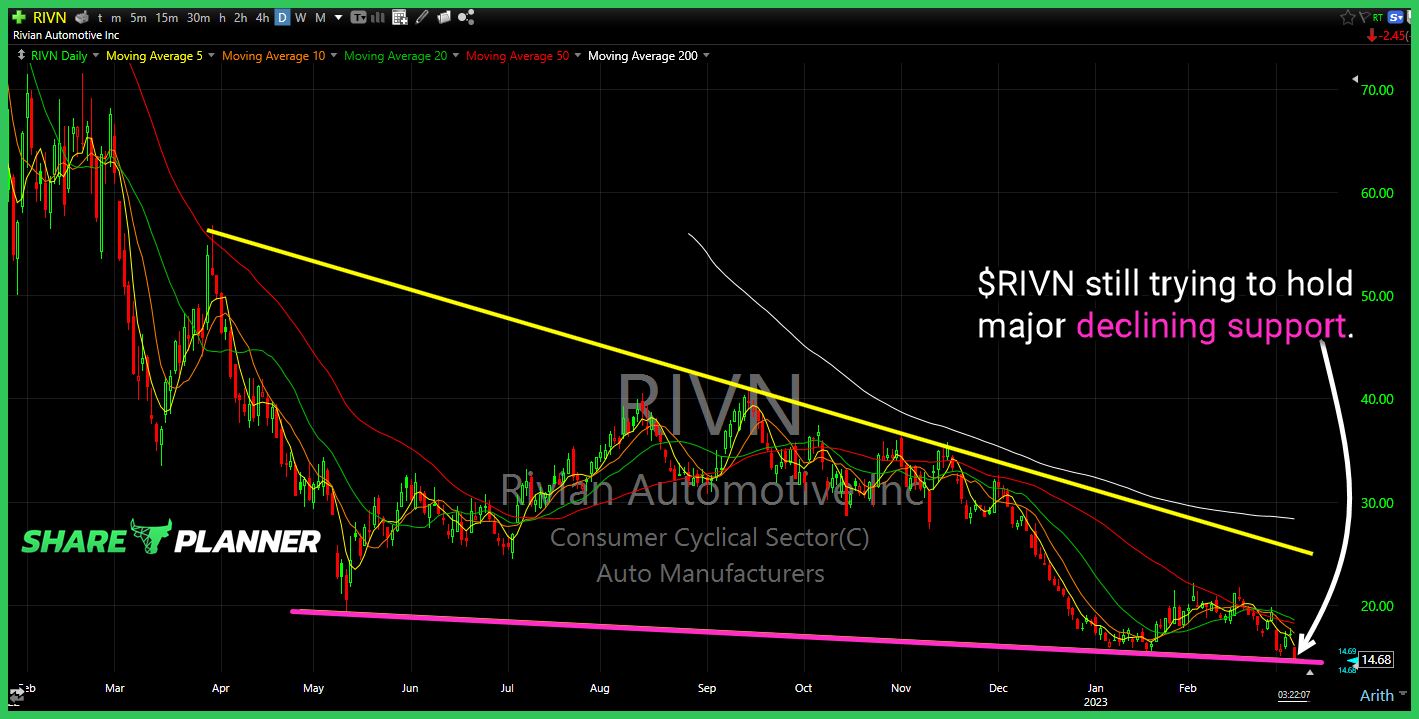

RIVN has fallen substantially since its IPO. Rivian (RIVN) has crashed 94% from its all-time highs. Will this stock make it at the rate it continues to decline, or is there a reason for optimism for this stock going forward? In this video, I will provide my technical analysis and go through the chart patterns,

TSLA clean break of declining resistance with old-trend-line resistance now looming, has previously struggled to push through in the past. Triangle pattern starting to break here, but just underneath it is testing the rising trend-line off of the March lows. Make or break moment for LLY. RIVN keep an eye this morning on a test

$RIVN downward channel bands remain in place. Potential for a base breakout within the channel though. Careful chasing $SNAP here at the upper end of this channel band. So far seeing some push back at resistance. Better to wait for consolidation and then a break through it. Extremely overbought here. $NVDA key support level breaking

