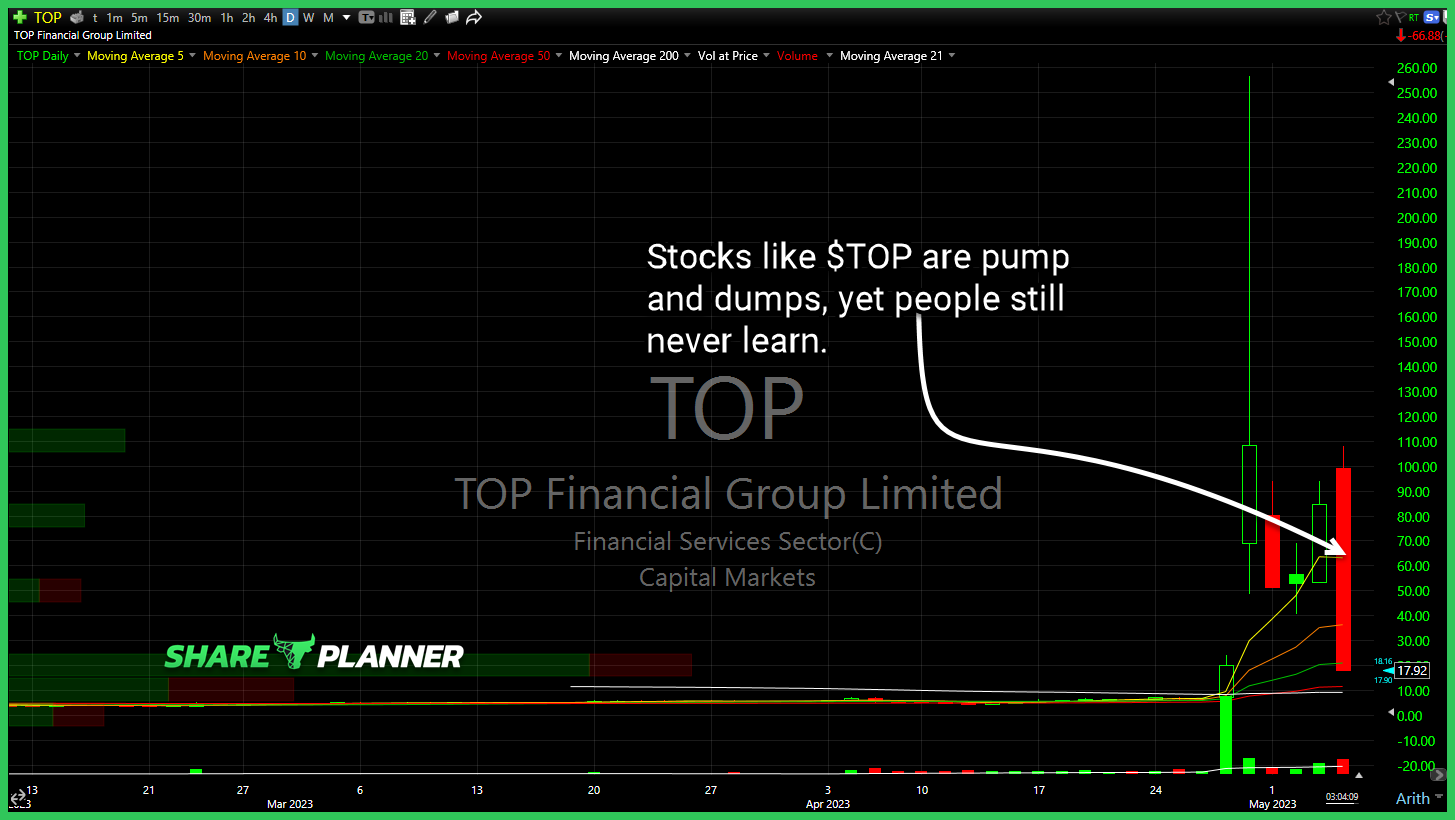

Stocks like TOP Financial Group (TOP) are pump and dumps, yet people still never learn. They still have to chase and then blame the boogeyman when it doesn't work out. Bearish Big move out of Advanced Micro Devices (AMD) on Microsoft (MSFT) news, but still within the short-term declining channel. Considering there hasn't been a