Chevron (CVX)Analysis 1) Short-term support broken, setting up for a retest of long-term trend-line. 2) Declining trend-line above creating lower-highs. 3) Short-term trend-line also broken. First Solar (FSLR) declining channel remains perfectly intact and seeing a hard rejection off the upper channel band today. Apple (AAPL) starting the week by pressing up against declining resistance.

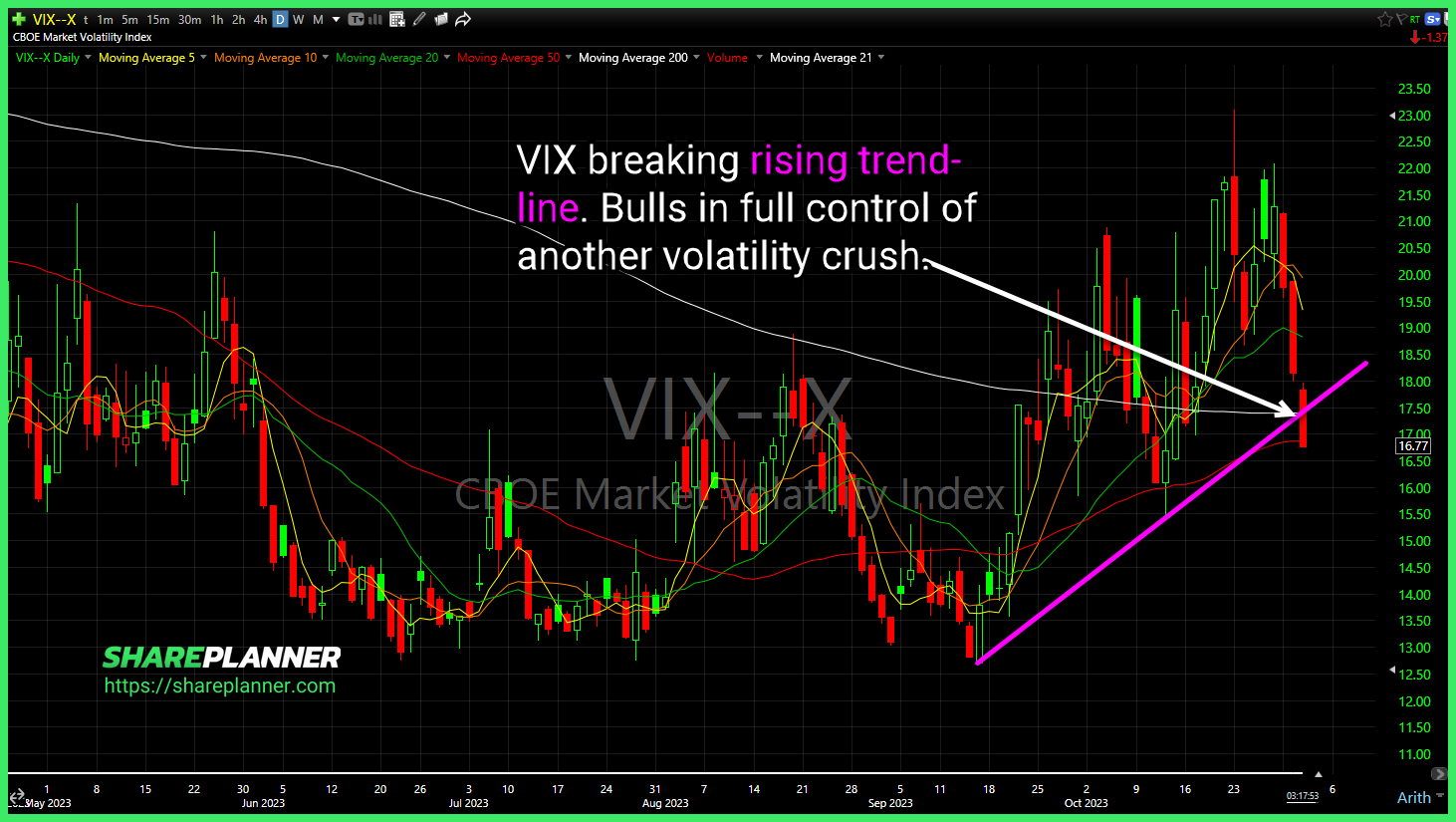

CBOE Market Volatility Index (VIX) breaking rising trend-line. Bears in full control of another volatility crush. Declining resistance on Boeing (BA) broken today. Declining channel in Advanced Micro Devices (AMD). Room to run, but watch for a potential reversal around the 106-107 area. Roku (ROKU) with a bullish wedge. Watch for the potential

