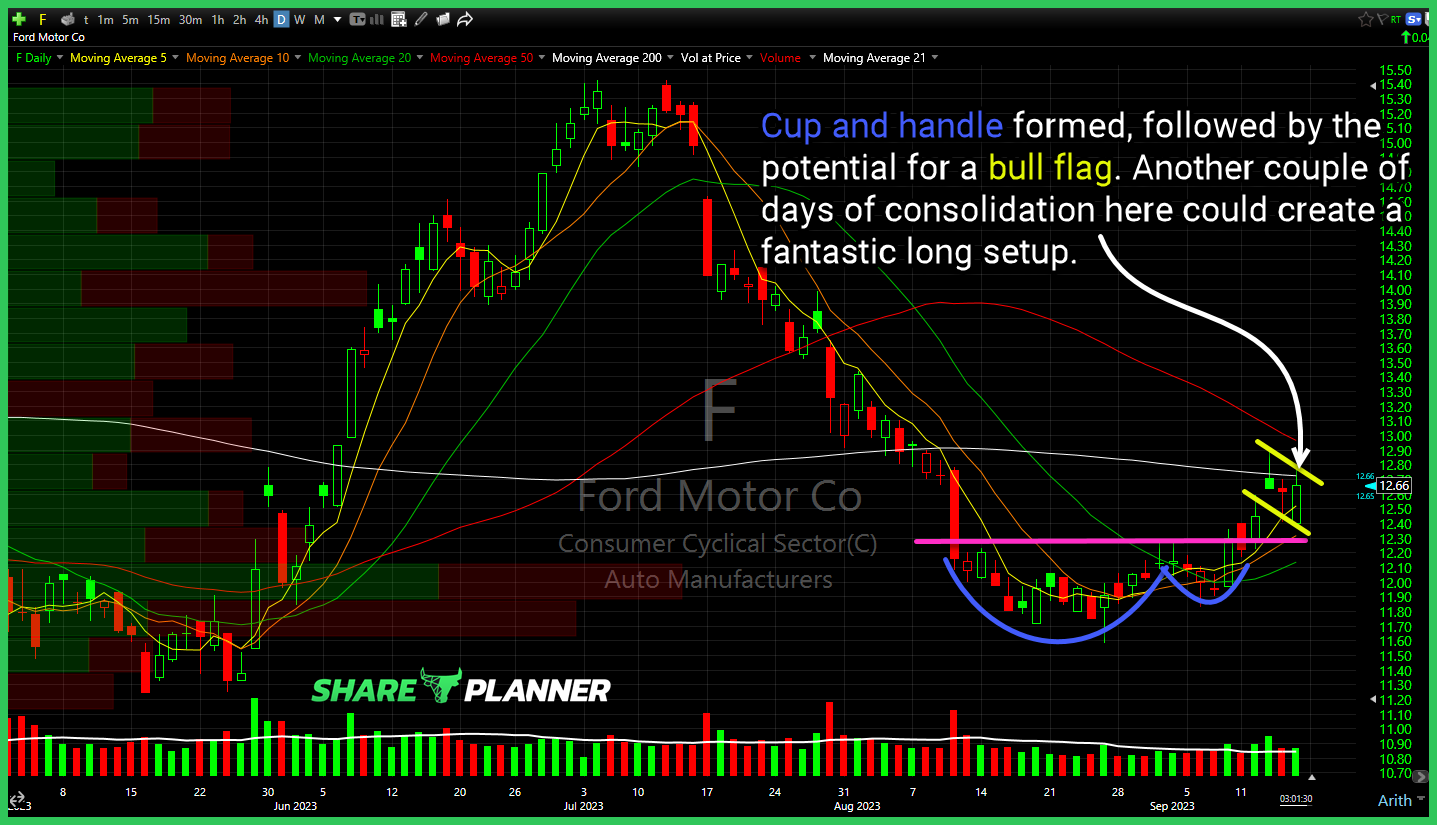

Ford Motor (F) Cup and handle formed, followed by the potential for a bull flag. Another couple of days of consolidation here could create a fantastic long setup. CBOE Market Volatility Index (VIX) hard bounce off price level support, now testing declining resistance. Advanced Micro Devices (AMD) breaking below its rising trend-line that goes back

$WING testing key support, and on the verge of a breakdown that has the potential for a move to the $130's. $VIX back to testing a major support level. Break it and the 11-12's are within reach. $EOG triangle forming - worth waiting for the breakout to help determine future direction for the stock. $PYPL

$IBB bouncing off of the rising trend-line from October '22. You'll still want to be mindful of overhead resistance. $CVS for a second straight day testing key support that if broken goes back down to 2019 & 2020 prices. $VIX running into heavy resistance at the 200-day moving average. $TNX 10 year yields showing rejection

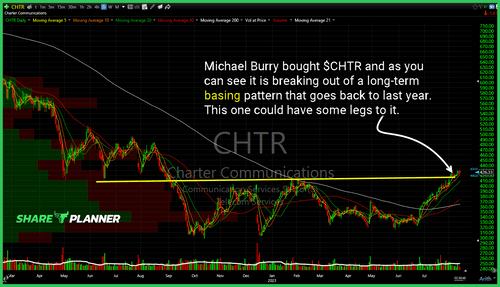

Michael Burry bought $CHTR and as you can see it is breaking out of a long-term basing pattern that goes back to last year. This one could have some legs to it. $VIX still can't break above resistance. Volatility shorts continue crushing the index with every bounce. Strong bounce so far today for $SMH, but

$DOW continuing to hold support going back to April. Could see a bounce here. 4th day in a row where there's been a big fight to keep $VIX under that 17.10 area. Today's candle not looking that great either, despite the 8% in gains so far. Needs a strong finish to change the narrative here.

Palantir Technologies (PLTR) Rising trend-line off of May lows tested and held so far today. Attempting to bounce from here. CBOE Market Volatility Index (VIX) pulling back some today, but still hovering just below a significant base breakout level here. Moderna (MRNA) was a one trick pony, and not one worth ever buying

Apple (AAPL) in one week has wiped out over 6 weeks in gains, and could be headed for a much bigger pullback to long-term support. Heavy resistance seeing a break today. Strong volume of late as well for The Mosaic Company (MOS) Amazon (AMZN) coming up on major long-term resistance. Volatility Index (VIX) continuing the

Electronic Arts (EA) breaking below key support and, so far, failing to bounce. Worth staying away from, for now while it searches out a new bottom. Microsoft (MSFT) possibly putting in a significant topping pattern and breaking below key support here. CBOE Market Volatility Index (VIX) break in the declining trend-line, and a

CBOE Volatility Index (VIX) hitting declining support here. Have seen a few bounces, but nothing substantial of late. Airbnb (ABNB) testing price level resistance, nice consolidation underneath. Watch for channel resistance on Expedia (EXPE) even if it does manage to break out of the bullish wedge. Enphase Energy (ENPH) with a hard rejection at the

$RCL reaching major resistance following an epic 1.5 month rally. Caution warranted here. Textbook inverse head and shoulders pattern playing out on $WTAI. Hardly a hawkish pause by the Fed as Post FOMC $VIX rushes for the 13's again.