Beyond the technical analysis of the overall market, it is critically important to keep tabs on each sector, to know where the strength lies. For instance, had you invested in utilities over the past two months, you would be down royally, on your trade, while the rest of the market rallied. The same could be

Finding the Best ETFs for Trading Exchange Traded Funds (ETFs) are all the rage these days. Traders are always on the hunt for the latest and greatest ETFs and what is the best ETF to trade on a day-to-day basis. ETFs come in all shapes and sizes and each day it seems like there is

Technical Outlook: Yesterday marked an extremely boring an inconsequential day of trading In the final hour of trading, SPX gave up all of its gains on the day and finished nearly flat. The big concern for me on the chart is that there is now a very obvious head and shoulders pattern that is forming

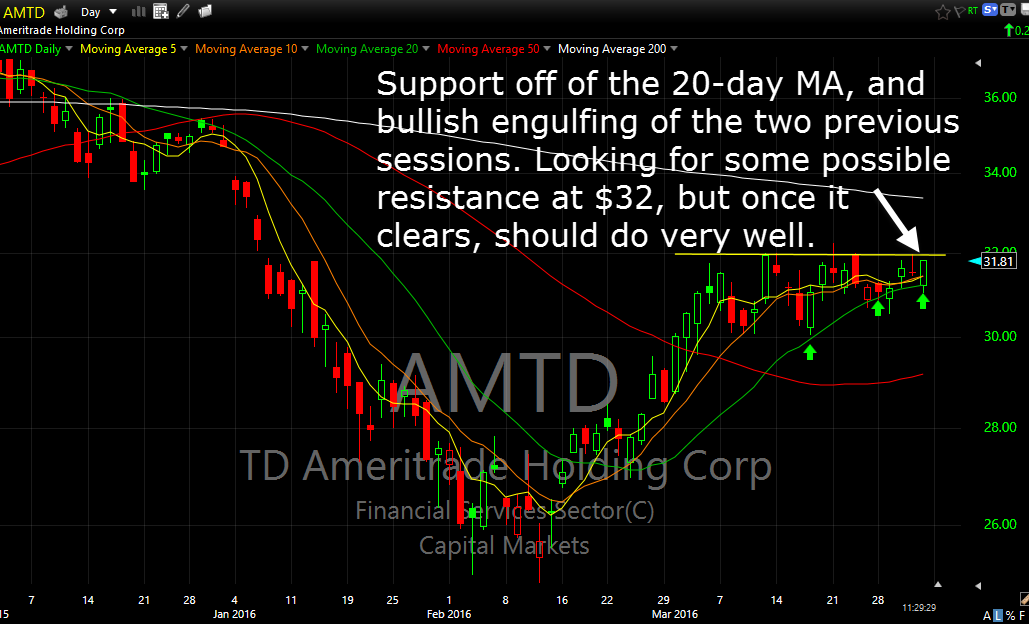

4/1: XLF showing signs of wanting to bounce off of the 20-day moving average, as is AMTD. As a result, I want to trade AMTD now while the risk/reward is favorable and the market is moving off of the lows of the day. once it clears $32, it should be clear sailing.

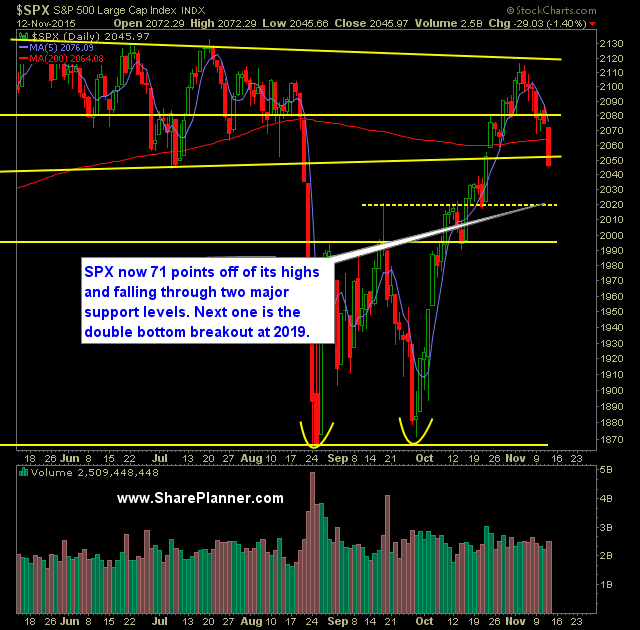

Technical Outlook: SPX had its strongest sell-off since the summer sell-off ended back in late October by dropping 1.4% yesterday. The 200-day moving average offered little to no support yesterday as price action sliced right through it. The Fibonacci retracements suggests a pullback to the 38.2% level at 2023 on SPX Head and shoulders pattern