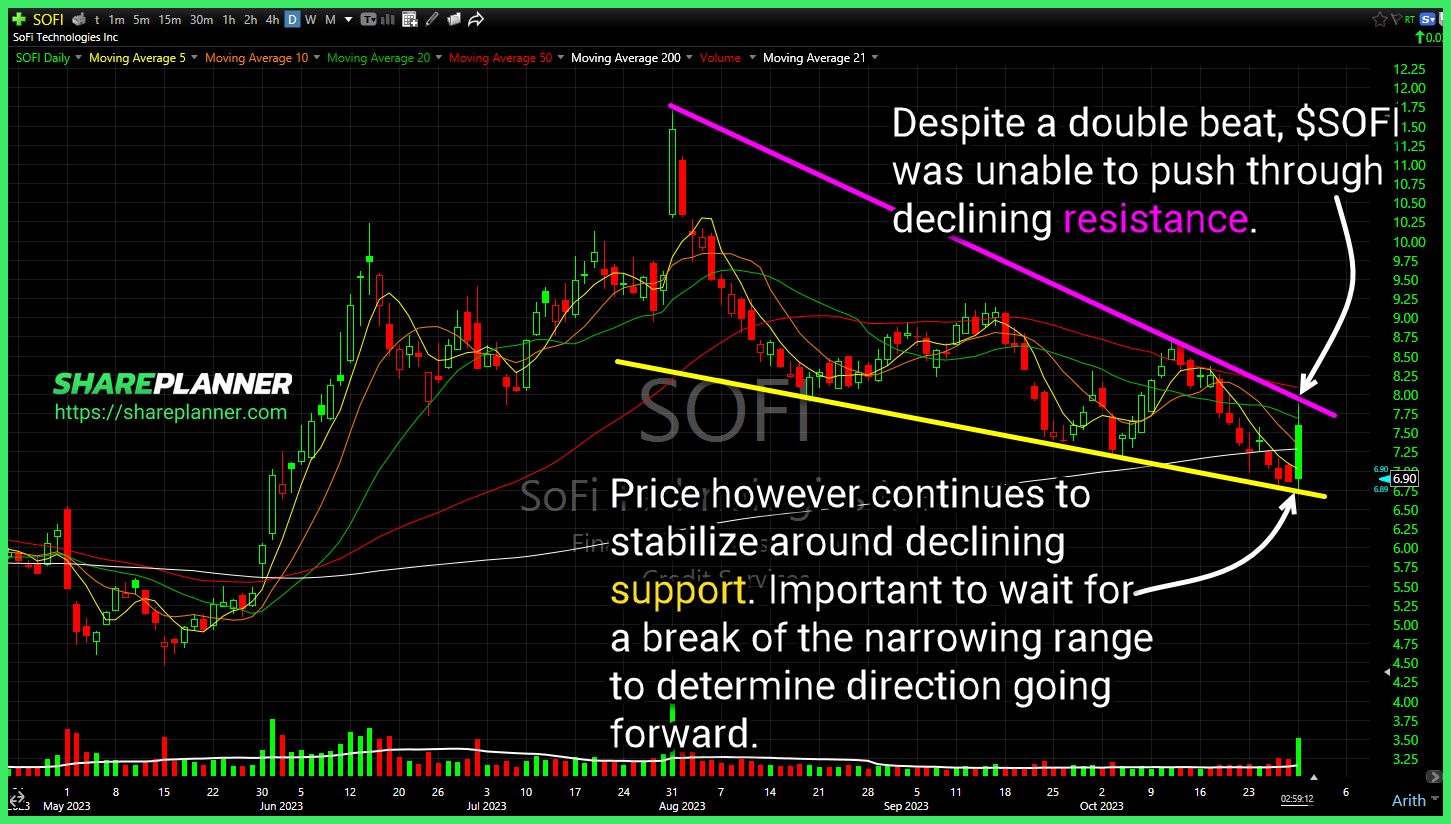

Despite a double beat, SoFi Technologies (SOFI) was unable to push through declining resistance. CBOE Market Volatility Index (VIX) giving up a lot of its gains from the past three days. A break back below support could signal a dead-cat bounce for equities underway. Become a Self-Made Trader Today: Two developments in Rivian Automotive (RIVN)

SoFi Technologies (SOFI) Possible bullish wedge trying to form, but with price testing support, could be setting up for the next leg lower, which has very little support until sub-$5 Big move here out of CBOE Market Volatility Index (VIX) today. May be setting up for another move up to 30. Holding support and bouncing