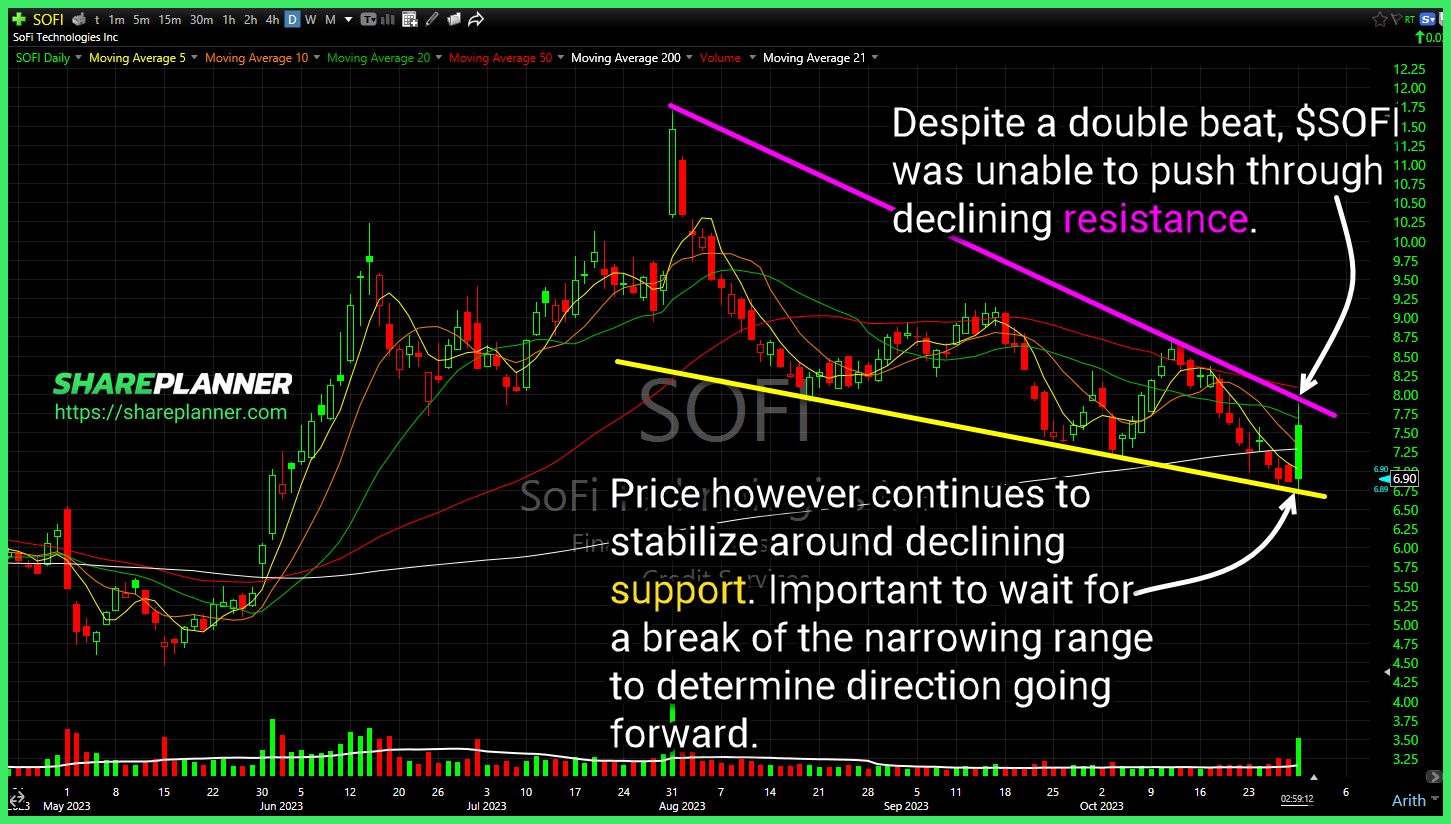

Despite a double beat, SoFi Technologies (SOFI) was unable to push through declining resistance. CBOE Market Volatility Index (VIX) giving up a lot of its gains from the past three days. A break back below support could signal a dead-cat bounce for equities underway. Become a Self-Made Trader Today: Two developments in Rivian Automotive (RIVN)

$TNX 10 year yield suggests we may very well hit 5% before the end of the year - very scary scenario for the entire economy, and a resistance level that goes back to 2001. Looking more and more like $TGT will ultimately, get to $94 for a test of long-term support. I won't looking to

Double top confirmation with the recall news on $RTX. Possible support at $75. $TSLA broke out of the triangle pattern with a massive gap higher, but be mindful of the heavy resistance lurking overhead, that doesn't make this trade an ideal reward/risk following the massive run higher today. Long-term resistance getting tested on $FNGR following

As mentioned on Friday, $DWAC pumps are short-lived, and the same thing happened yet again as it has happened in the past. These pops in $AMC, like the one today, tend to be short lived. Broke through one resistance level, but quickly coming against another. $FRSH not there yet, but watch for a big run

$NIO coming out of its basing pattern from the past month.

$RIVN still trying to hold major declining support.

$NIO key long-term support getting a major test today. So important that it bounces right here.