My Swing Trading Strategy I closed out one of my trades yesterday that simply wasn’t doing anything for me and was simply wavering far too much due to the low volume, summer trading. However, I added one additional trade to the portfolio and looking to ride my two positions that I currently have, to higher

My Swing Trading Strategy The market decided to throw a temper-tantrum on Friday, with above average volume, and sell-off that wiped out one of my long positions. Should the market want to shake off the sell-off, I am more than open to adding a new long position, however, I am also poised to short this

My Swing Trading Strategy I was stopped out of my Disney (DIS) trade yesterday, primarily due to the heavy influence from the Netflix (NFLX) earnings miss. However, I added two additional trades following the stop-out, and will consider adding a third position if the early morning strength can hold. Indicators Volatility Index (VIX) –

My Swing Trading Strategy I booked some profits yesterday with a +2.4% profit in Nike (NKE) and +2.1% in Twitter (TWTR). I had a day-trade in Square (SQ) that started out great, but couldn’t hold the gains into the close, so sold it for a small profit of +0.3%. I only have one position coming into today, so

My Swing Trading Strategy I didn’t increase my overall exposure in the market yesterday, as I sold my position in Boeing (BA) for a small loss, after it simply refused to bounce. This morning, I will watch overall market action to see if the bulls are able too bounce off the overnight lows. Regardless,

My Swing Trading Strategy I reduced my long exposure yesterday by closing out two positions, and adding one additional trade to my account. The bears have a similar grip on this market (this week) to what we saw two weeks ago. Nothing major, but certainly keeping the bulls from pushing price higher. Indicators Volatility Index

My Swing Trading Strategy The low volume trading environment is making for difficult trading conditions, as the market is unable to follow through or hold on to any gains to the upside, and thereby creating wild intraday swings that cannot be counted on. Indicators Volatility Index (VIX) – Respectable bounce on the VIX yesterday, that engulfed

My Swing Trading Strategy I added another long position yesterday and will look to increase the value of my current positions before adding anything new to the portfolio. I don’t see myself adding any more than one new position today. Indicators Volatility Index (VIX) – Traded higher 1.7% yesterday, but was due for a bounce of

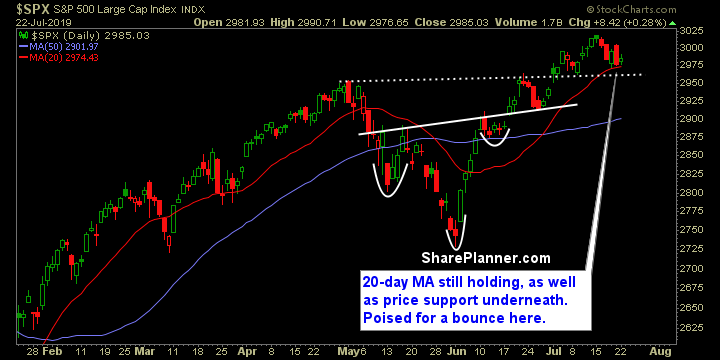

My Swing Trading Strategy I did not add any new positions on Friday, but now with SPX having closed above key resistance, opens me up to additional long positions. Indicators Volatility Index (VIX) – Broke support at the 13.39 area, and dropped into the 12’s with Friday’s move. Good chance we could see a