Volatility Index (VIX) Bears 11 times in a row continue to reject any movement above this threshold. Riot Platforms (RIOT) with tight consolidation and continues to get rejected on the breakout attempts. Heavy resistance at the 200-day moving average as well. Strong potential for a downside break. US 10 year treasury yield (TNX) Another jump

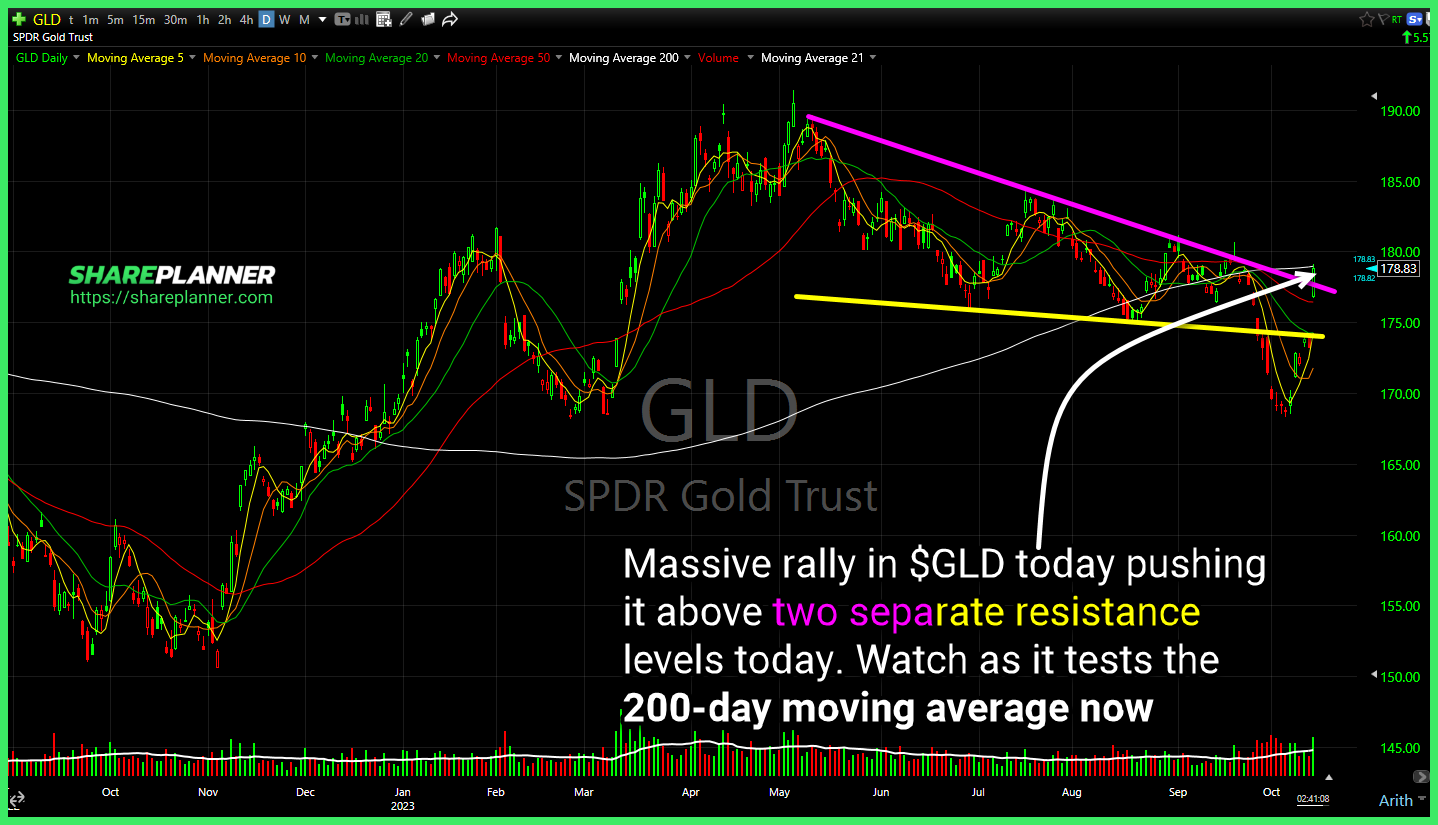

Massive rally in $GLD today pushing it above two separate resistance levels today. Watch as it tests the 200-day moving average now $VIX with a break back above major resistance. Key is to hold that level into the close. Rising resistance could prove important next week. A new layer of resistance is forming for $JPM

