My Swing Trading Strategy

I didn’t increase my overall exposure in the market yesterday, as I sold my position in Boeing (BA) for a small loss, after it simply refused to bounce. This morning, I will watch overall market action to see if the bulls are able too bounce off the overnight lows. Regardless, I will be raising my stops as much as possible to protect profits.

Indicators

- Volatility Index (VIX) – Despite a +30 point move in SPX yesterday, the VIX didn’t give up much ground with only a 2% decline. Expect to see an increase in volatility today.

- T2108 (% of stocks trading above their 40-day moving average): A strong rally yesterday shot the indicator up 12% to 62%. A very good and much need move to avoid a confirmed breakdown on the chart.

- Moving averages (SPX): Held the 5-day moving average and now trading above all other major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology established new all-time highs yesterday and re-established itself as the market leader. Real Estate continues to come on strong as well. Financials should be avoided at all costs – in particular the banks – as they are running hard against the market. Don’t trust their bounces either.

My Market Sentiment

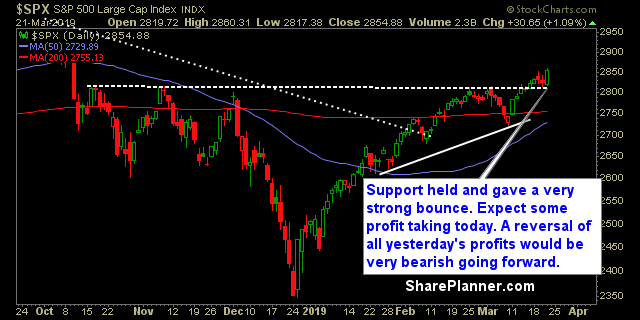

SPX bounced off of support yesterday, following two days of declines. However, there’s plenty of weakness heading into the open today, and holding onto a large portion of the previous day’s rally will be essential to keeping the market momentum intact. A reversal that takes price back below key support would certainly be bearish going forward.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 30% Long.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.