My Swing Trading Approach I’m not opposed to adding a new position in this rally, but stocks are in overbought territory, and may see some profit taking. I’m taking a “wait-and-see” to this market. Indicators

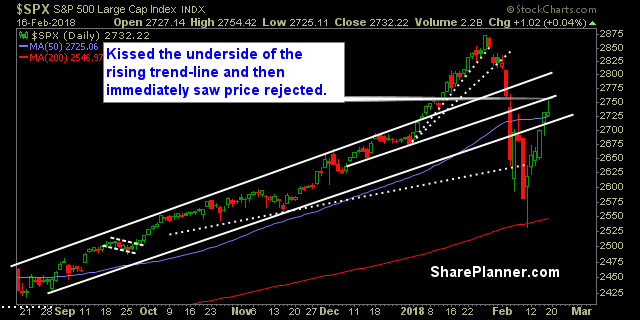

My Swing Trading Approach There is a solid possibility that I put a couple of short positions to work today. Plenty of trade setups to the downside are out there, and bears may be hitting the end of this dead cat bounce. If not, then I will look to continue playing the long side.

My Swing Trading Approach Three day weekend ahead of us, where I will likely take a more passive approach to trading today, while raising my stop losses on all the positions in my portfolio to protect profits. Indicators

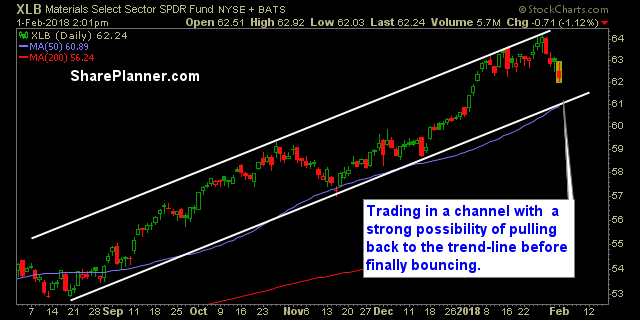

Beyond the technical analysis of the overall market, it is critically important to keep tabs on each sector, to know where the strength lies. For instance, had you invested in utilities over the past two months, you would be down royally, on your trade, while the rest of the market rallied. The same could be

My Swing Trading Approach Should this rally continue into today, 1-2 new positions is likely for the portfolio. I will also continue raising my stops on my profitable positions. Indicators

My Swing Trading Approach I’m concerned by this market, and I’m taking a much more cautious tone to my swing-trading. Not against adding new positions, but won’t do so unless the market makes a compelling reason for doing so. Indicators

My Swing Trading Approach I have plenty of flexibility to play the market in either direction, depending on what the market ultimately wants to do. Only way I will get short is if the market shows signs of breaking down. Indicators

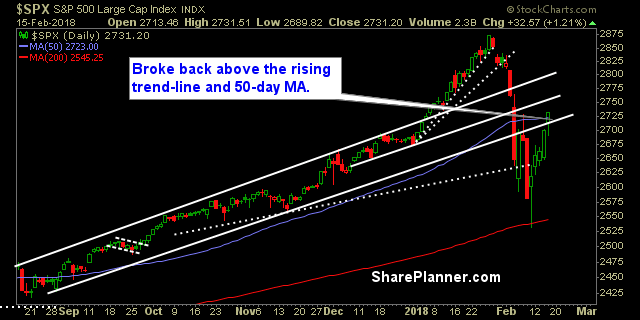

My Swing Trading Approach I’m looking to add some long exposure today, should the market show enough bullishness to support a move. Still maintaining the ability to get short quickly, should the opportunity arise. Indicators

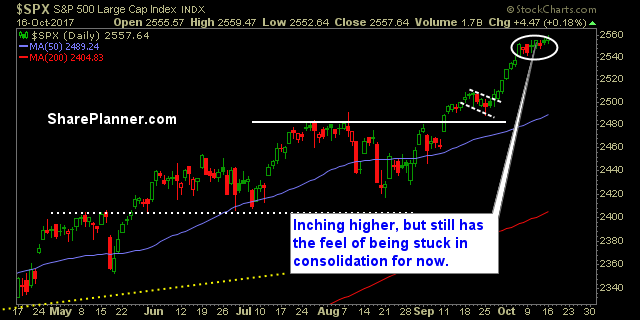

My Swing Trading Approach I would like more price action from this market, but I can’t force that. I have to wait for that to happen, and to place my trades accordingly. Right now, I don’t want to add additional long exposure, until this market can put together a decent breakout to the upside. Indicators

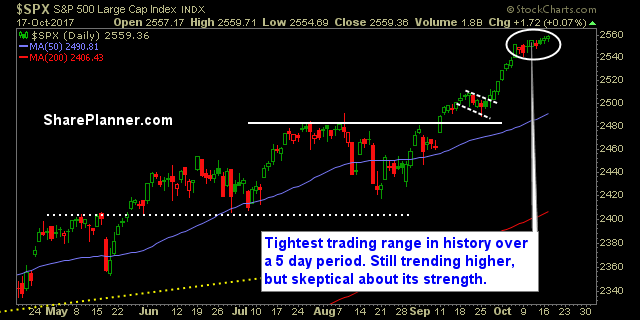

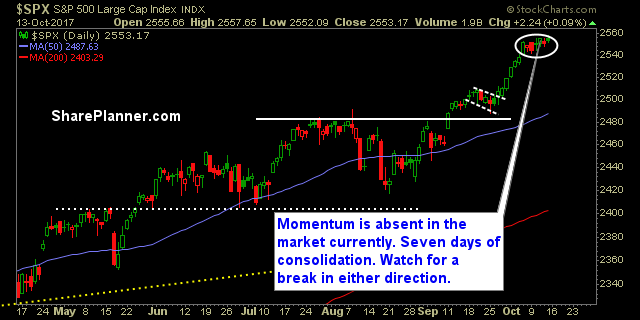

My Swing Trading Approach I’m nearing a point where I want to see price action move out of the recent price coil before getting any more aggressive on this market. As always, I’ll look for opportunities where appropriate, to book profits and move up stop-losses. Indicators