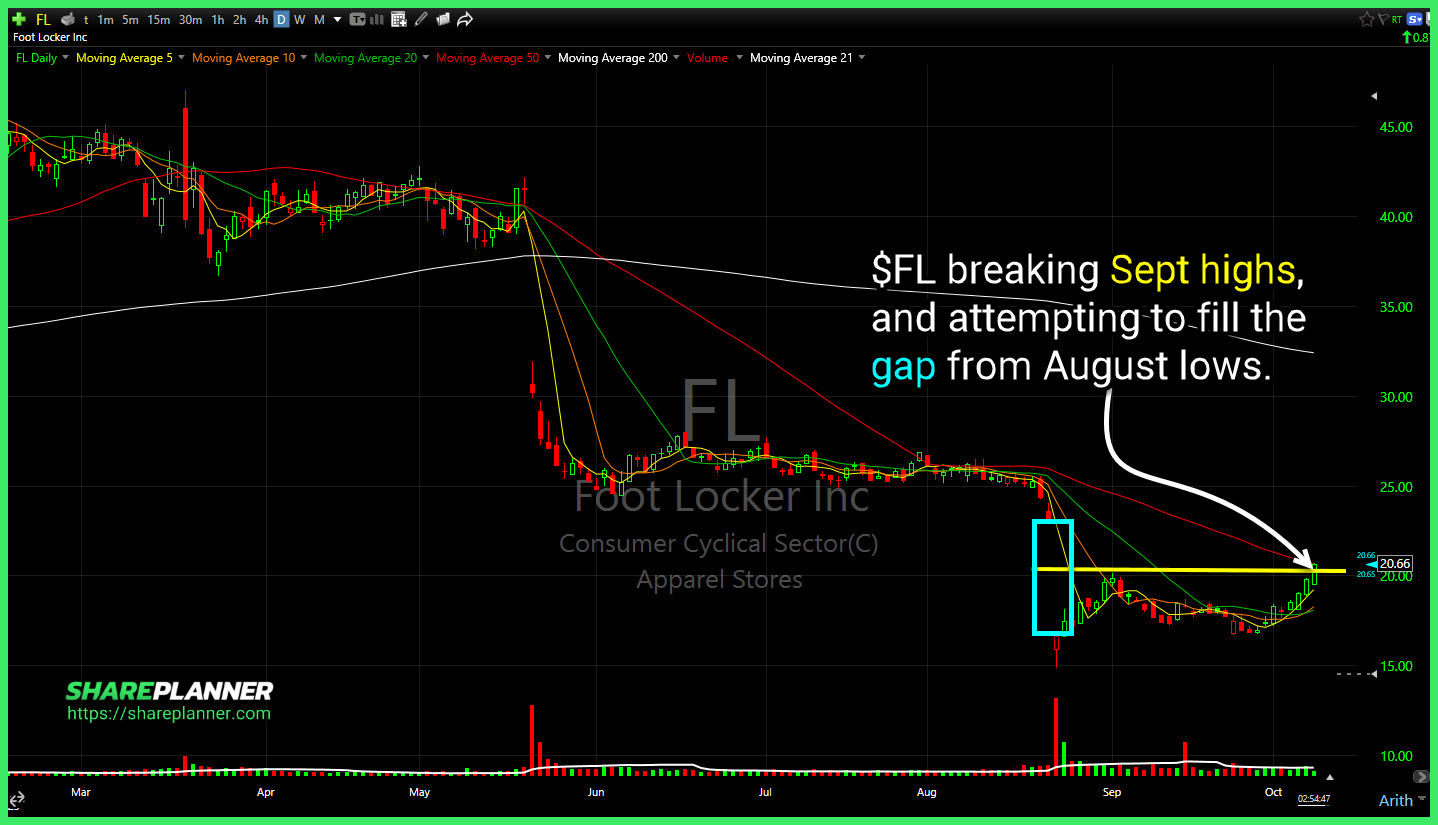

$FL breaking Sept highs, and attempting to fill the gap from August lows. Hard fade in $VIX today, with the lower-channel band getting tested again. A break to the downside would likely signify more upside for equities. $LMT declining resistance and price level resistance overhead to watch. If US gets involved, or provides aide, likely

$COST breakout holding so far, but very little upside move since pushing through the resistance - just consolidation. Key support lies at the rising trend-line. Triangle in $GBTC nearing a breakout. A bit overextended inside the pattern, could benefit from a few days of consolidation first. The sell-off in $BYND is intense! $VIX struggling with