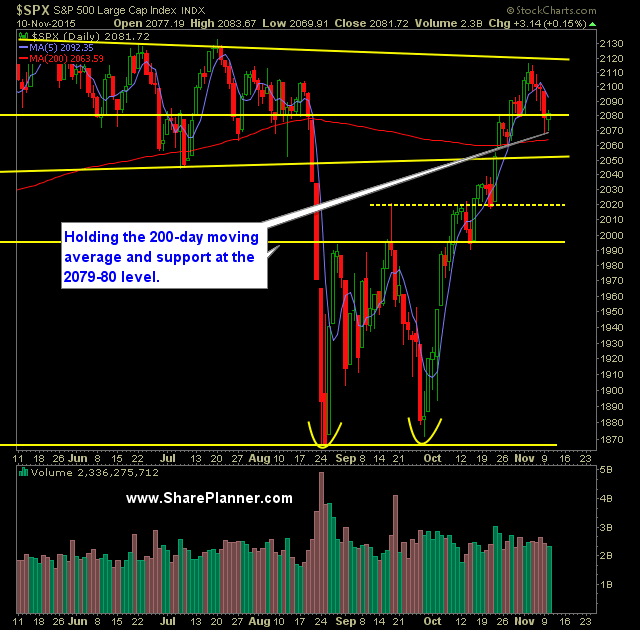

Technical Outlook: SPX down in the pre market following some comments out of Bullard that was perceived as being hawkish, and of course bearish for the market and stocks. The 200-day moving average is the key level to watch here today. The 20-day moving average will be broken immediately at the market open. I am

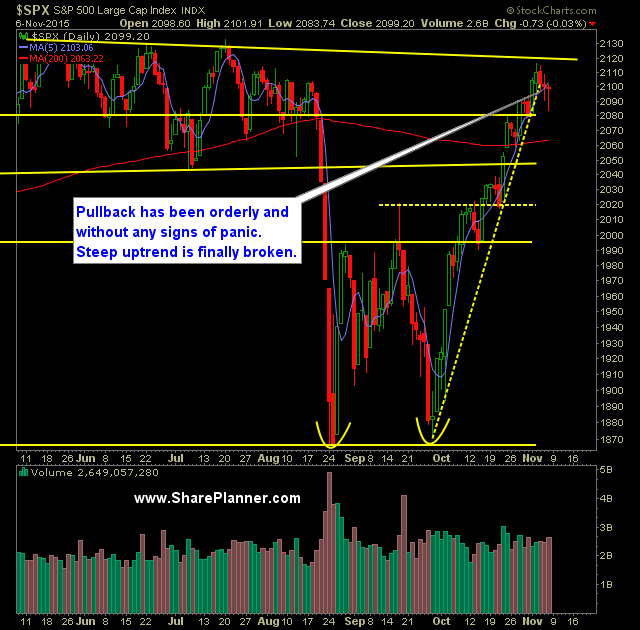

Technical Outlook: SPX managed to put a stop to the four-day sell-off yesterday and rally off of the 20-day and 200-day moving averages a slight bit. SPY volume dropped off again and was well below average. The price action of the last five trading days, despite four of them finishing lower, does not appear

Technical Outlook: Significant pullback that saw price on SPX pull back 1% yesterday . The converged 20 and 200-day moving averages will be a key testing point for the bulls today should the sell-off continue for a fifth straight day. Volume on SPY increased for a second straight day yesterday and came in at

Technical Outlook: SPX had its first 3-day pullback since September and the first of this rally. Unlike previous sell-offs the 10-day moving average did break intraday. But like the October rally has done, it managed to close above it by the end of day. Volume saw a noticeable uptick on Friday, due mainly to